Market Scorecard

Did you see that Japan and the EU, have just signed the biggest trade deal ever!

Japan, EU Sign Trade Deal to Eliminate Nearly All Tariffs; the deal covers nearly a third of the global economy and over 600 million people. A big win for free trade proponents. As the US alienates itself with its trading partners, it creates an opportunity for other trading partners to fill the gap. When the trade wars are over, and the dust settles, I wonder how the trading landscape will be?

Yesterday the

JSE All-share closed up 1.21%, the

S&P 500 closed up 0.40%, and the

Nasdaq closed up 0.63%.

Company Corner

One thing, from Paul

Johnson & Johnson is a mega-cap ($354 billion) healthcare giant, owned by most Vestact clients in New York portfolios. It published quarterly results yesterday, before the opening bell. Earnings came in notably higher than expected, and the stock rose 3.5% over the course of the day, to $129.11.

The

pharmaceutical division was the standout performer, with key products like Zytiga, Stelara, Remicade and Traceleer (from the recently acquired Actelion portfolio) all doing well.

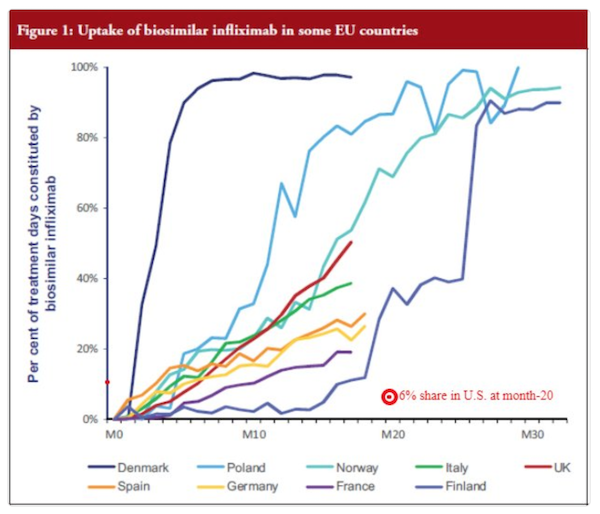

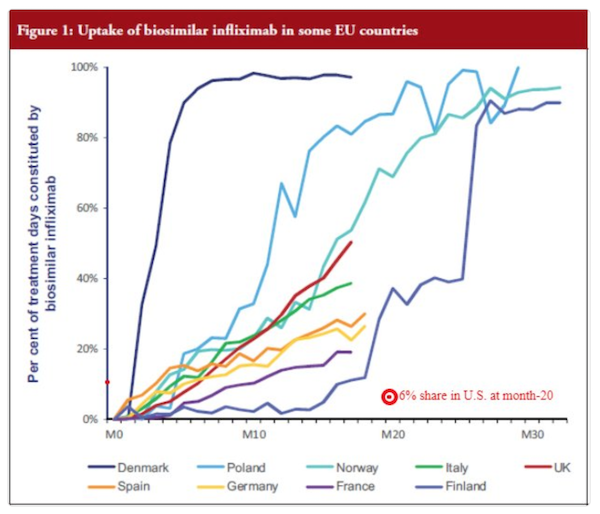

As a matter of interest, I recently saw this chart below, which showed that despite the existence of two generic versions, US doctors continue to prescribe Remicade for autoimmune diseases such as Crohn's disease and rheumatoid arthritis. The drug still has a 94% market share. In Europe, that has not been the case, where the generic versions have sold well.

Johnson & Johnson's

medical device division continues to underperform a little. Maybe they should sell it to Stryker? Not likely, but I'm just saying.

The performance of their

consumer division was also a bit flat, affected by soft demand in some regions, a logistics setback in Brazil and currency effects.

Management did not rule out another Actelion-sized deal (around $30 billion). According to Goldman Sachs, Johnson & Johnson has about $112bn in "cumulative firepower" over 2018-2021. Must be nice?

Johnson & Johnson's share price has been stuck at around $130 for the last two years. After a period of relative underperformance, it's looking better. This is a good time to buy some more for your portfolio.

Bright's Banter

Netflix

released it's second-quarter earnings after the US markets closed on Monday (July 16th). The shares took a pounding, down 14% in after-hours trade as the company

missed on subscriber growth numbers for the first time in five consecutive quarters. The shares closed down 5.2% yesterday recovering most of its losses on the day. Netflix has now missed its forecast only three times in the last ten quarters.

US subscriber numbers showed 674 000 new additions as compared to the 1.23 million expected additions. The more exciting

international business saw subscriber numbers come in at 4.47 million new additions, compared to the 5.11 million expected.

Netflix now boasts 130.1 million subscribers globally, who enjoy binge watching classics like The Crown and The Legendary BoJack. Revenues were stronger showing a print of $3.91 billion another small miss compared to the $3.94 billion estimated by Reuters.

What added salt to the wound was the weaker guidance for the third quarter, where the CEO Reed Hastings said that they expect to 'only' grow subscriber numbers by 5 million; 650 000 in the US and 4.35 million internationally.

Investors biggest worry is that the company cannot grow as quickly now coming off its more significant base. The share price has already more than doubled this year making Netflix more valuable than media giant Comcast. There is no doubt that competition is rising as Hulu, Amazon, AT&T (HBO) and even

Walmart are playing in the online streaming space, where there is less regulatory scrutiny as compared to traditional tv, dish and cable. However, the

true opportunity lies in converting more people to "cut the cord" and go online. The fortunes of a company like Netflix lies in the widespread growth in faster internet penetration and the growing middle class across the globe.

The biggest challenge for Netflix going forward is retaining the converts and luring new bingers by having more entertaining content than what's out there. So I guess the question is: can Netflix replicate the same success its enjoyed from originals like

Master of None, Narcos, Ozark, Stranger Things, House of Cards, 13 Reasons Why, Unbreakable Kimmy Schmidt, GLOW, Luke Cage, The Crown, Dear White People etc.? The answer includes even more spending on original content to make this a possibility, and the company expects to spend at least $10 billion this year to achieve this goal. As a long-term investor we hope this aggressive investment in new content yields great dividends in the future.

The chart below shows Netflix's subscriber growth number since 2011.

You will find more infographics at

Statista

Our 10c Worth

Byron's Beats

We have often spoken about tech companies who have many fingers in many pies. None more so than Tencent. Yesterday it was announced that a Chinese e-commerce startup called Pinduoduo (PDD) will IPO in the US, looking to raise $1.6bn.

Tencent, who already have a stake in the business, could pony up (excuse the pun) a further $250m into the business which has a target valuation of $30bn. The size and scale of these businesses is just incredible. It reminds me of how fortunate we are to have access to the Chinese tech world via Naspers.

This Business Day article titled

China's PDD, backed by Tencent, to raise up to $1.6bn in US IPO does a great job at explaining the details.

Michael's Musings

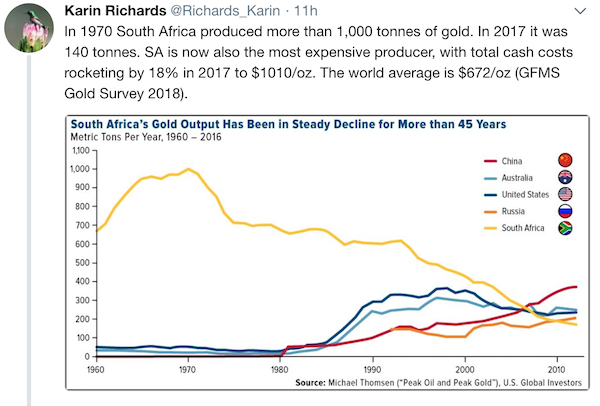

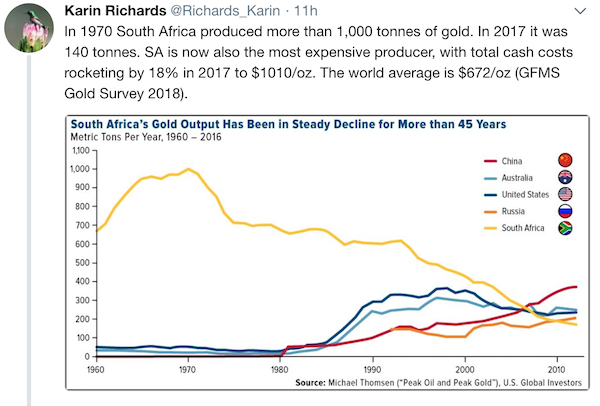

I remember the day clearly, when China overtook South Africa to become the globe's biggest gold producer. It was a rather big deal because South Africa had been the biggest gold producer for over 100 years. I can't find the exact numbers, but I think I saw a stat once saying that of all the gold mined in history, more than 50% of it comes from South Africa. This graph shows how much things have changed in South Africa.

To make matters worse, last week the Mineral Council of South Africa announced that as many as 75% of gold mines are not profitable. Given their age and now depth, our mines are just more expensive to operate, not to mention all the dangers. We are at a point now where to save lives, mines will have to become more mechanised.

Linkfest, Lap it Up

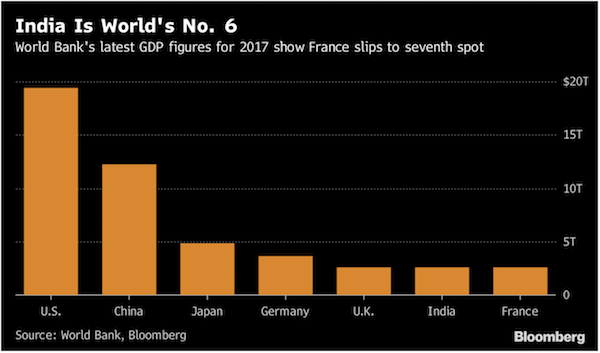

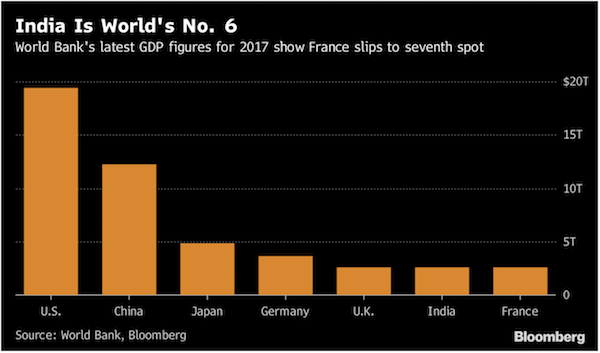

Did you see this news from last week? Having a look at the graph below, you get a better understanding how huge both China and the US are, and why a trade war between them is not good for the globe in general -

India Overtakes France to Become World's Sixth-Largest Economy

Who would think that we could run out of Carbon Dioxide

Who would think that we could run out of Carbon Dioxide? I didn't realise how much C02 we use in industrial processes -

The seemingly illogical reason Europe is running low on carbon dioxide. . . and beer.

For a trip to space,

For a trip to space, this does not sound too expensive? Especially if you think of the billions it cost 60-years ago to get people into space; I have no doubt that over the next few decades the price of space travel will continue to drop substantially -

Jeff Bezos plans to charge at least $200,000 for space rides

Vestact in the Media

Vestact in the Media

Through Moneyweb radio, Bright chatted to Nompu on SAFM about yesterday's events -

Market commentator - Bright from Vestact

Signing off

Today is a big data day locally, we have both CPI and retail sales figures. The expectation is for inflation to have risen from 4.4% to 4.8%, thanks to a weaker Rand and higher oil price. The All-share is off to another green start, great to see!

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista