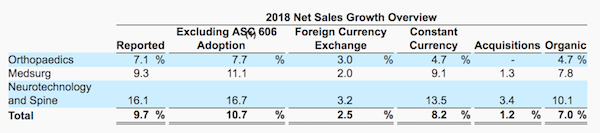

Last week Stryker reported first quarter results which looked solid. Sales increased 9.7% whilst adjusted earnings per share grew by 13.5% to $1.68.

The below table illustrates growth amongst Stryker's three main segments. It also indicates organic growth versus acquisitions.

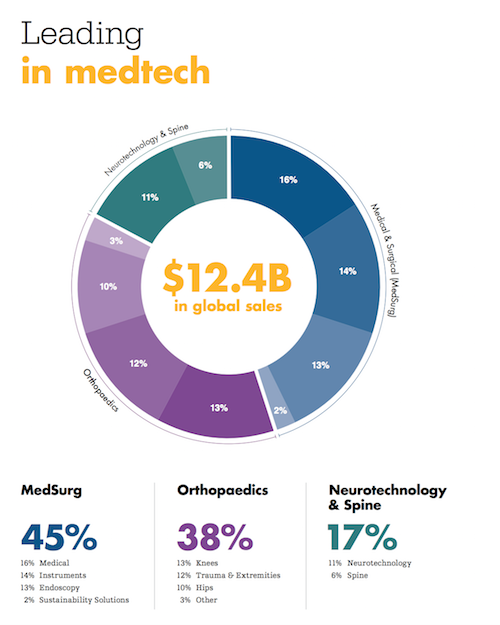

To get an even better idea of where Stryker makes their money, take a look at the informative pie graph from the 2017 annual report.

The company expects to make $7.25 in 2018. Trading at $168 the share affords a multiple of 23 times. Considering that the business has minimal debt, great margins (operating margin of 66%) and solid growth prospects, this makes sense.

Stryker is a very well managed business which continually gains market share in the medical devices market. Where they see gaps in the market they look to acquire smaller innovators in a sector constantly evolving. They are now large enough to do this on a regular basis.

New hospitals are being built and improved all over the globe as governments and private institutions prioritise healthcare. The demand will not stop growing. We are very happy to align ourselves with this consistent performer in the sector and we expect this to continue.