I did some number crunching on Netflix yesterday to try and understand why the share price has flown so fast. I wanted to see the potential profits this company can make.

I assumed 200 million subscribers. They currently have 125 million and growing fast so this number is not outrageous. I then assumed an average monthly subscription of $10 per month. This is higher than the current average of $8 but I feel the fee does have room to trend upwards.

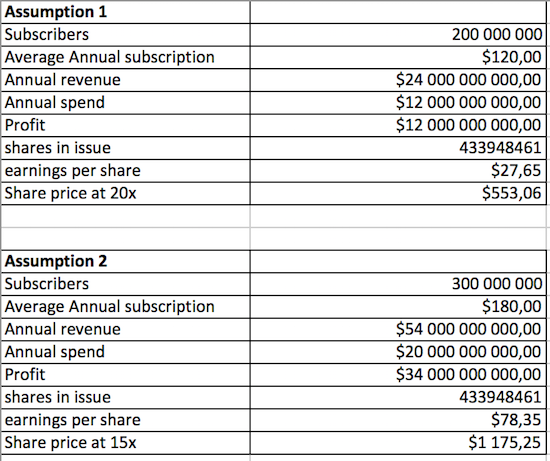

That equates to revenues of $24bn (currently $11.2bn). I then assumed annual expenditure on content, advertising and operations of $12bn (currently $8bn). This resulted in the company making $12bn in profits which equates to $27.65 a share. The share currently trades at $338. Assuming a PE of 20 (the market average) and you get to $553 a share.

I don't think these projected numbers are unrealistic in the near term at all. They are growing subscribers by 30% per annum.

When you play around with these numbers the potential profits are staggering. Assume 300 million subscribers are paying on average $15 per month. That equates to annual revenues of $54bn. Even if they bring their spend up to $20bn (their spend does not need to match their growth) and the business will be making $34bn in profits or $78.35 a share. Apply a 15 multiple and we get a share price of $1175.25. Again I don't think these assumptions are unreasonable.

That is why Netflix has flown and why we continue to like it as an investment, even after this great run.