Market Scorecard

Focus over the last two days has been on the airstrikes in Syria. One side says all their missiles hit their targets, the other says most of the missiles were shot down. Rule number one in politics, choose the 'truth' that best suits you.

More pressing for markets is China giving dates for when they will drop foreign ownership rules for automakers.

Electric vehicle ownership restrictions will be removed this year, commercial vehicles in 2020 and passenger vehicles in 2022. Very good news for Tesla, who has been wanting to build a factory in China for a while now. Then something that looks linked to the trade war build-up, but US officials insist it isn't -

ZTE banned from buying US tech for 7 years. ZTE was found guilty last year of selling US tech to Iran and North Korea; this 7 year ban is because the US feels ZTE didn't take decisive enough action to rectify the problem.

Yesterday the

JSE All-share closed up 0.16%, the

Dow closed up 1.06%, the

S&P 500 closed up 1.38%, and the

Nasdaq closed up 2.61%.

Our 10c Worth

One thing, from Paul

I recently mentioned that we had an interesting meeting with MTN CEO Rob Shuter. One of the points he made very firmly was that

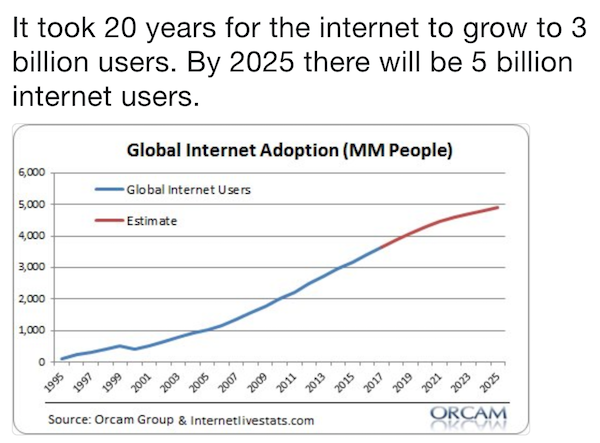

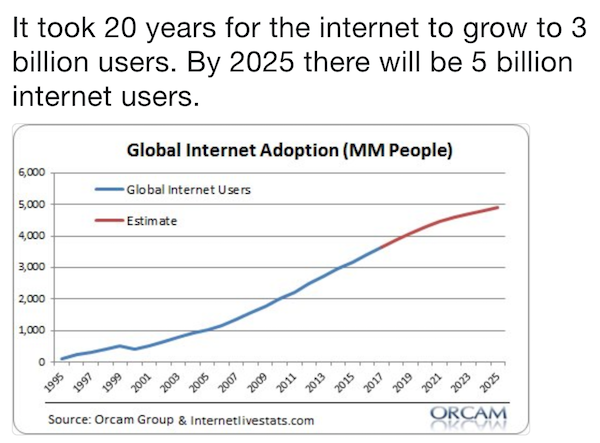

the number of people with access to the mobile internet is still growing fast.

Remember, this requires the customer to own a smartphone. It doesn't need to be the latest Apple iPhone-X either, a basic Samsung Galaxy J1 Mini Prime will be fine!

Here is the chart that makes that point. Another 2 billion to come. Most of them in emerging markets, of course. Many in countries served by MTN.

Michael's Musings

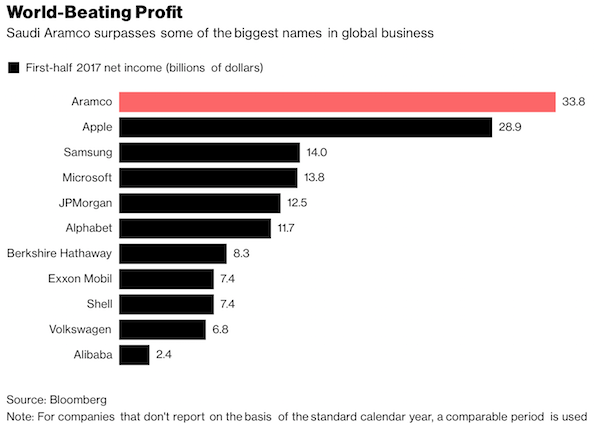

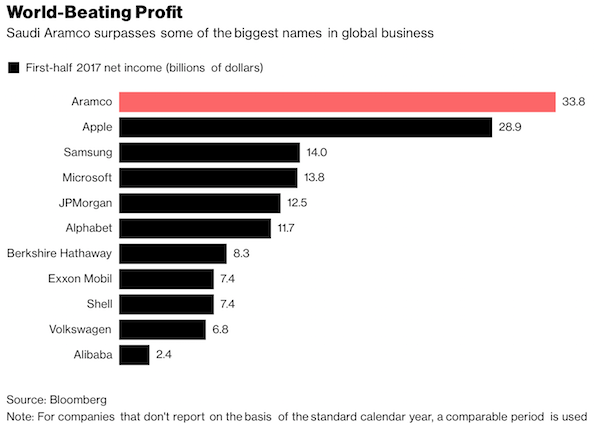

For the last 2-years, we have heard that Saudi Aramco wants to list, and when it does, it will be the biggest listed company in the world. To give you a sense of the size of the company and how much cash it produces, Bloomberg wrote the following piece -

The Aramco Accounts: Inside the World's Most Profitable Company.

The point that Bloomberg makes about the profits in the above graph is that this is from the first half of 2017 when oil was around $50. The oil price is now around $70 a barrel, so their profitability is even higher. One of the reasons Aramco makes so much money is due to their low-cost access to the oil:

"Using a rough measure of total oil, condensate and gas production, Aramco spent less than $4 per barrel to pump hydrocarbons, compared to similarly rough calculations of around $20 a barrel for Exxon and Shell."

All governments would love to own a company that spits out $13 billion in dividends every 6-months!

Bright's Banter

On this episode of Masters in Business Barry Ritholtz has a chat with the colourful Mark Cuban, Owner of Dallas Mavericks, co-founder of Broadcast.com and regular on ABC's "Shark Tank".

In the year 1999 Mark Cuban sold Broadcast.com, a sports streaming business ahead of its time to Yahoo.com for $5.6 billion. He also founded and seeded plenty more businesses since then, and it feels like he's not running out of steam.

This is definitely one energetic guy who's living life to the fullest, it was great to just understand his approach to life and how he processes information to action -

Masters In Business Dallas Mavericks Mark Cuban

Linkfest, Lap it Up

Steinhoff paid a premium of around 115% for Mattress Firm, shelling out around $3.8 billion. The firm was in decline when they bought it, and required a shake up. The shake up doesn't seem to be working though -

We shopped at Mattress Firm and saw why it could be on the verge of closing hundreds of stores.

One of the most exciting uses of AI is the ability to find relevant information, to complex questions -

Google's astounding new search tool will answer any question by reading thousands of books.

Company Corner

Byron's Beats

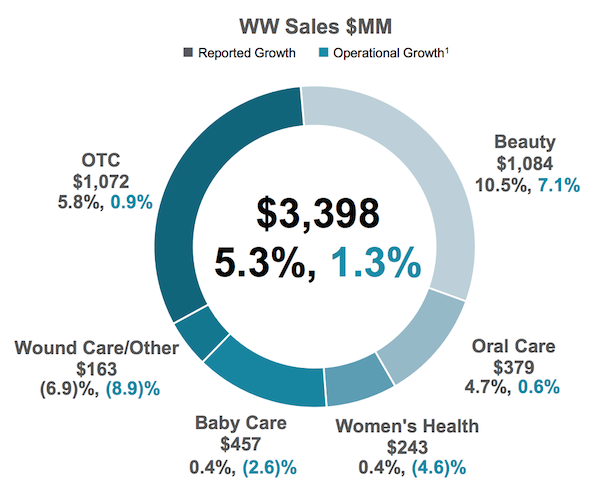

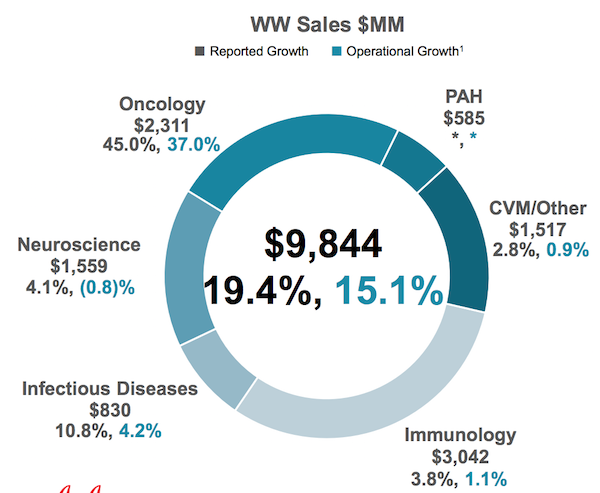

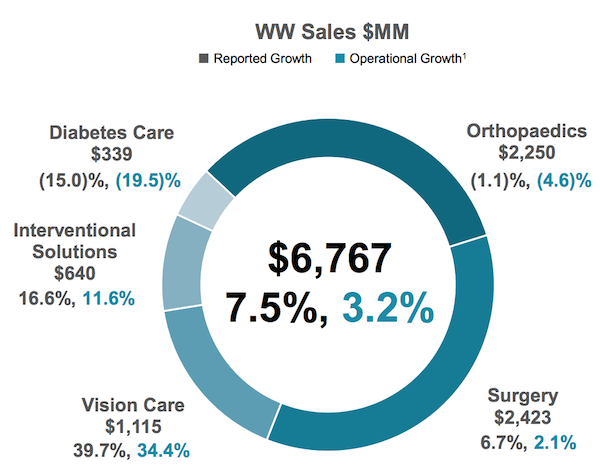

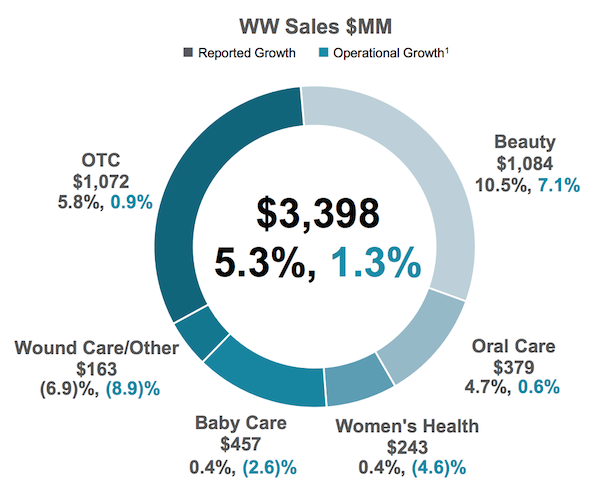

Yesterday Johnson & Johnson released 1st quarter results. This is quite a difficult business to understand because of all the moving parts. I will try something different today and use mostly images to explain these numbers.

JNJ has 3 main divisions. Consumer, Pharma and Devices. The below images shows how these divisions fared.

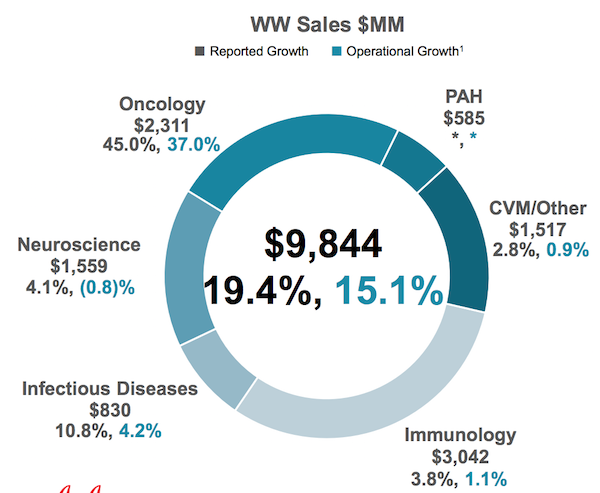

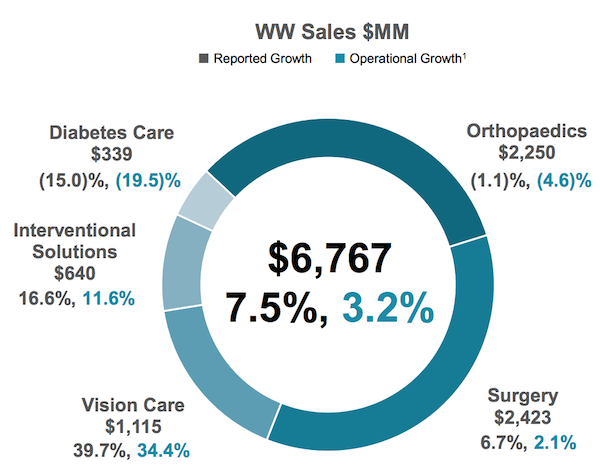

The next three pie graphs show the sales mix within each division.

Consumer

Pharma

Pharma

Medical Devices

Medical Devices

Overall

sales grew by 12.6% for the period to $20bn. This equated to $2.06 per share earnings. The company announced that

they would be investing a whopping $30bn in R&D and capital investments over the next four years thanks to the recent tax cuts. An immediate positive consequence of the new tax legislation.

The company is showing steady growth and trades at 16 times forward earnings. It pays a solid dividend and is reinvesting heavily in a sector where demand will consistently grow. JNJ is great stable balancer within our portfolios.

Yesterday

Starbucks announced that they will be temporarily closing more than half their US stores for training on the 29 May. Howard Schultz did the same thing when he returned as CEO in 2008. It caused a stir then and cost the company millions in lost sales, but he said it needed to be done.

In this case, the training is focused on racial bias training in response to the racial incident at their Philadelphia store. The news of the store closure didn't have an impact on the share price. Here is a Bloomberg piece on the topic -

Starbucks' Training Shutdown Could Cost It Just $16.7 Million.

Signing off

Our market is higher this morning following on from higher global markets. Mediclinic released a FY trading update this morning that the market liked, the stock is up close to 5%. On the data front, we had RSA CPI data out this morning, coming in at 3.8%, lower than expected. Low inflation is good news for the consumer and could mean a further interest rate cut down the line. We also have CPI out of the UK and the EU later.

Sent to you by Team Vestact.