Market Scorecard

Yesterday morning, there was very little market driving news. Then as the US woke up and Trump reached for his phone, to start tweeting, things got interesting. He kicked things off with the following tweet

"Russia vows to shoot down any and all missiles fired at Syria. Get ready Russia, because they will be coming, nice and new and "smart!" You shouldn't be partners with a Gas Killing Animal who kills his people and enjoys it!".

War in general is not a good thing, so as you can imagine, stocks were lower. The biggest impact was felt in the oil market though, with prices rising to levels last seen in 2014. In fairness, the oil market was a whisker from that mark anyway, even without a Trump tweet it probably would have reached the 'milestone'.

Then at around lunchtime in New York, the minutes from the last Fed meeting were released. Basically, they see the US economy 'running hot' for the next couple of years. Which is central banker speak for,

we will need to raise interest rates. These views are mostly priced into the market already. It seems the only unanswered question is whether the US has three or four interest rate hikes this year.

Yesterday the

JSE All-share closed down 1.02%, the

Dow closed down 0.90%, the

S&P 500 closed down 0.55%, and the

Nasdaq closed down 0.36%.

Our 10c Worth

One thing, from Paul

We work hard to make sure that our daily newsletter is of a high standard. Byron edits what we all contribute, and then Michael puts a lot effort into the final layout.

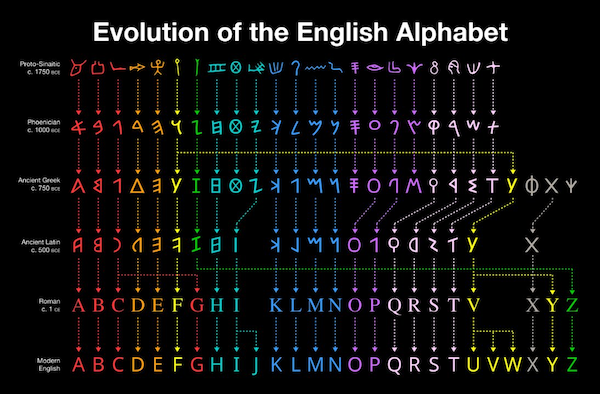

I liked the chart below, showing how the letters of the English alphabet have evolved over time. I guess that the early writers would have loved to have an automatic spell-checker!

Byron's Beats

When MTN started hiring big shots such as Rob Shuter, Ralph Mupita and Stephen Van Coller (all former bankers) investors expected some changes to the model. MTN has 220m clients to potentially tap with products other than mobile connection.

Their first go to was financial services, which has proved to be a big growth area for mobile companies in many underbanked African countries. MTN already has nearly 22 million Mobile Money customers

This article titled

MTN expands financial services offering with Ecobank deal explains how MTN plans to expand in this potential market. Ecobank has over 14 million clients in 36 African countries including Nigeria.

Remember that governments also encourage these types of developments because they bring down cash transactions which are hard to track.

Michael's Musings

Our view of technical analysis is similar to that of Buffett's, we don't use it. I must say the 'vomiting camel' chart formation was fun but pretty pictures on a graph is as far as it goes for us.

Recently, the S&P 500 broke below the 200 day moving average, which is considered a negative signal. Ben Carlson wrote a piece for Bloomberg exploring how useful this negative signal is for market timing, his title gives the ending away though -

Don't Use the 200-Day Moving Average as a Sell Signal.

I understand why people like to have a sell signal; to avoid all the big drops. No one wants to watch their portfolio drop by 20%, it hurts! The problem is not the selling part, the problem is when to buy back.

Most impending big stock sell-offs never happen, which means on average you end up selling low and buying back high. Paying transaction costs along the way.

Here is what Jeremy Siegel's research shows, it is better just to buy and hold.

"Siegel's results showed an annualized return of 9.7 percent from 1886-2012 for the timing model versus a 9.4 percent return for a simple buy and hold strategy. Once transaction costs were factored in, the timing model would have dropped to a return of 8.1 percent."

Bright's Banter

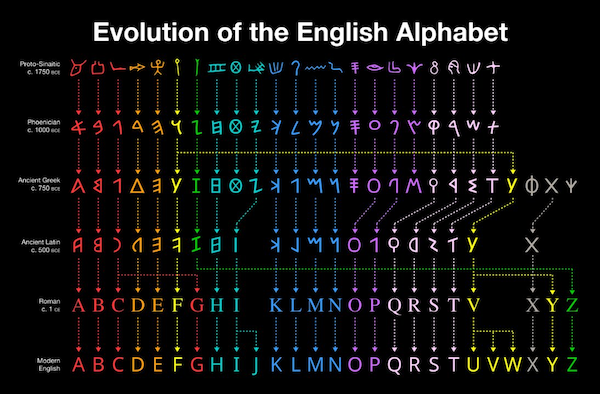

Do you remember Trump's tweet "trade wars are good, and easy to win", well in real life all wars are bad because wars come with casualties. The US implemented tariffs on Chinese steel and aluminium and to retaliate China introduced their own tariffs on American Aircrafts, Automobiles, Soybeans, Whiskey/Bourbon, and Chemicals.

The graph below shows the top 10 US industries that are going to be adversely affected by this Trade War.

You will find more infographics at

Statista

Linkfest, Lap it Up

DNA testing is shaking up our understanding of ancient history, just like carbon dating did in the late 1940's -

Divided by DNA: The uneasy relationship between archaeology and ancient genomics.

The human brain has not needed to deal with complex statistics for most of human existence, as a result there are some very common mistakes that we make when dealing with data -

Here are 15 Common Data Fallacies to Avoid.

Vestact in the Media

Byron was on CNBC's Closing Bell last night talking about Facebook -

Why Facebook is still a good buy despite data breach scandal.

Signing off

Asian markets and the JSE All-share are down this morning. The Rand has been rooted around the $/R 12.00 mark for a while now, good news for RSA consumers. Then later today we have RSA February mining production.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista