Market Scorecard

While you were sleeping Xi Jinping gave a speech, which was music to the market's ears. He said that China would decrease import tariffs and work at enforcing intellectual property of international firms. He went on to say:

"China does not seek trade surplus. We have a genuine desire to increase imports and achieve greater balance of international payments under the current account" and "This way, we will make economic globalization, more open, inclusive, balanced and beneficial to all".

You can read a more in-depth analysis of his speech here,

China's Xi announces plans to 'open' China, including lowering tariffs on imported autos.

For now, it looks like the speech has defused the 'trade wars', global futures are higher and commodity prices are higher. Viva!

Yesterday the

JSE All-share closed up 0.38%, the

Dow closed down 0.19%, the

S&P 500 closed up 0.33%, and the

Nasdaq closed up 0.51%.

Our 10c Worth

One thing, from Paul

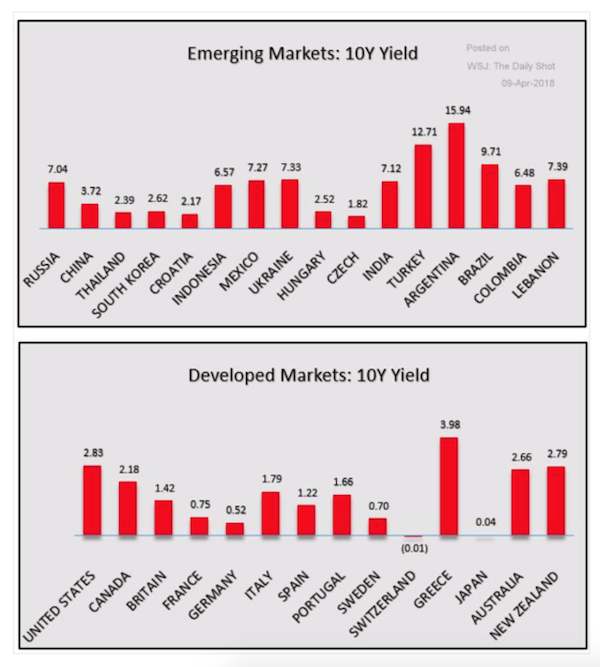

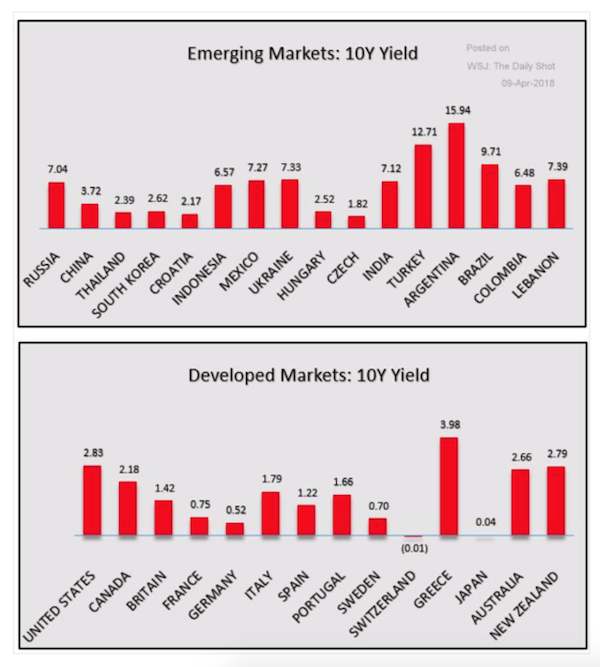

Are you invested in government bonds? If you own a pension or retirement annuity, then you probably are. I'm not really a close follower of the bond market. I had to ask Michael what the current yield on the benchmark 10-year bond in South Africa. It's 8.08%.

Government bonds are considered safe, as their coupon payments are effectively guaranteed by taxes paid by citizens. Of course, that's not always a sure thing. South Africa defaulted on its international bond obligations in 1985. Greece got into trouble a few years ago, and Mozambique is currently giving its bondholders the runaround. The worse the state of a nation's finances the higher the effective yield that they have to pay in order to attract investors.

See below how that 8.08% of ours compares to our peer countries around the world. We are not amongst the best, but we are not the worst either.

Byron's Beats

I strongly believe that consistent reading is extremely important for ongoing development. I prefer reading non-fiction, but any book is better than no book. These days TV can also be very educational. Especially if you splash out the R120 a month to have a Netflix subscription (that is the price of 1 pizza these days!)

I love watching non-fiction shows that look back at history. There are also some great shows which look at financial stories and current events. Some of my favourites include Betting on Zero, The Big Short (movie), Dirty Money, Banking on Bitcoin and the recent show about Donald Trump called Trump, An American Dream.

Get watching and sound far more intellectual around the braai on Saturday.

Michael's Musings

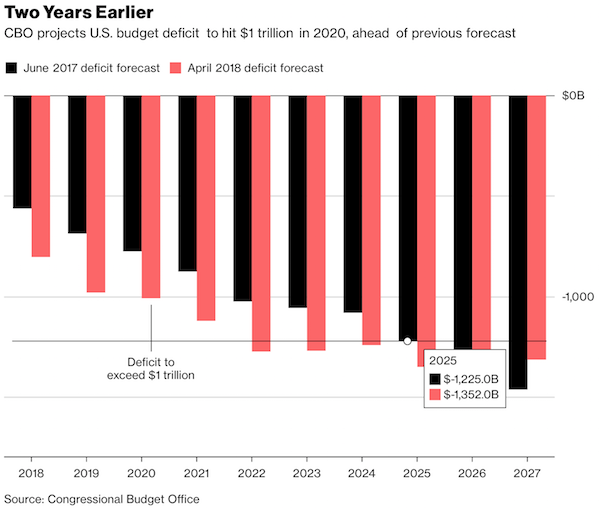

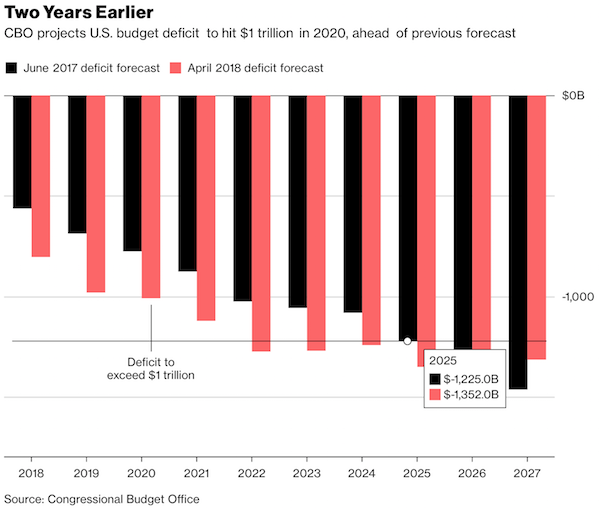

Yesterday the Congressional Budget Office (CBO) released their forecast of what US finances will look like for the next decade. Generally, these reports don't get too much attention as a country's finances don't change much from one reporting period to the next. This one was of particular importance though because of the recent tax overhauls.

Trump's theory is that lower taxes will lead to higher tax collection in years to come. Basically, go backwards now to be better off tomorrow. The CBO sees the US budget deficit increasing substantially over the next 9-years, which isn't great. General economic theory says that during the good times countries should pay down their debts, or at the very least keep it the same, so that during the bad times governments have room to increase their spending to prop up the economy.

It is too early to tell if Trump's plan is going to work or not, we will have to wait a few years. By that time, it is either going to be a huge success or a massive failure. You can read Bloomberg's take here -

U.S. Deficit to Surpass $1 Trillion Two Years Ahead of Estimates, CBO Says

Bright's Banter

One of my all-time favourites, John Kenneth Galbraith, said the following, "There is nothing reliable to be learned about making money. If there were, study would be intense and everyone with a positive IQ would be rich."

There is no sure way to investment success. As soon as most market participants follow the same method of making money, that method becomes obsolete instantaneously. And all the people that use that same method will achieve the same results.

In his book Pioneering Portfolio Management, David Swensen says that "establishing and maintaining an unconventional investment profile requires acceptance of uncomfortably idiosyncratic portfolios, which frequently appears downright imprudent in the eyes of conventional wisdom."

If you want investment success, you have to bet against the consensus

and be right.

The article below shows exactly how hard it can be for investment managers who "lose their passion for the game". This story is very rare because many investment professionals choose not to share their failures in such an open manner.

Whitney Tilson, once an all-star investment manager, has decided to close his fund due to poor performance in what is described as one of the best bull markets in modern day -

The Last Days Of Whitney Tilson at Kase Capital

Signing off

Our All-share is surging today, led by mining stocks which are more than happy to see higher commodity prices. There is not much to speak of from a data perspective today. Of significance though, is 'The Zuck' will be appearing before Congress today and tomorrow, this follows him meeting some top lawmakers yesterday. Expect some very tough questions to come his way.

Sent to you by Team Vestact.