Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

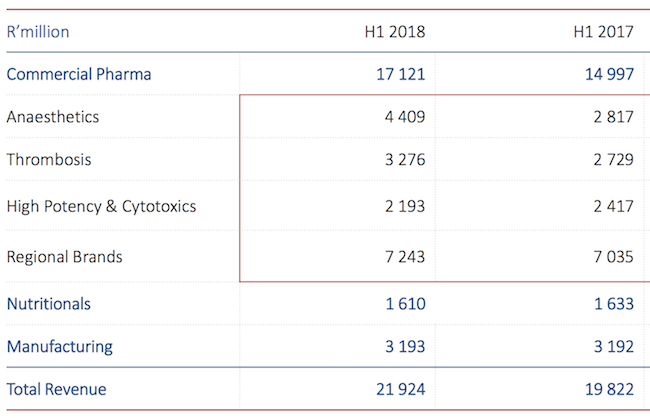

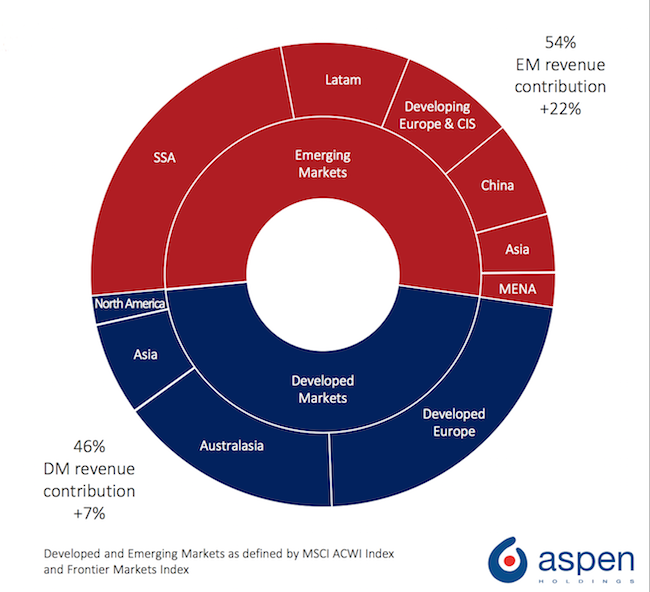

Towards the end of last week Aspen released their 6-month results for the period ending 31 December 2017. As expected from the trading update, the growth in earnings looked solid. Revenues grew by 11%, and headline earnings grew by 26%. The below table shows the businesses product breakdown by revenue. The pie graph below then shows the product mix by region.

There is still a lot of hard work being done to integrate recent acquisitions. You can see this within the divisions. Anaesthetics for example grew by 59% to become a major contributor. This was because the AstraZeneca deal had now been fully integrated for the first time.

Regional Brands, which is basically the old business, pre-2013, now only accounts for one-third of sales. Although revenues for the division were up 4%, there were lots of moving parts. For example their ARV tender has doubled from this period last year due to bottlenecks experienced last year. Mybulen, which is Aspen's version of Myprodol, has been stealing solid market share. That resulted in Aspen's OTC division in Southern Africa growing 38% for the period.

Nutritionals were relatively flat. That business is in transition as they push their new and approved brand; Alula. There are high expectations for this business as well as a potential collaboration with a big a distributor.

Borrowings increased to R43bn from R35.5bn. This sits at 3.6 x EBITA which remains manageable for a business with good margins and solid cash flows. Normalised headline earnings per share came in at R8.42.

We think these are a good set of numbers as the 5-year plan to internationalise this business comes together. Trading at 15 time forward earnings, the share price is still offering value. Recent rumours of more short interest has put pressure on the share price. You should ignore the short term noise.