Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On the 21st of February I went to Bidcorp's results presentation which was held in the beautiful Standard Bank head office building in Rosebank. The company was reporting their half year results to the end of December 2017. Just a quick refresh, this business has diverse food service operation across 30 countries. 90% of Bidcorp's earnings continue to be offshore. Only 10% is earned locally, making it another useful Rand-hedge.

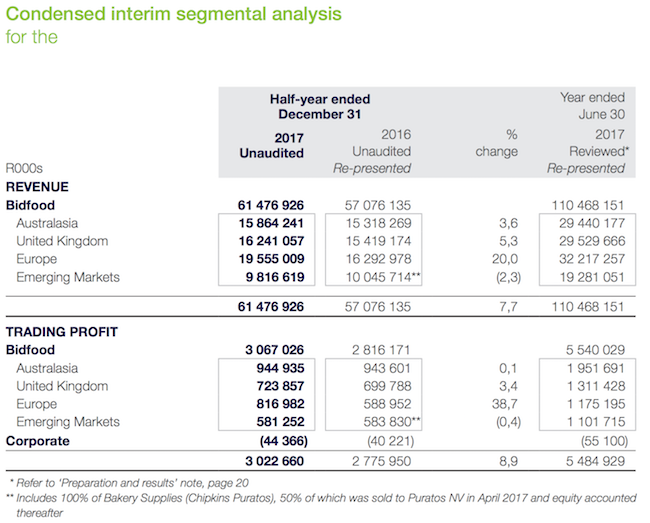

We've seen the Rand strengthen in recent times, so that's not helpful. Notwithstanding that headwind, the company reported total revenues of R61.4 billion, that's up 7.7% from the previous year. Headline earnings per share were up 8.6% to 640c and the company increased the interim dividend by 12% to 280c.

The segmental analysis below shows that the Australasian region continues to be largest contributor to both the top and bottom line. Food inflation was mixed and muted on average (never forget the 6-foot-tall man who drowned crossing the stream that was 5 feet deep on average). Wage inflation has been relentless across the board, management worry about that.

The company confirmed that they were reinvesting in their business and expanding capacity in Australia & New Zealand in order to fill territorial gaps and be closer to the consumer. In those two countries Bidcorp is expanding from one distribution centre each to about three to five smaller, more manageable urban facilities.

Trading in Europe was fantastic with revenues up 16.2% and trading profits up 32.9% in constant currencies with improving margins from 3.6% to 4.2%. Overall the businesses in Europe are making steady progress notwithstanding some avian flu outbreaks which led to a shortage in eggs and dairy products. The disruptions were temporary.

They business continued to make small bolt-on acquisitions as a way to enter new regions or to supplement existing capacity for broader reach. Emerging markets revenues were up 0.7%, trading profit was up 1.7% but the margins stood at 5.9%. The business entered the Vietnam market and Malaysia is starting to contribute. The Greater China region was also affected by the dairy and poultry situation.

The CEO Bernard Berson was asked if the likes of Uber Eats and Delivery Hero were eating their lunch? He explained that in order for a restaurant to deliver food directly to the customer, they still need Bidcorp for the ingredients. Ex-restaurant or ghost/shadow kitchens use platforms like Uber Eats to get the food to the customer but they need food ingredient suppliers. Bidcorp will benefitting from more eating out and more takeout food delivery. Sounds good! #KaChing.

I would argue that Bidcorp's edge is their complex infrastructure, and "routes to market". They have spent billions over the years to develop the infrastructure to reach their customers. Adding more customers to that system is easy and adds to margins. I don't want to get too excited here but management mentioned that they are using "big data analytics" to better understand their customers. They have all the data already! This tech spend makes good sense.

The food services industry remains fragmented with only a few big players spread across the globe. Bidcorp is a consolidator and sees more opportunities to grow. The company trades at a historic PE of 21 which is cheaper than its peers. Bidcorp believes that a low-debt balance sheet is a strong competitive advantage. For the moment, the strong Rand is a bonus when considering capital purchases.