Last week Starbucks released its First Quarter numbers. Below, Paul goes into our thinking around owning them, so I will focus on the numbers. This was the first time that they had over $6 billion in revenue for a quarter, that is a monster number for a company that sells coffee! For comparison purposes, Woolworths' current market cap is R70 billion, Starbucks sold more in three months than the entire value of Woolworths.

Since this time last year, they opened 700 new stores (almost two new stores a day) globally bringing their footprint to 28 039 stores across 76 countries. Of those 700 new stores, 300 of them were in the China/Asia Pacific region.

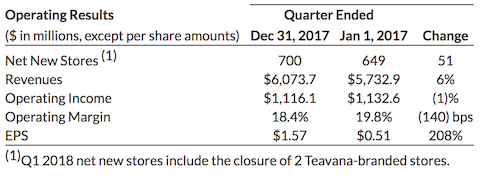

The below table gives the best snapshot of where the company currently stands. The drop in margin is due to them selling more food; it is a more 'commodity' type product where margins are lower than coffee.

The key figure in the numbers for us was the 30% growth for China, specifically. As it stands, of the $6 billion in revenue, China is less than $1 billion, showing the amount of growth potential going forward.