To market to market to buy a fat pig. There you have it folks, interest rates will be the same until at least the last week of March. The next MPC meeting falls just before Easter weekend; we might go into that weekend with just a little bit more cash in our pockets. One member of the MPC had voted yesterday to cut rates by 25 basis points, with the other five members voting to leave them as is. That one vote signals the direction rates are heading, assuming things stay as is in the economy.

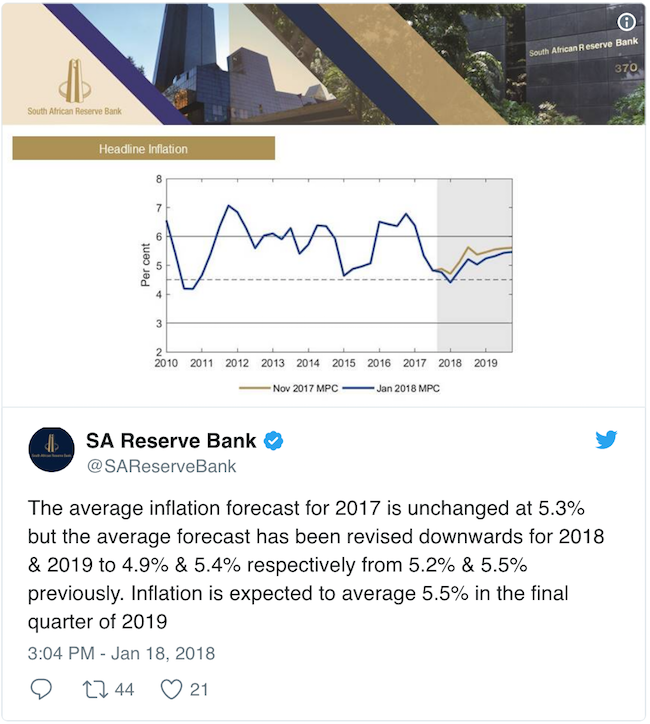

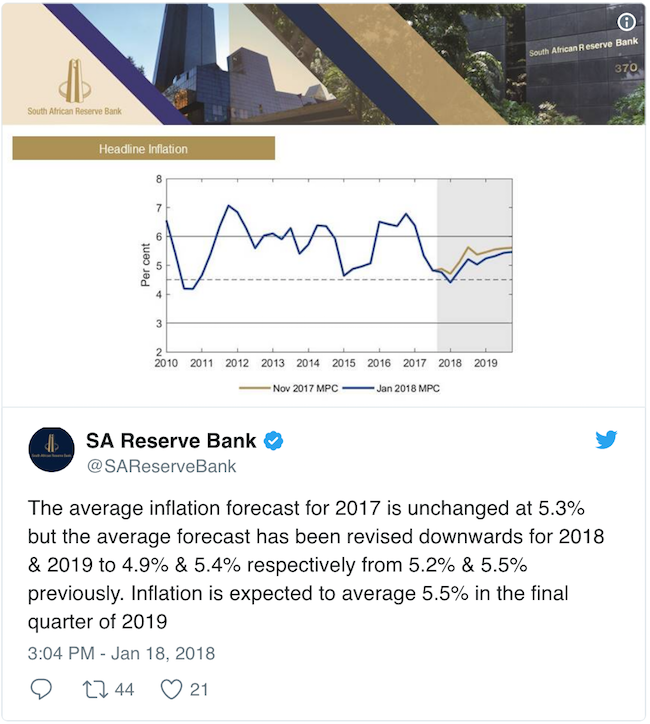

Given that the SARB has one mandate, to keep inflation under control, inflation forecasts give us a good idea of what the MPC is thinking. Their forecast has inflation staying inside of their targeted 4% - 6% band until at least the end of 2019. A significant component of their inflation forecast model is our exchange rate; good luck to anyone forecasting our exchange rate for February 2018, let alone December 2019! For now, thanks to a stronger currency and more subdued electricity tariff hikes, the forecasted track of inflation has improved.

The above information points to a cut on the cards sometime this year. The counter-argument though is that a rate cut will hurt the Rand. Lower interest rates leads to money flowing out the economy, looking for higher yields elsewhere. Remember, developed countries are in a prolonged cycle of raising their rates, making the US and EU an increasingly more attractive destination for capital. A weaker Rand would then lead to higher inflation and the need for a rate hike. So to avoid all the up and down, rather leave rates as is.

I am of the opinion that as a developing country, more capital flows can be gained by having a low-interest rate and high growth rate environment.

Luckily we don't have to make those calls. We have skilled individuals, who spend many hours studying the data to make educated decisions on what is best. Proof of that quality can be seen in our very own Lesetja Kganyago being appointed Chair of the International Monetary and Financial Committee (IMFC) for a term of three years. Here is the announcement from the IMF, IMFC Selects South African Reserve Bank Governor Lesetja Kganyago as New Chairman.

Market Scorecard. After Wednesday's record-breaking day, stocks were less buoyant on Thursday. The Dow was down 0.37%, the S&P 500 was down 0.16%, and the Nasdaq was down 0.03%. Looking at the All-share, my graph shows it is a few points up on the day, the numbers show a few points down on the day and the percentage change is recorded as 0.00%. We can safely say it was flat. Locally, it was all about the retailers yesterday, Woolies was up 9%, STAR was up 7%, Shoprite was up 4% and Spar was up 3%.

Company Corner

One thing, from Paul

By now, we are all familiar with the debacle at

Steinhoff, the South African-based furniture and general retailer. It blew up late last year when its CEO

Markus Jooste stepped down amidst allegations of fraud and accounting irregularities. The group has a complex global structure, and it has a EUR 6 billion hole in its balance sheet, apparently centred on its German-based financing subsidiaries. That's what Jooste was covering up, it seems. The registered address of the international group is in the Netherlands, but it is listed in Germany on the Frankfurt bourse, and here in Joburg.

The then chairman of the board of Steinhoff, legendary investor

Christo Wiese lost about $4 billion in the wipeout. That's R50 billion, in case you were wondering. Wiese had a number of margin loans in place where he used his Steinhoff shares (obtained from selling Pepkor to Steinhoff) as collateral to buy more and more Steinhoff shares. A range of global banks lined up to provide funding in that process, and they have also all had to swallow down on multi-million US dollar losses in recent days.

The share price of Steinhoff here in the JSE fell from an all-time high of around R95 in March 2016, to a low of R3.90 on December 21, late last year. It's now trading just above R7 per share.

The group announced yesterday that they had more or less stabilised the ship, obtaining adequate funding at an operational level to continue trading in all their subsidiaries. These include Pepkor, Ackermans, Conforama, Poundland, Mattress Firm and Fantastic Furniture.

PWC and Deloittes are working overtime to republish financial accounts for the firm for at least the last three years. As for that balance sheet hole at the top of the group, Steinhoff International has obtained limited funding from the release of its obligations to its African subsidiary STAR, and is basically begging its bondholders and other creditors for more breathing space.

So in summary, it's not dead yet, but it's not out of the woods either! For now, we suggest that clients hold on to the shares. We will probably still advise that you sell them, once they are trading as a going concern.

Read the announcement for yourself here:

Process And Liquidity Update

Linkfest, lap it up

Michael's Musings

One of the concerns around Apple is that they won't find a product to replace the significance of the iPhone in years to come. With the speed of growth and the prominence of apps in our lives, their next product may not be hardware but software -

2017 Retrospective: A Monumental Year for the App Economy.

This blog post has a look at the history of Tesla

This blog post has a look at the history of Tesla and what the future of transportation may look like -

Tesla Motors, The Visionary Dream of Elon Musk. Personally, I would like to see Tesla buy Space X, and roll out rockets to speed up international travel!

Vestact in the Media

Earlier in the week, Bright chatted to PowerFM about retail trading updates -

Bright Khumalo, Shoprite and TFG operational updates.

Home again, home again, jiggety-jog. Our market is down this morning, taking its lead from the US markets overnight. The only slightly significant data out today, is the retail sales read from the UK. Some South African retailers have operations in the UK, in particular Brait's New Look asset which has been struggling recently.

Sent to you by Team Vestact.