Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week Friday we received fourth quarter and end of year results from JP Morgan. This is the first results release since we put JP Morgan on our buy list. US companies usually disclose more details on the quarterly movements. I will therefore give a summary of the annual results and then focus more on the quarterly numbers in detail.

For the financial year 2017, revenues came in at a whopping $103.6bn; $51.4bn of that was net interest income and $52.2bn was non-interest income. After all costs, net income for us common shareholders equated to $22.6bn. That equates to R278bn in profits, bigger than the entire market cap of MTN (R252bn)!

Per-share this equated to $6.87 excluding once offs. Trading at $112 a share the company affords a historic PE of 16.3. This is lower than the general market but historically high for a bank. The price is factoring in the higher interest rates as well as the tax cuts. Earnings for next year are expected to be substantially higher (up 25%) at $8.60. Putting the stock on a forward multiple of 13.

Another important measure for banks, is their return on equity (ROE). For the quarter, JP Morgan reported an ROE of 13%, well above the average of around 10%.

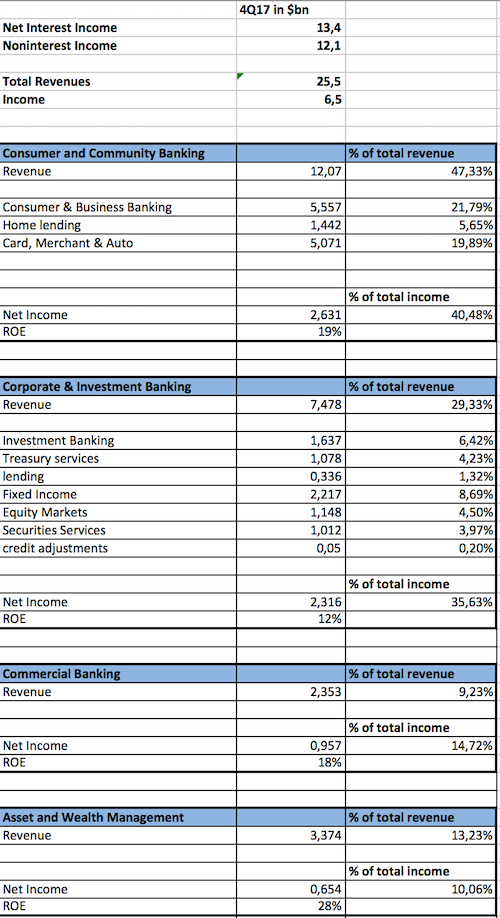

Segmental analysis for the quarter.

I have plugged the numbers from the report into a spreadsheet to make things simpler (I hope).

As you can see, the business is very well diversified across everything and anything a bank can make money from. It is not too reliant on Investment Banking, but it still makes a big chunk of cash from that division. Investment Banking can be volatile; those profits should be taken as an added bonus. They even mention a $143m loss within their Equity Markets division from a single client margin loan, AKA Christo Wiese.

The cream of this business for us is the retail banking division (consumer banking). This division equates to 47% of revenues and 40% of net income. It stands to benefit from three major factors.