Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

For many investors they had flashbacks of Steinhoff yesterday as the Aspen share price dropped 10% and the the words 'Viceroy report' were mentioned. Viceroy Research were the guys who published a report showing how Steinhoff were cooking the books. This Tweet from Viceroy in late December confirms that they have a South African company in their sites.

I'm not sure how the market even 'knows' it is Aspen because Viceroy hasn't publicly stated any company name. Maybe the Viceroy people brought up Aspen one too many times when asking questions?

This SENS announcement from Aspen yesterday afternoon, helped the share price recover some of its losses. Thanks to all the attention around Aspen yesterday, I'm sure the Viceroy team received many requests for comments. They released the below comment last night. We will only know in the next three months which South African company is in their sites.

What do we know at the moment?

1) Aspen is being investigated in the UK by the UK Competition and Markets Authority ("CMA") for two drugs that have a combined revenue of GBP11.1 million. This investigation was opened in October 2017.

2) In early October 2017 the South African Competition Commission decided to drop its investigation of Aspen for suspected abuse of dominance and excessive pricing.

3) The Italian Competition Authority ("ICA") fined Aspen EUR 5.2 million and dismissed Aspen's appeal in June 2017. In their SENS announcement Aspen does note that "a generic version of one of the Aspen drugs in question has recently been approved in Italy with a list price of more than double that of the Aspen drug on an equivalent dose basis."

4) In May 2017 the the European Commission "opens formal investigation into Aspen Pharma's pricing practices for cancer medicines". This was in line with the Italian investigation but excluded drugs sold in Italy given that Italy was doing their own investigation.

There are also some similarities between Steinhoff and Aspen that people are now focussing on. The first of which is that both Aspen and Steinhoff's business model is to buy companies and then plug it into the efficiently run parent company, creating value for shareholders. For both companies they have operations on every continent. Many purchases and multiple operating jurisdictions create many moving parts, which creates gaps for managers to hide things. This is where the auditors come in, to ensure that the numbers reported reflect the business.

The second is that both companies have big debt burdens, which come with big interest bills. In Aspen's case they have around R73 billion in debt, which they pay around R2 billion a year on. That number is irrelevant without context though. Aspen have R116 billion in assets, which includes R60 billion in intangible assets (things like brand names, patents and licenses). More importantly, how does their cashflow stack up agains the interest payments? In the last financial year they had an operating profit of R8.3 billion and cash generated from operating activities of R6.5 billion. Depending on how you want to look at it, they can cover their interest payments three or four times overs. Their debt is high but not excessive.

All of this is not new information though. What has changed is people's perception of these facts due to fear and recency bias. Are there skeletons hiding in Aspen's closest? Publicly available information says there aren't.

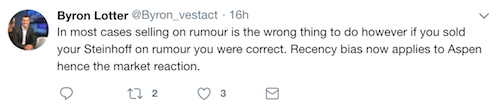

What to do from here? Making long term investment decisions based on emotion almost always ends badly. Wait for concrete facts to make decisions, right now there aren't any. There might not even be any new information. It is not unusual for organisations to write negative reports about other companies. Especially companies where the organisation has a short position. This tweet from Byron yesterday sums things up well.