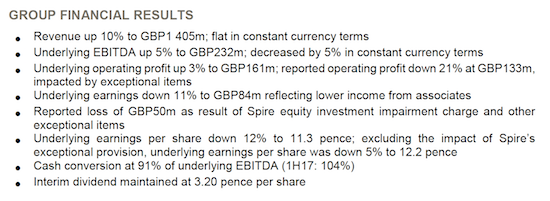

Last week Thursday we received interim results from Mediclinic. It was a very busy 6 months for the business as they tried to turn around the Middle Eastern division whilst dealing with tough conditions in South Africa and Switzerland. Here are the financial highlights for the 6 month period.

As you can see, it certainly isn't easy but if you strip out a few once offs as well as the write down from the Spire asset, things are slowly improving.

Unfortunately the share price has taken more heat. The market had high expectations for Mediclinic following an incredible growth patch and then the London listing. What we have seen here is a rerating for the company as these expectations have not been met.

The underlying fundamentals are still strong and the company is reinvesting a lot of capital into their hospitals to keep them world class.

There is also the pending Spire transaction which, as of this morning has been taken off the table. Maybe this is not such a bad thing. Running hospitals is an expensive business. It seems Mediclinic already have their hands full. The share had popped 6% on the news but has since pulled back.

We are monitoring this one closely, we are still happy to be patient and see what they can achieve over the next 6 months. Stay tuned.