Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Stryker 3Q numbers

- Completed the purchase of NOVADAQ Technologies on the 1st of September 2017

- Acquired French company Vexim on the 24th of October 2017 to be completed in Q4

- Sage recalls and hurricane impact expected to result in approximately $45 Million in lost sales in Q4

On Friday the 27th of October Stryker reported better than expected numbers for the third quarter and that sent the share price soaring over 7% on the day. A good day for Vestact clients that hold this counter in our offshore portfolios. They also increased its guidance for the 2017 full year with expected sales between 6.5% to 7% and earnings of $6.45 to $6.50.

How did the company do compared to Wall Street's Expectations?

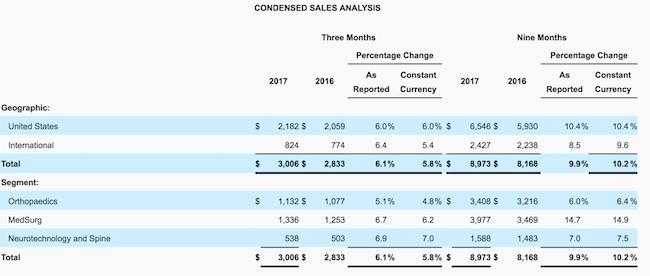

1) Third-Quarter Net Sales grew by 6.1% to $3 Billion (5.8% in constant currency) which beat expectations by $30 Million

- Orthopaedics grew by 5.1%

- MedSurg grew by 6.7%

- Neurotechnology and Spine grew by 6.9%

2) Third-Quarter Net Earnings Per Share grew by 21.3% to $1.14

3) Third-Quarter Adjusted Net Earnings Per Share grew by 9.4% to $1.52, a modest beat of $0.02

All three reporting division of Stryker did well in the third quarter notwithstanding the negative impact of the Sage product recalls in their MedSurg division and the hurricane that halted production in the quarter. Production volumes were also up throughout the company. Mako Robots which are mostly used in knee surgeries are still driving sales in a big way as the company sold 33 Mako Robots of which 23 were installed in the U.S. Total knee procedures increased more than 50%.

On the 1st of September 2017 Stryker acquired NOVADAQ for a purchase price of $678 million. We wrote a comprehensive piece here on what NOVADAQ does and how it complements the Stryker's Endoscopy's portfolio. NOVADAQ is said to have contributed positively to Endoscopy sales as those were up 13.4%.

Stryker also acquired a French company VEXIM for EUR183 Million in exchange for 50.7% of the shares in the company. VEXIM is a specialist in design of minimally invasive spine surgery medical devices. The prominent brand is called SpineJack which the company describes as a mechanical expandable VCF implant for vertebral fracture reduction and stabilisation. This spine technology will complement the Stryker interventional spine business and transform its position in the space.

Stryker is still our preferred company in the medical devices space because the business has the margins of an iPhone, strong brands which drive volumes and better market positioning over competitors like Medtronic, Thermo Fisher, or Zimmer. Their devices are still the favourite across the medical community.