Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Wednesday we had 3rd quarter results from Amgen. Remember these guys discover, develop and manufacture various human therapeutics. When looking at this company, all focus needs to be on their portfolio of therapies; what they cure, competition, FDA approval, medical aid adoption, doctor adoption, side effects, how the therapy is administered, regulation and many more factors. Fortunately, Amgen has a market cap of $130bn (30% bigger than Naspers) and boasts a portfolio of more than 13 mainstream products with annual sales ranging from $150m to $6bn.

My point here is that, yes the industry can be volatile with lots of moving parts, but Amgen is diversified enough to absorb these factors while growing within a very exciting and fast-moving sector.

Let's get into those numbers.

Currently, the portfolio is in a transition phase. Some of the blockbusters are slowing, while a few potential big sellers are showing progress. This meant that revenues declined by 1% for the period. However margins were much better, and there were fewer shares in issue. This resulted in earnings per share growing by 8% to $3.27 for the period. Expectations for the full year are for earnings per share of $12.60.

The share trades at $177 or 14 times earnings. For a company with operating margins of 55% and a cash position of $41.4bn (debt sits at $35.8bn) these are very solid fundamentals. Not to mention the 2.7% dividend yield.

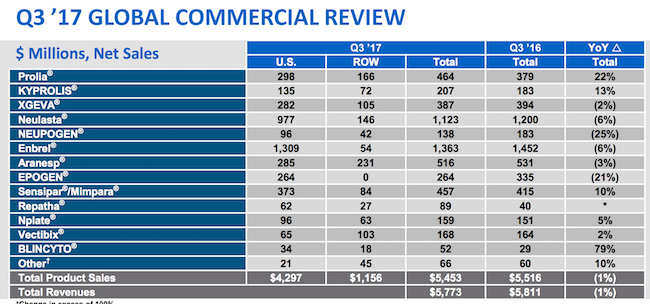

In case you are interested (we do have a few Doctors as clients) here is their product mix. These therapies attempt to cure all sorts of diseases that range from arthritis, heart disease, cancer, osteoporosis, migraines and many other awful ailments you never want to have.

As you can see, Prolia which helps cure osteoporosis in women after menopause was responsible for some solid growth. They expect this drug to continue to power ahead and become a major revenue driver. Repatha which brings down cholesterol is another potential blockbuster. This drug saw sales increase 123% year on year albeit off a low base.

So far this year Amgen has spent $2.5bn on Research and Development. That should breach $3bn by the end of the year. You are buying this company for its size, diversity and ability to attract quality talent. These factors will result in a constant supply of quality therapies in a booming sector. Not all of them will be major successes but the ones that are will result in outperformance. We are conviction buy on Amgen at these attractive levels.