Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Friday last week, before the US market opened, Wells Fargo reported their 3Q numbers. Whenever I read their results, I am amazed at their size and the size of the US economy as a whole. Here are some of the massive numbers, for reference bear in mind that South Africa's GDP last year was $295 billion. Over the previous quarter, they had applications for $73 billion in home loans, $59 billion were approved. Over the period, the average deposits in the bank were $1.3 trillion and the average outstanding loans were $952 billion. Shifting to the Wealth and Investment Management division, it had $1.9 trillion in assets! When people talk about the most prominent asset managers, Wells Fargo is never mentioned, even though there are only a handful of firms with over $1 trillion in assets.

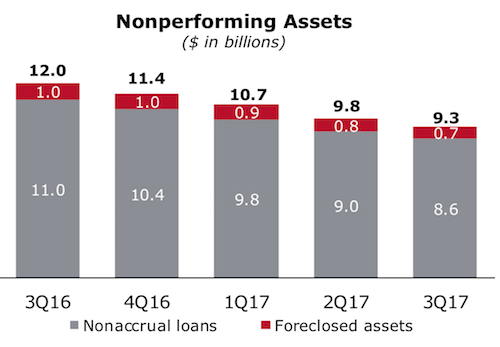

A sign that the US economy is back on track, is the number of nonperforming loans is decreasing. Half of the improvement comes from their commercial and industrial customers, and the other half comes from what they call 'Real estate 1-4 family first mortgage' segment. Even though they have $9 billion in nonperforming assets, it is less than 1% of their loan book.

Unfortunately, the number overshadowing the results was their $1 billion they had to spend in legal costs. To make matters worse, it is not a tax-deductible expense. Thanks to that $1 billion expense, Net Income was down 18% to $4.6 billion. When you type, Wells Fargo and scandal into Google, there are a few that pop up from the last year. Wells Fargo employs just short of 300 000 people, the hope is that there were a few bad eggs that have now been removed and that it is not a company-wide culture problem. It seems that the strategy from management is to comb through the company, find the practices that are questionable, stop them and then refund customers any potential damages. By doing this, it may be costly upfront, but they then get to start with a clean slate.

The reason to own Wells Fargo is that their performance is closely tied to that of the US economy, which should continue to grow for generations. Added to the growth of the US economy is the ability of Wells Fargo to cut costs by encouraging customers to go electronic. Over the last year, they have consolidated 145 branches into existing branches; they still have around 6 000 retail branches in their network. Americans love using cash though, less than 1 in 2 customers have a credit card. There has also been a big push to move customers online; you can now apply for a home loan through their webpage, and they have made doing an EFT easier. Management is starting to see behaviour shifts in clients, who are beginning to embrace electronic channels.

Wells Fargo is a juggernaut that keeps rolling forward, despite all the scandals swirling around them. If they can cut out the cancer of putting profits above the customer, they will survive and probably be stronger down the road for it.