Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Thursday we had full year earnings from Aspen, one of our biggest local holdings. This one certainly deserves a closer look.

I went to the results presentation and I must say, Stephen Saad looked a lot more relaxed than he did at previous results releases. He started off by saying that in 2013 they decided to change from being regional player to a global player. It was a big decision and has resulted in a massive slog for the team over the last four years. They announced their first major deal with Merck in June 2013. The share price popped on the news from R185 a share to R235. It then went all the way to R438 a share in January 2015. Sadly, they then crawled down to a recent low of R250 in February 2016. The share price is now at R310 a share after surging 8% after these results. It has been a very busy four years. Saad said yesterday that these results finally reflect the business that they have been trying to build.

Here are the numbers

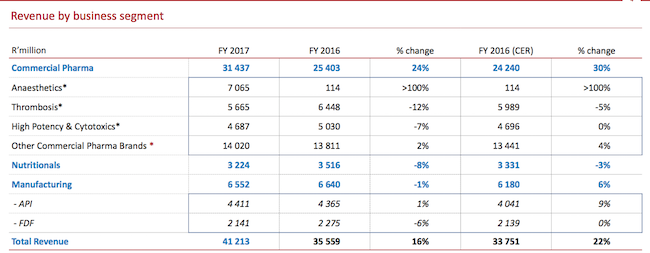

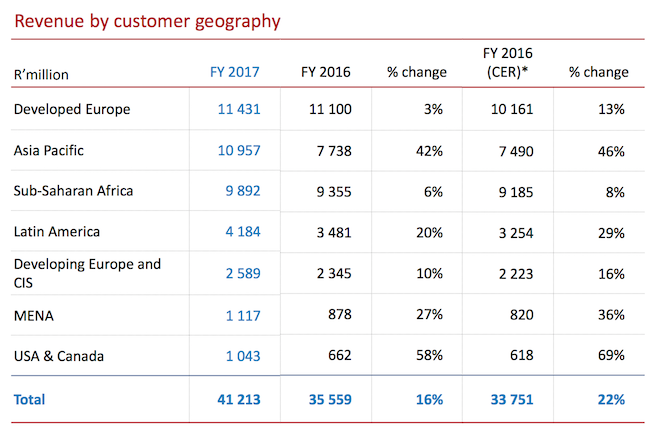

Revenues for the year increased by 16% in Rands. In constant currencies (which reflect the operating environment of each business) revenues increased by 22%. So the strong Rand was a drag on the numbers. Most notably, constant currency revenues increased 31% in the second half. This is why Saad said that everything was starting to come together. Normalised earnings per share increased by 16% to 1463c per share.

While we are on the numbers, lets focus on their debt levels. These have increased significantly over the years due to to all their acquisitions. The Rand may have had a negative impact on earnings but 69% of their debt is in Euros. That makes the debt look smaller in the reported results in Rands. So interest payments actually declined. Cashflows increased 101% to R6.5bn. That's great news, since the overall debt level is R37bn but Aspen is in a comfortable position, and remains very cash generative. That is also why they can raise debt in Europe at very attractive rates, around of 2.1%

An overview of the business

These results were a lot more transparent about where their sales come from and which products make the most money. They used to be a generics business, but now only 10% of sales come from generic drugs. They also used to be a South African business, but are not anymore. Take a look at the two images below, which show where there sales were made and from which products.

Anaesthetics and Thrombosis are two pharmaceutical categories where Aspen have focused their global expansion. Remember Aspen are essentially a manufacturing and logistics business. They do not put money into original drug research and development, or try to create the drugs from scratch. They buy non-core, neglected assets from major drug companies and turn them around. Once a business is bought and Aspen takes over production, they have to show the regulators that they will maintain the same standards. This takes time. So does revamping production sites, establishing sales forces and improving logistics. This is why results have been slow for these two new divisions.

Aspen are confident that they have now received approval and created the capacities to sell these products more efficiently, around the globe. Expect a lot more sales growth from these two divisions. In fact, they announced a deal yesterday to buy the rest of the AstraZeneca's anaesthetics portfolio for up to $770 million. Never standing still.

The Other Commercial Pharma Division is what they call the heartbeat of the company. Mainly because 54% of sales come from emerging markets. That is unique to global pharma companies.

The last pharma segment on the table above is High Potency & Cytotoxics which is mostly complex female health products. They have an exciting new licensing agreement with Teva in the USA which should give them good exposure to that region. They see this area as having good growth potential.

Finally, we look at the Infant Nutritional Division which makes milk formula. This business has really struggled recently because the Chinese authorities have clamped down on unregistered imports of milk formula into China. As of December 2017, no unregistered formula's may be sold there. This will mean a big over supply of formula leading up to December. That market should then normalise at the middle of next year. Aspen have created a new, registered brand which they will push throughout China. This division has great fundamentals as the globe's population grows.

Valuation

The stock now trades at R310 a share. Or 21 times earnings. You are paying up here for an incredible management team that extracted R1.2bn in synergies during the year. They are very good at what they do. Saad said to expect more deals, always expect more deals. The cash generative model and access to cheap debt allows for this model to continue to thrive. As long as the team are willing to put in the hard yards. The founders are still there and as energetic as ever. We continue to buy and hold this stock as a core holding in our recommended portfolios.