Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

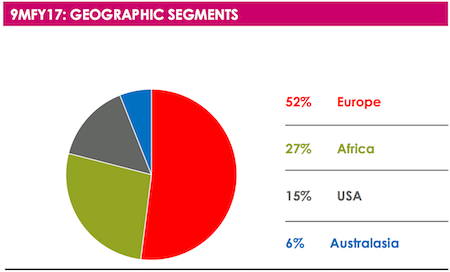

Thanks to their positive nine-month sales update, Steinhoff stock closed 2.6% higher. The company has been very busy in terms of purchases in the UK, US and Australia and many new store openings in all their regions. They have seen a 48% increase in sales to EUR 14.9 billion for the nine months, with 8% organic growth. Here is a breakdown of how that EUR 15 billion in sales is split:

Now that Steinhoff is listed in Germany, they have to report their numbers in Euros. It is not often that you hear the words, "the strong Rand had a significant positive impact on the numbers but the weaker Pound had a negative impact". The Africa division saw sales increase 10% in constant currency terms but a solid 26% increase when measured at current exchange rates.

Probably the division most people were looking at, was how is their recent purchase of Mattress Firm in the US going. They took over Mattress Firm in September last year and immediately set to work overhauling things. You will remember that they booted Tempur Sealy out as a supplier and signed more favourable terms with Serta Simmons. Other major changes are the overhauling stores and the rebranding many of them, currently around 40% of their stores have gone through the makeover. All this change has meant a 10% drop is sale values but a lower 6% drop in actual transaction numbers. Now that the initial shock of all the change has happened, management is reporting a tick up in sales and better margins, things bode well for the future.

Steinhoff looks well positioned for future growth. As Paul shared yesterday, consumer confidence is strong in Europe. Their Eastern European arm of the business had like for like sales growth of 20% over this reporting period. The Africa division is about to get a boost from the listing of STAR and then the effective purchase of Shoprite. Lastly, the US business is on track with its 'Steinhoff overhaul'. Hopefully, their issues with the German tax authorities can be resolved soon, so that they can focus on what they do best, making supply chains efficient so that they can bring the lowest price possible to the consumer.