Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

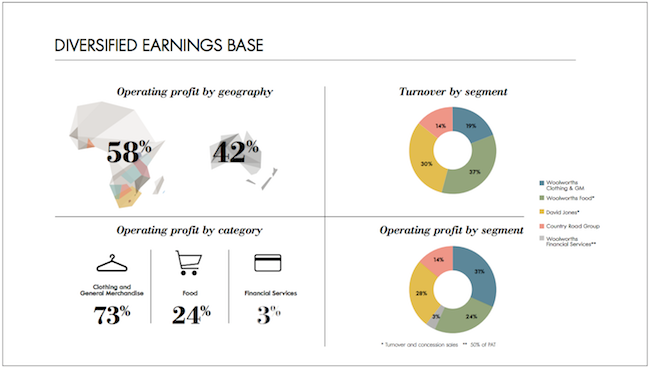

On Thursday morning Woolies released their 52 week or full year numbers for the period ending 25 June 2017. The stock has lost around a quarter of its value over the last 12 months, so the market knew the results were not going to show the strong growth that we had become accustomed to with Woolies. Turn over for the period was up 3%. Considering that inflation is higher than that, sales volume went backwards. HEPS were down 7.6% and then some good news, management maintained the dividend at R3.13 per share. See below how and where the company makes their money.

Notice how food is a very big chunk of their turn over but significantly smaller part of profits. Then notice how small "Woolworths clothes & GM" is on the turn over graph but it is the biggest segment on the profits graph, showing that selling clothes and house accessories is far more profitable than selling food. Although more cyclical. For reference purposes here are management's goals for the operating profit margins in each segment. The only division basically at the target already is food, with current operating margins of 6.9%, down from 7.1%.

The most important division, Clothes and general merchandise saw sales increase 1.4% but they had product inflation of 6.6% , so a negative result for the year. It is not a surprise given current low consumer confidence in South Africa and the lack of economic growth. People don't splash out on new wardrobes when bank balances are low (no bonuses) and when they don't feel secure about their job. Tougher trading conditions meant the operating profit margins dropped from 17.9% to 16.5%. Going forward the plan is to introduce international beauty brands like Chanel, Estee Lauder and Clinique to their stores. Beauty products traditionally have high margins but more importantly the hope is that the beauty products increase foot traffic to the stores.

David Jones is the core of the Australian operations, where performance was mostly flat. There are many moving parts in the division as they move toward selling more of their own brands and introducing new merchandise, planning and finance systems. More exciting is the introduction of their David Jones food division, currently only in one store but planning to roll out country wide in the years going forward. David Jones Food is only expected to be profitable in 2019, reaching full scale around 2020.

Lastly Country Road, the division with the highest gross profit margins at 60.3%, had sales growth of 5.1%. What was interesting is that even though they have the highest gross profit margins, the cost of making the shopping experience world class and the cost of advertising is that much higher than their other divisions, thus brining their operating profits in at 9.9%. For comparison purposes the Woolworths Clothing & GM division has gross profit margins of 47.9%.

All in all, the retail landscape in South Africa is going to be tough at least for another year but the good news is that Australia is expected to grow their GDP by around 3% for the next couple of years. Going forward though, until the revamp of David Jones in Australia is complete and South Africa gets back on an economic growth track, I don't see much lift off in the share price. A major benefit of buying Woolworths currently is that they sit on a 5% dividend yield, something to keep you happy until their growth path picks up again.