Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

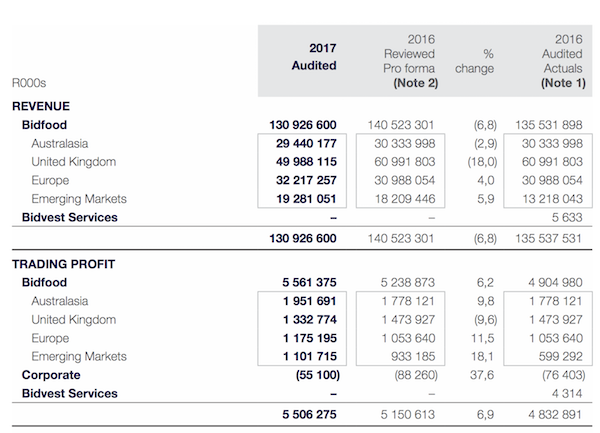

Yesterday we had solid full year results from Bidcorp. These are the first full year numbers since the Bidvest split. This business is well diversified geographically, operating in over 30 countries. Ironically Rand strength had a big negative impact on the numbers. Headline earnings per share grew 9.4% to 1181c. On a constant currency basis, this would have been a 19.1% uptick. That is encouraging considering the developed markets they operate in such as Australia, the UK and big parts of Europe. For a good idea of the segmental analysis you can look at the image below. Remember there are still a few irregularities there from the Bidvest split.

As you can see, the UK is their biggest revenue driver although Australia is more profitable. I guess that is why CEO Bernie Berson is based in Aus. South Africa has been included in the emerging market segment. On the TV yesterday Bernie mentioned that growth in South Africa was a cracking 24%. A very different contrast to the Famous Brands numbers. Maybe it is the more high end, sit down dining that is doing well?

The other day we put a link in the message on the trends millennials were following. One of those was ordering in and eating at home. This trend suits Bidcorp because instead of buying from a grocery store, they are using Uber Eats or Delivery Hero to buy meals from restaurants. Essentially they become Bidcorp clients.

The share trades at 25 times earnings which is by no means cheap. Sysco, a $27bn market cap competitor in the US trades on the same multiple. These guys have shown interest in Bidcorp before, I wouldn't be surprised to see more interest in the future. The company has R1.2bn in debt, next to nothing compared to their R100bn market cap and R5.5bn trading profit. I mention this because there is still huge room for consolidation in the industry. During the year the group concluded small acquisitions in Spain, Australia, Brazil, Belgium, Italy and the UK totalling R1.7bn. Expect a lot more of that this year.

To conclude, we are pleased with these results. Considering the geographic spread, low gearing and room for acquisitions we are happy to carry on adding at these levels. This is a must have in every local portfolio.