Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

A company that we haven't spoken about before is Activision Blizzard, who own brands like Call of Duty, Star Craft, World of Warcraft and Candy Crush. Depending on your age and how you spend your evenings, those are all very big names. The significance of this company though is that Tencent owns 12% of it.

A quick history of the company, Activision was founded in 1979 to produce games for Atari. Blizzard Entertainment was founded in 1991 by three friends fresh out of university. Fast-forward to 2007, Activision merged with Vivendi Games who already owned Blizzard Entertainment and renamed the merged entity, Activision Blizzard. Then in 2013, due to Vivendi having a huge debt burden, they (Vivendi) sold the bulk of their shares to a consortium, which included the founders of Activision and Tencent. Then the last major division of the company is King Digital Entertainment, the maker of Candy Crush, who Activision Blizzard bought for $5.9 billion at the end of 2015.

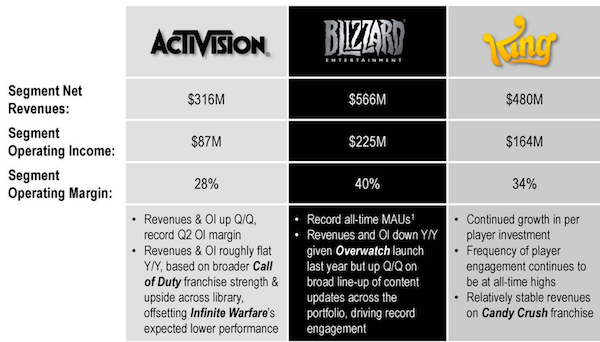

Here is a look at the company breakdown:

The first thing to note is those very healthy operating margins, company wide they average out to 35%. To put things into perspective, in the last quarter they had revenues of $1.6 billion (around R21 billion) and operating income of $576 million, not bad for a company that sells games. Currently, all the money is made from owning some of the biggest gaming brands ever, where they continuously launch new versions of those brands. Given that being in the entertainment industry is all about being relevant to the tastes of the consumer at that moment, it is important to have many different games on the market at the same time to try buffer the ebbs and flows of the consumer's feet.

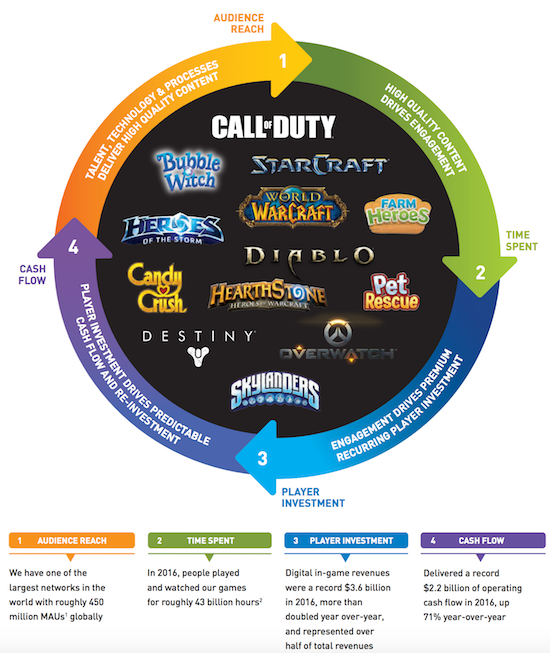

Continuously coming up with new content can be challenging and results in lumpy profits, a hit game this quarter and none the next. I think the future of the company is in the e-sport sector, where creating leagues, having teams and a solid fan base means more stable profits. For comparison, the NFL has 240 million fans watching 7 billion hours of content creating $12 billion in revenues. The NBA has 176 million fans watching 2.1 billion hours generating $5.2 billion in revenues. In last financial year Activision Blizzard had 450 million monthly active users, playing 40 billion hours and watching a further 3 billion hours to generate $3.6 billion in revenues. E-sport still has huge potential as a form of entertainment that fans will pay to watch, remember that it is being considered for the 2022 Olympics.

Until e-sport becomes a significant part of their revenues and earnings, here is how the company plans to stay relevant. Their "moat" so to speak.

Like any good tech firm the market has high expectations, currently giving them a market cap of slightly more than $48 billion and a P/E ratio of 43. What is impressive is that even with such a high multiple, they are still able to have a dividend yield of 1.2%. Back to the P/E, which looks rather high considering that in the last quarter two of their three divisions had shrinking revenues and the last one was flat, so no growth currently and management aren't forecasting any either.

For Tencent, I think it is a great investment, not only because Tencent has about tripled their investment value over four years but because of their ability to team up on projects. Tencent and Activision Blizzard have already collaborated to make Call of Duty for the Chinese market and I wouldn't be surprised to see more collaborations in the future. An investment for your personal portfolio? I am less convinced. Personally, I own a few mostly because of my personal nostalgia attached to their brand portfolio but also because I think e-sport is going to be huge in the future, when I can't be sure though.