Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

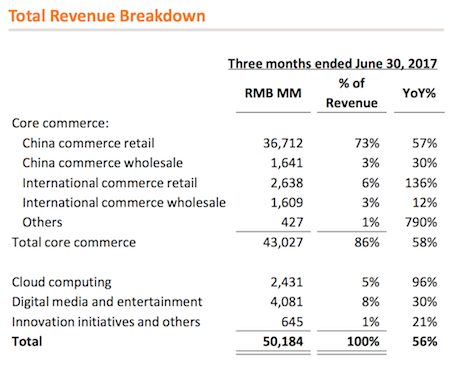

On Thursday we had another expectation smashing, set of numbers from a Chinese internet company, this time it was from Alibaba. They had revenues of RMB 50.1 billion ($7.4 billion) for the first quarter, an increase of 56%. Analysts had estimated it to come in at RMB 47.7 billion. Earnings per share were up even more, growing by 62%, showing that even with their monster top line growth they are not sacrificing margins. Here is a look at how the different divisions stack up.

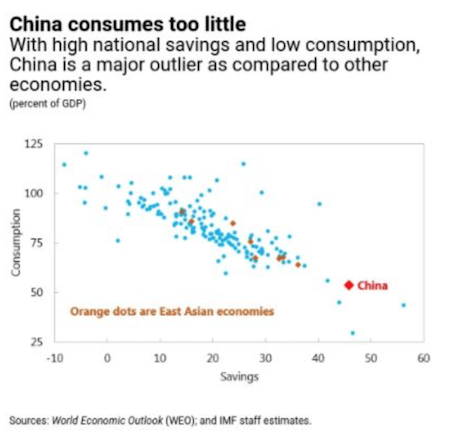

As you can see, the bulk of the business is Chinese retail, which is not a bad thing considering how fast their middle class is growing. Even though the country's growth is slowing to 6.9%, retail growth is still above 10%. Based on the following graphic, the Chinese consumer still has plenty in their 'consumption tank'.

The first thing that stood out to me though was how many opportunities there are for their international division. Currently, if you are a business and want to buy a container of anything from China, you would strike up a relationship with an agent in China who will source the product for you. The agent will pick the factory who can produce what you want, in the correct time frame and at the correct quality. The agent then charges you for their services but as a business, it is worth it because you know that what you ordered will arrive. Imagine if you can now use Alibaba to find what you are looking for and Alibaba will guarantee quality and delivery time? Given the size of the company, they would have no problem refunding you if your order goes wrong. I think that there is huge potential for the 3% 'International Wholesale' figure to become more significant.

On the 'International Retail' front, there has been a strong push into South-East Asia. Part of the push includes free shipping on selected items in Singapore. Added to that Alibaba have also teamed up with Netflix and Uber. Cross-marketing where ordering something from Alibaba gives you free services from Netflix and Uber. Their approach seems to be working shown by the 136% growth for 'International Retail'. How long until they are in South Africa in a big way and we have access to their HUGE singles day (11/11) promotions?

Much has been made of their cloud division in the media since their results came out and you can see why. Revenues were up 96% and the number of customers increased from 577 000 to just over 1 million. One of their significant customers is Air-Asia, having a well know brand run their systems and app through the Alibaba Cloud infrastructure is a vote of confidence that I am sure the sales team is using to lure other customers. The division is still loss-making though which is not a concern for now, as long as they keep growing at this rapid pace. The beauty of the cloud business is that once a company chooses to run their IT systems on a particular cloud infrastructure it is very difficult to move to a competing cloud company.

In this space, our preferred company is Amazon due to their primary market being the US and having a much larger cloud division. That seems to be the market consensus at the moment because, at current valuation metrics, Alibaba is cheaper than Amazon.