Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

An Educated Call on AdvTech

Vestact is initiating a buy recommendation on education group AdvTech for JSE accounts.

The big picture of education in South Africa

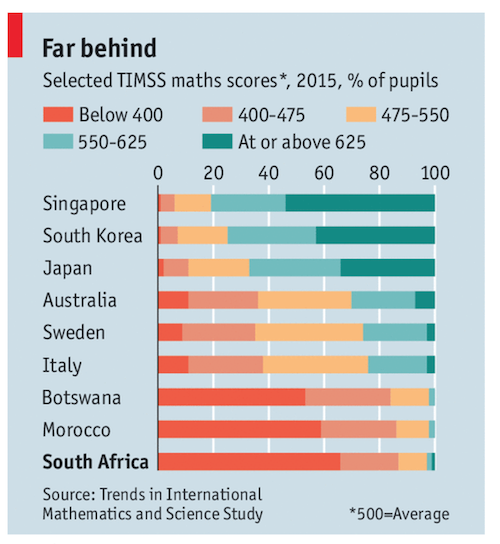

Education in South Africa is an emotive topic. We live in one of the most unequal nations in the world and there is no doubt that education is the secret sauce to fixing that. According to the OECD, South Africa came 75th out of 76 in the latest Trends in International Mathematics and Science Study (TIMSS). See image below sourced by The Economist.

According to the same Economist article, the gap in test scores between the top 20% of schools and the rest is wider than any other country in the world. This despite over 20% of the national budget being spent on education. A report from Curro in 2014 suggested that only 4% of all school students in South Africa went to private schools. The room for growth in the private schooling sector is huge.

In 2015 close to 1 million students were enrolled in South African universities. Almost double the "ideal" enrolment level of 600 000 according to Stats SA General Pali Lehohla. These state institutions pulled in over R63bn in revenue. The bulk going to staff, rental and maintenance. R27bn of that came from government grants and R21.5bn in tuition fees. Clearly the universities are heavily overrun and the pressure to increase fees in order to manage demand spurred massive protests last year.

Step in the private sector

AdvTech listed in 1987 as Advanced Technical Systems with its roots in recruitment. They bought their first college in 1995 which spurred a large array of educational focused acquisitions including Varsity College and Crawford College in 1997. Other well known brands include Trinityhouse, Abbotts College, Rosebank College and Vega.

The Numbers

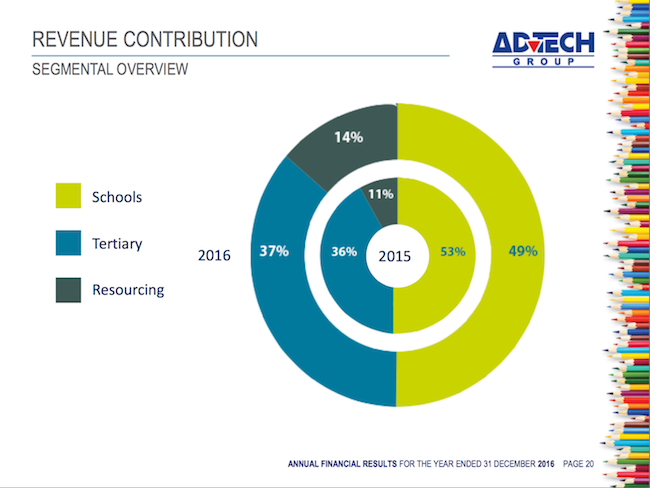

The business is well diversified between schools, tertiary and resourcing. Covering the entire pipeline from your first day at school to your first, second and third job. The below image shows segmental revenue for the year of 2016 compared to 2015. The schools are far more profitable, contributing 59% of the profits versus 38% for tertiary and 3% for resourcing in 2016.

Group revenue increased 24% for the full financial year ending 2016 to R3.35bn while operating margins increased from 16.6% to 18.1%. This equated to trading profits of R585 million or headline earnings per share of 71.1c, an increase of 39%. Although much of this was acquisitive, the company only sits on R1.1bn in debt which is far below their borrowing capacity of R2.6bn. The current market cap sits at R9.8bn. The share trades at R17.90 which equates to 25 times earnings but is growing HEPS at 39%. Although that kind of growth may be a big ask for this year, the stock trades on a PEG ratio of 0.64. Well below 1, which the market considers fairly valued. The dividend yield is just short of 2% before tax, which is nothing to write home about but to be expected for a capital intensive business that is growing fast.

Schools Division

The schools division consists of 90 schools across 47 campuses. Summit College was purchased last year whilst there are a few more acquisitions in the pipeline. There are also 2 greenfield projects underway in Johannesburg. In February 2017 there were 26 700 students enrolled out of the existing building capacity of 31 200. Ultimate potential holding capacity is 41 500 students excluding future deals.

They pride themselves on great results with a 100% matric pass rate. Even more impressive is that 98% of students qualified for entrance into higher education institutions.

Tertiary Division

The tertiary division includes Varsity College, Vega, Rosebank College, The Design School Southern Africa and Capsicum Culinary Studio. AdvTech are very annoyed about not being able to call these institutions universities in terms of the Higher Education Act. Even though the degrees obtained are fully accredited with the same standing as those from the state universities. Nonetheless, the number of students grew 20% in 2016 with an 84% module pass rate. There were 81% graduates placed within 6 months. In 2017 the group expects 60 176 students operating through 118 sites under 26 brands. This division turned over R1.25bn last year. That is 2% of the revenue of the state run universities. Still tiny in comparison.

Resourcing Division

Although a legacy business, it still fits in well with the model. This division has a huge amount of AdvTech graduates to find jobs for every year. It has been under pressure as the jobs market has slowed down with the local economy. As you have seen from the above, this sector only contributes 3% to profits.

Acquisitions and the future

More recently they have purchased three premium fee schools as well as Capsicum, the largest chef school in SA. Interestingly they bought 51% of Oxbridge Group which has over 21 000 distance leaners. Oxbridge offers tertiary courses such as Advertising, Beauty Therapy, Book Keeping and Tourism. In the same realm they purchased 51% of University of Africa (UoA) which has 2000 distance learners based in Zambia. The Independent Institute of Education (IIE) will help benchmark UoA's degrees and diploma's to a globally recognisable standard.

This acquisition is very exciting because it represents an exciting future for education in many under developed African countries where logistics is a huge challenge. All you need is an internet connection and you can access world class degrees. Judging by AdvTech's recent commentary they seem excited and well exposed to distance learning. As well as bringing in more innovation in the classes they offer, adapting to the times. For example they now offer a Bachelor in Computer Sciences, specialising in Game Design!

There has also been a trend in post school education that has steered away from mainstream degrees. This is because the service sector has changed. More people eating out means a higher demand for chefs. Facebook, Instagram and Youtube have meant that skills in photography and branding become more valuable. AdvTech have all of these skills covered amongst their tertiary offerings. They are passionate about innovating away from old school teaching methods and courses.

Conclusion

As the earlier stats suggest, there is a massive gap in the supply of education in South Africa. Where the state fails, that gap will grow. Even if the state does not fail (we hope this is the case) the room for growth is still massive for private businesses. Both at school level and at a tertiary level. We feel that AdvTech have the potential to fill that gap through remote learning, acquisitions and organic growth of their existing businesses.

Education is an absolute priority for most households that can afford it. We would like to make education a priority in our Vestact portfolios. Usually good things happen to companies that are making a positive difference. We initiate AdvTech with a conviction buy.