Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

It is still a phenomenal story, the growth of Facebook from a dormitory, nearly 13 and a half years ago now. The date most people take as the launch of what is now a sprawling network is 4 February 2004. I had been sitting in my Vestact chair for a little over a year. A few Harvard mates (led by the Zuck) created a platform, before the launch of thefacebook.com, which originally was for connecting people through social networks at colleges. The likes of Berkley, Chicago, Columbia, Cornell, really an Ivy League connection tool.

It was pretty lame by the high standards we expect today, yet is was simple and effective and pulled at the core of us all, communication. It is what separates us from the beasts, the ability to communicate more effectively (sometimes it seems not) than any other species. Facebook enables us to keep abreast of our friends and their lives, what is important to them and what they think about it.

Along the way, Facebook acquired Instagram and WhatsApp (Buying WhatsApp), as well as "less successful" (for now) Oculus. They spun out Messenger from the core product offering, that application is used widely and will continue to have multiple applications (like paying friends, etc.). For laughs, kicks and giggles, let us share the "original" Facebook image, those are freely available on the web, here was one I found:

At the time of the IPO in May 2012, it was the largest valuation of an IPO ever, over 100 billion Dollars at 38 Dollars a share. At the time, the company raised the third largest amount in US IPO history, 16 billion Dollars. Technical glitches at the get go overshadowed what was the highest trading volumes for an IPO ever, the next few months were horrid for the stock. By the end of that year, the main platform had a billion users, monetising them on mobile was the next market handwringing moment. By late August of 2012, the stock had halved (and some more) from the IPO price. The rest, as they say in the classics, is history. Revenue growth has been nothing short of eye popping, from 400 thousand Dollars for the year 2004 to 9.321 billion Dollars in revenues for the quarter just passed.

For the quarter? Wow. Revenue estimates for this year are for close to 39 billion Dollars, and then the market expects beyond 50 billion the year after, maintaining the growth trajectory. As a result of the company being able to monetise their multiple platforms aggressively, earnings growth has kept pace too. The market expects earnings per share for the current year to come in at about 5.10 and then over 6 Dollars a share for 2018.

In the pre-market the stock trades at 171.10 Dollars a share, meaning that on current year estimates (yes, estimates), the stock trades on 33 times. Next year, 28 times. With around 18-20 percent earnings growth expected by Mr. Market, that means the PEG is 1.55 times. My Bloomberg app on my (not so fresh anymore) iPhone, tells me that the estimated PEG ratio is closer to what people would consider good value, 1.01 times.

For what it is worth, people have consistently gotten the price of Facebook "wrong", their estimates have always been way too low and the company has been able to evolve at a breakneck speed. In part due to their incredible in-sync with the trends, and in part just plain old user adoption. According to the Internet World Stats, of a global population of 7.5 billion people at the end of March 2017, 49.7 percent of all people used the internet.

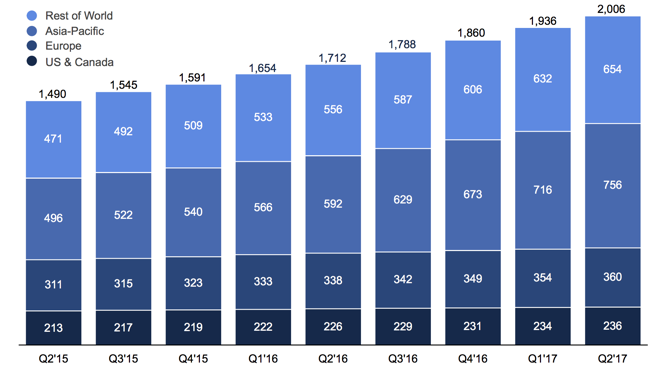

So I guess we are at that point, where the world drops over to more than half of us using the best tool and the finest leveller of them all, the internet. I share "The Zuck's" theory on that, the more people have access to this tool, the better their lives will be. Cost is the key here, internet costs that is. What is also very interesting, for Facebook and their competitors is that there is room for growth across many regions, Facebook has a pretty good spread, herewith their monthly active users by geographical regions:

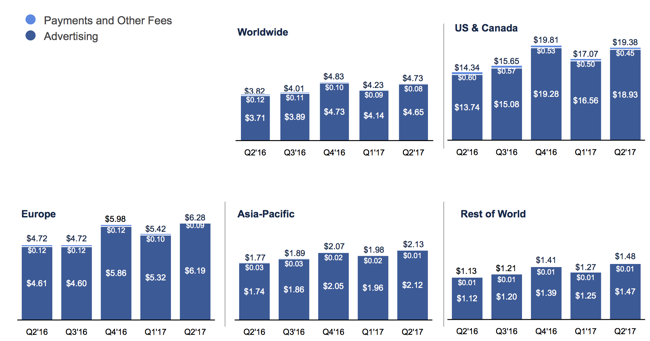

The reason why I think that there is plenty of scope for growth is that the average revenue per user for Facebook in North America is three times higher than in Europe, and around four times the average worldwide user. There continues to be growth across all of their regions, see the slide from the presentation below here:

That slide from the presentation is the most important for me. The stock market reaction to the earnings was interesting, initially the stock sold off sharply and then rallied as the earnings conference call proceeded to unfold. Whilst the company has aggressively added to their staffing compliment along the way (there are now over 20 thousand Facebook employees), all the major metrics have kept inline from a costs point of view. The research and development expense still hovers around 20 percent of revenues, marketing and sales in the low teens, general and administrative in the 6-8 percent bracket. Operating margins have fluctuated between 40 and 50 percent over the last two years, currently 47 percent. This is important, the company continues to search for growth whilst being mindful to keep an even keel.

Part of the reason that the stock popped later is that even in light of increased spend from the company, they are going to explore ways to monetise WhatsApp and Messenger more aggressively. What to do? I get the feeling that we are still in the infancy of exploring all sorts of applications on the existing platforms, using artificial intelligence to serve you the content that you should be getting, connecting you with likeminded people, finding new favourable and lasting relationships, be that with new service providers or opportunities. We continue to recommend Facebook as a strong buy, obviously one needs to keep an eye on trends a little more closely, they have all the "right people" at the helm. And ..... the company is about to breach the half a trillion Dollar mark, not bad for a flopped IPO now, wouldn't you say?