Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

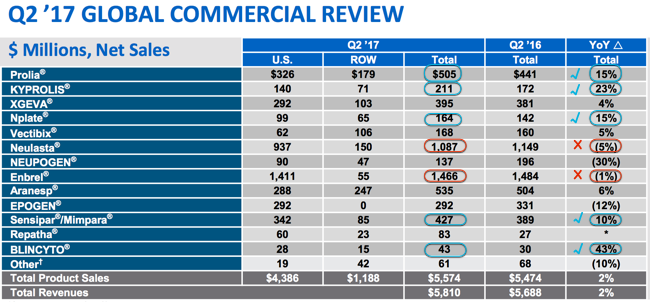

Amgen Reported their Q2 2017 results aftermarket yesterday, with both a top-line and a bottom line beat. Earnings per share clocked 3.27 US Dollars (up 15 percent) on revenues of 5.81 billion Dollars (up 2 percent). Whilst there was momentum on their new products, there was a definite slowdown on their older products which obviously face increasing competition over time. It is the nature of the beast. Which is why, when owning a business in this very important space, healthcare, you need to find a business like Amgen, which has multiple lines in the water, so to speak. To illustrate this point, you need to look no further than to the breakdown per therapy:

Through some very low level editing, I have managed to point out that there are two crosses and several more ticks, when it comes to the more competition (red cross) and new therapies (turquoise tick). The company spends, like most of their peer grouping, a large number on research and development, they have spent roughly 15 percent of their product sales for the first six months of the year.

Yes, around 1.64 billion Dollars of their 10.773 billion Dollars worth off sales goes into developing and finding cures for the likes of the prevention of the crippling migraine (Aimovig) and newer oncology drugs like Avastin (for the treatment of metastatic colorectal cancer) and Herceptin (Breast cancer targeted therapy). Along with several other therapies, these above are in the final stages of of their clinical programs.

Whilst it is easy to point to these businesses as society has painted them (it must have come from somewhere), not enough credit is given to their ability to come up with life saving therapies. I feel. We have often made the point that it is far better to part with your money and give it to the likes of Amgen, becoming a shareholder along the way in searching for a cure for certain cancers and other life threatening and debilitating diseases, than it is to parting ways with your hard earned money in supporting a product that ultimately is responsible for many dread diseases.

Without getting too close to the moral high ground (which is very dangerous territory), if one can profit by investing in a business that cures, rather than the opposite, it adds a certain feeling. There is of course the moral argument about the company recouping their investment by charging thousands and thousands of Dollars for their therapies, and whether insurance and government medical schemes can afford to pay. Which is why ethics and health are tough arguing ground.

There is also increased arguments to be made for governments who tax the products that cause dread disease that help pay for the therapies that cure the people later. i.e. prevention is better than cure, which always motivates the argument for an investment in Discovery. You are never going to change human behaviour to the point that everyone is a yoga praising, meditating, calm and collected vegan that has complete life/work balance. Besides, not everyone wants to be all those things, that is what makes us individuals, we like the choices.

The company updated their full year guidance, tweaking it ever so slightly. The Earnings per share range is expected to be between 12.15 to 12.65 Dollars a share on revenues for the full year of 22.5 to 23 billion Dollars. Whilst the earnings range moves higher at both the bottom and top end, the revenues range is pulled back a little at both ends, perhaps that is what the market is worried about. The stock is off two and one-third of a percent in pre-market trade, the stock is of course up 23 percent year to date (before this move).

At 176.6 Dollars, the indicated price, Amgen trades on a FY multiple of just less than 14 times. Which is hardly expensive. In this transitionary period in-between the decline of the old therapies and the rise of the new, the market is likely to be more cautious, and in that, I think there is an opportunity. A great business for the long run, and our preferred biotech stock. Continue to accumulate.