Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Wells Fargo reported numbers Friday, before the market opened, here is the news filing - Wells Fargo Reports $5.8 Billion In Quarterly Net Income. Revenues of 22.2 billion Dollars produced net income of 5.8 billion Dollars, diluted earnings per share clocked 107 US cents, up 6 percent from the prior reporting period. Total average loans grew only a percent to just shy of 957 billion Dollars, what is more interesting is that net deposits grew 5 percent to 1.3 trillion Dollars.

It always boggles the mind that with the lowest rates historically in US history, that cash deposits are still growing. Is it perhaps a lack of confidence in both individuals and businesses to borrow, scared by the events of nearly ten years ago now? Once bitten, twice shy. Why would people not want to take more risks in an environment like this? Or, is it more likely that we are in the early stages returned confidence which may well coincide with the Fed hiking rates. If ever you needed a sign that generally "things" are not white hot, this certainly is a pointer. The company does offer some pointers as to what is happening - "growth in consumer and small business deposits was offset by lower commercial deposits."

There are many areas in which the bank can change customer experiences and massage them towards the "less physical". In other words, there are just under 6000 retail bank branches across the US, and the company employs 1 out of 500 people with a job in America. That number equally boggles the mind. They (Wells Fargo) according to their fact sheet, employ over 270 thousand people (271 thousand to be exact). The company has identified 2 billion Dollars in savings, including my bugbear, corporate travel. Of course, for client events, all good. Annual savings of 100 million Dollars: "Reduction in non-customer facing travel and expenses with focused efforts on virtual conferences and telepresence, as well as leveraging internal meeting spaces and services "

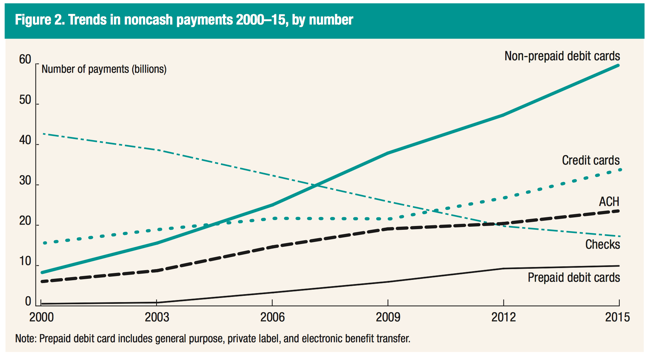

The company will also close 450 branches. That is pretty huge. Most of the savings will come from "Centralization and Optimization". I suspect that the company has reached "peak employment". I suspect that the US consumer has to adapt to evolving payment options, they all exist. The "check" is a thing of the past, and it is reducing at a serious pace, having halved since 2000, according to a Federal Reserve release - The Federal Reserve Payments Study 2016:

ACH stands for automated clearinghouse. With fewer physical branches and more automation, that may not bode well for the staff at Wells Fargo and future employment, I think that it bodes really well for cost savings and a general better consumer experience. South Africans are well used to not going to branches and being able to exist without cash, it is a mindset shift that will take place.

The stock is not particularly expensive at current levels, the market is expecting around 4.15 Dollars in earnings for this year, and 4.52 Dollars for next year, putting the stock on a multiple of closer to 12.2 X next year's earnings. The yield is around 2.8 percent (two and one-quarter percent after dividend withholding tax), which is pretty handsome in an environment in which you can expect that to creep higher. And that is on account of the Fed having loosened requirements. Traditionally at Vestact we have been reluctant to own banks and financials, too many issues and too cyclical. We have however picked the best quality of the lot here, and they have come through a pretty trying time from a reputational point of view. We continue to accumulate what is a fine business.