"Visa recently conducted a study that found that if businesses in 100 cities transitioned from cash to digital, their cities stand to experience net benefits of $312 billion per year. According to this study, in New York City alone, businesses could generate an additional $6.8 billion in revenue and save more than 186 million hours in labor, by making greater use of digital payments."

To market to market to buy a fat pig Stocks in Jozi caught a serious bid yesterday, a global rally that was given more impetus in the afternoon as Janet Yellen delivered her bi-annual report to Congress. Janet Yellen is of course the chair of the Fed, or Fed being the short name for

Board of Governors of the Federal Reserve System. She is possibly the most powerful central banker in the world, right next to Mario Draghi, who is arguably in second place by a whisker. The other Fed was also in action yesterday, making light work of Grigor Dimitrov on centre court at Wimbledon, in a day of drama where only "the Fed" of the top four is left standing. That never gets old, the Fed and THE Fed .....

The Fed (the Yellen one) has and always will be a focus for the markets. The Fed is supposed to have all the answers. The Fed is supposed to act when necessary. The Fed has a tricky job, they are responsible for making sure that growth and full employment is achieved whilst keeping inflation in check. For the time being, inflation has not been a problem, in fact the opposite actually. In reality the Federal Reserve watch and act in exactly the same way as everybody else. They try and predict what is likely to happen next.

What armchair Fed critics don't realise is that their actions have a direct impact on the thinking and actions globally. So it is possibly better for the Fed to tread carefully, less serve and volley and more wear them down with well placed groundstrokes. The Fed is more like Rafa on a clay court, with a final set tiebreak never coming.

It was William McChesney Martin, the longest serving Fed chair (yes, longer than Greenspan) who said that

the job of the Fed was "to take away the punch bowl just as the party gets going", recognising that when citizens start extending themselves, you have to stop them at that moment. Tell them to go home, less boom and bust, no more punch people, let us wrap this up. There is no point at 4am (borrowing hog wild) having the time of your life, or so you think, (extending yourself to the max) when you are going to be very sorry about that when you finally do wake up and realize you have a whole house to clean (the economy is buffered by bad loans). Martin used a party analogy that people could relate.

In the 104 year history of the Fed, there have been only 15 governors, Janet Yellen is likely not to be appointed by the current US president. It is what it is, the Fed is likely to act in a way that they see fit. They do not have the magic or secret sauce. The WSJ headline says it all:

Inflation Should Rebound, but Fed Could Alter Policy if Softness Persists. In other words, in the famous sign off line of a fellow we used to speak to a lot around here (in the early days),

"Let's watch it".

The market responded in a favourable fashion, the Dow climbed by over half a percent, setting an intra-day all time high in the process. The broader market S&P 500 added nearly three-quarters of a percent by the close of business to settle within half a percent of the all time highs. The nerds of NASDAQ, strongly boosted by the likes of Facebook, Alphabet, Microsoft (and others), closed within a percent and a half of the all time highs. Err ..... so much for that major tech sell off. See below, courtesy Google Finance. How obvious was that?

Without being too smug, there may well be a post company earnings (starting soon) sell offs that impacts all and sundry. For the time being the businesses that do attract high multiples which people are worried about (people are always worried in my experience) have the earnings power to justify the prices.

At the end of the day, that is all that it is about, earnings only.

Here in Jozi, we added over a percent by the close, notwithstanding the strengthening Rand to the US Dollar over the course of the day. Financials and industrials ruled the roost, resources were only marginally lower. Anglo American was the biggest loser on the day amongst the majors, mostly just the currency really, in London the stock was over a percent higher. At the other end of a much longer list of stocks that were stronger on the day, the likes of PSG, Standard Bank, Barclays Africa and Capitec, as well as FirstRand were all around two and three-quarters of a percent higher and more. Anyways, the last three months, with all the shenanigans going on around us, stocks are basically flat. Yes .....

Company corner

The timing was good, with regards to the release titled:

Visa to Help U.S. Small Businesses Go Cashless. The long and the short of it all is as follows:

"Visa will be awarding up to $500,000 to 50 eligible US-based small business food service owners who commit to joining the 100% cashless quest." We don't need any convincing, South Africa is actually pretty well covered on this score.

The company continues:

"Visa has recognised the net benefits for merchants when they reduce dependency on cash transaction. Visa recently conducted a study that found that if businesses in 100 cities transitioned from cash to digital, their cities stand to experience net benefits of $312 billion per year. According to this study, in New York City alone, businesses could generate an additional $6.8 billion in revenue and save more than 186 million hours in labor, by making greater use of digital payments. This amounts to more than $5 billion annual costs savings for businesses in New York."

At the same time, a report titled

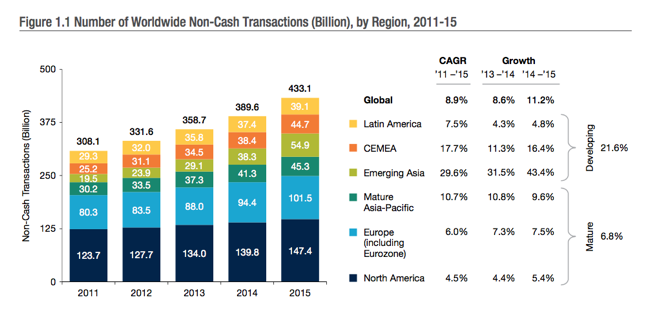

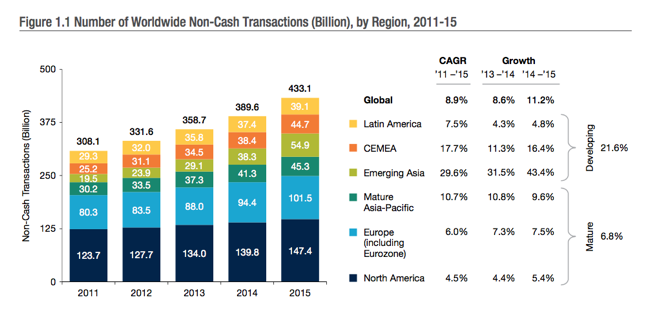

World Payments Report 2017 appeared two days ago. There were some interesting graphs in there, mostly around the use of payment methods via cards, and electronic payments. There are going to quite simply, be more and more of these. First things first, with the "latest" data from 2015, herewith the

Number of Worldwide Non-Cash Transactions (Billion), courtesy of Capgemini (they are actually reporting results today) and BNP Paribas.

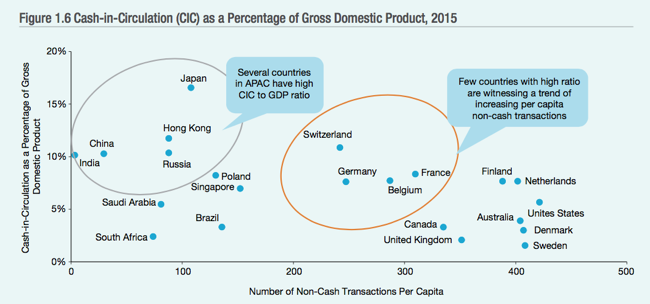

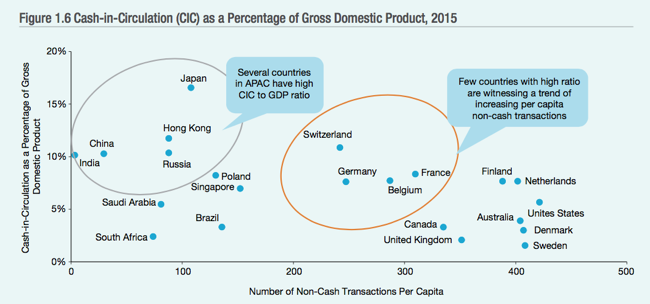

For me, a more challenging graph and a sign of great things to come (with India and China on a very low base), is the following graph. The X axis represents the number of non-cash (i.e. electronic) transactions per capita for the country. Understandably Sweden, Denmark and even the US is very high. At the opposite end of that list is India and China, both with huge populations and low electronic payments. The Y axis represents the amount of cash in the country relative to the GDP of a country.

What is interesting is that Japan has the highest cash in circulation relative to their GDP, higher than India, ourselves and Brazil. Perhaps that has to do with an older generation being used to the idea of cash. The average age in Japan is around 47, as you can imagine, if you were born in 1970, you are less receptive to Apple Pay, PayPal and Visa cards. South Africa, for example is 27 years, most young people are receptive to the idea of change. Older people .... not so much.

Anyhows, all of this shows one thing. Electronic payments are going to continue to grow. Governments, banks, even consumers are changing their mindsets to carrying cash.

Bank notes may well become a relic at some point in the future, which is why we can remain long Visa for a long time. Which we plan to.

Linkfest, lap it up!

Money is an emotive issue for many people, the result is that we have psychological biases when it comes to dealing with it. This blog explores some of our irrational behaviours when it comes to money -

Why using Venmo makes you happier.

The changing retail landscape has left a number of retailers in it's dust -

True Religion Joins Growing List of 2017 Retail Bankruptcies. It has been ugly out there and there are probably more changes to the retail industry to come.

Start-ups nowadays are labour light and ideas heavy, the result is that office sharing/ hot desking is on the rise -

WeWork, the company that simulates startup life, is worth more than Twitter, Box, and Blue Apron combined.

Home again, home again, jiggety-jog. Phew, the ex-president of Brazil is going to jail -

Lula Sentenced to Prison and Tension Mounts in Brazil Once Again. Stocks have started on an even footing today. Viva green on the screen, Viva.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.