Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Nike reported results last evening, they are a little out of sync with the rest of the businesses that we own. These numbers are for their fourth quarter to end 31 May, a strange financial year end in any place. There certainly are no governments that run their fiscal year to end May. It must have been something about starting the financial year at the beginning of the North American summer, when athletes and enthusiasts get back on the road. Perhaps I will email them and ask them why this is the case.

Immediately one is struck with the fact that the direct business (website and own stores) and the international business, as we thought and conveyed, is doing better than the North American business, driving sales at a faster pace than the market anticipated. Revenues for the quarter were up 7 percent on a currency neutral basis (5 percent up in Dollars), the company saw double digit growth in the likes of Western Europe, Mainland China and other emerging markets.

Diluted EPS rose 22 percent over the corresponding quarter, to 60 US cents, for the full year up 16 percent to 2.51 Dollars. Helped by lower tax rates, outside of the US and fewer shares. 3 percent less shares, as a result of course of company buybacks. During this year the company bought back 14.9 million shares for 820 million Dollars, as part of the extended 12 billion Dollar buyback program. That is around 55.03 Dollars a share, which is higher than the closing price last evening, which was 53.17 Dollars. The 52 week trading range has been 49.01 to 60.33 Dollars a share. We will get to the market and the price reaction in a bit.

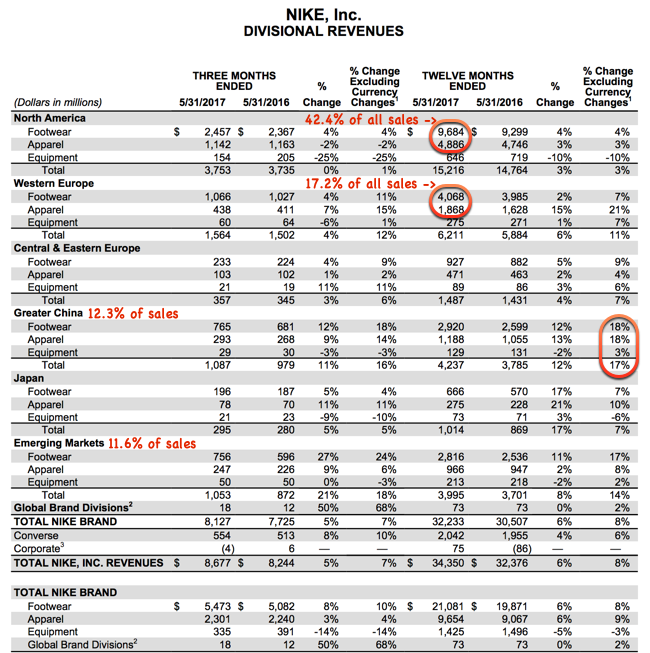

For the full year the company managed to grow revenues by 6 percent to 34.4 billion Dollars, that is up 8 percent on a currency neutral basis. There are now (as at the year end) 985 Nike stores globally. Some of the iconic ones stand out, in New York and London, the experience is always "good" and the variety and quality is always excellent. This sales matrix below tells you a lot about the business. It is still predominantly a shoes business, with 61 percent of sales coming from footwear (see right at the bottom of the table). It is still predominantly a developed market business, with 60 percent of the sales of shoes and clothing coming from North America and Western Europe.

China, although growing quickly, is only 12 odd percent of the total sales. Ditto emerging markets. These are the fast growing businesses and present big opportunities. In the unofficial transcript, the point is clearly made by Andy Campion (The CFO and executive vice president): "current per capita spend on Nike in those markets is still less than 1/10th of the per capita spend on Nike in more developed markets. Over time, macroeconomic drivers and consumers' expanding passion for sport will create even greater capacity for the Nike Brand to grow in those markets."

The market agrees wholeheartedly that the company is once again poised for growth and is through the worst of the North American "retail malaise". The stock, pre-market, is up 7.81 percent to 57.32 Dollars. I suspect that in the coming days and weeks, the analyst community will now be "excited" about the prospects and I think that they are likely to be upgraded. We continue to accumulate what we think is a positive multi-decade investment theme, thanks to growing health awareness and higher emerging market incomes. Likey, likey, Buy Nike.