Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

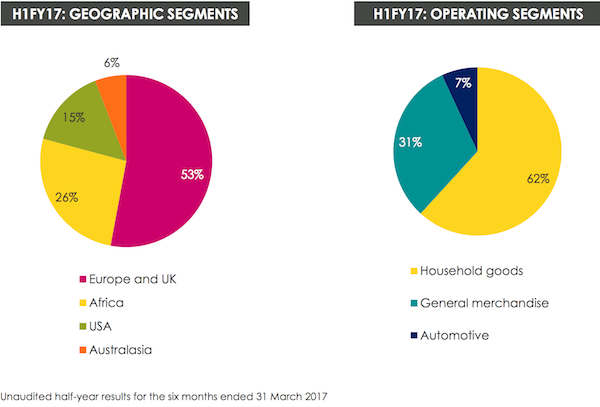

Last week we had 6 month numbers out of Steinhoff, who are the world's third-largest integrated household goods retailer by turnover (Half year numbers). Given how active management are, it is difficult to get comparative numbers, but based on managements calculations normalized revenues are up 7% and normalized EPS is up 4%. Here is a look at breakdown of the group sales:

The big change up there is the new US segment, thanks to their purchase of Mattress Firm in September last year. At the time the "analysts" view was that on the surface it looked like they overpaid for the asset, time will tell who are right, management or the analysts. Since then management have been very busy! One of their major suppliers was Tempur Sealy, who resisted attempts by Steinhoff to renegotiate their partnership with the end result being Sealy pulling out of the partnership (and the Sealy share price dropping by 23%).

To fill in the Sealy gap Mattress firm increased their partnership with the other major mattress maker Simmons, where they have agreed to spend over $100 million on marketing and then collaborate to come up with new products over the next 5 years. Have a look at their new advertising campaign - Mattress Firm Launches New Campaign And Announces Strategic Partnership In Pursuit Of Sleep Innovation

Next up management have also bought a majority stake in bedding maker Sherwood bedding, to roll out more in-house merchandise, improving profit margins. Then lastly they have a trial partnership with an online bed retailer, Purple beds, who started in 2016. The idea is to sell Purple beds in the Mattress Firm stores, hoping to increase foot traffic to the stores and then sell the extra customers bed 'add-ons' like bedding and pillows. Then lastly Mattress Firm applied for a trade mark in the UK last year, does that mean Steinhoff are thinking of rolling out that brand in the UK too?

The next phase for Steinhoff is getting the African assets listed which is expected to happen towards the end of this year. I think listing the African assets is in part a play to try court Shoprite again in a few years. Remember last time the sticking point in the deal was "what is the value of the Steinhoff African assets".

My one concern about Steinhoff is that tax dispute that has been ongoing with Germany. The company says that talks are still in progress and they should reach a settlement agreement soon. Remember that the dispute is around where the company records their profits and by extension pay the taxes on those profits. This fine could be expensive.

Steinhoff management have shown their skill in taking tired businesses, shaking them up by improving their backend and logistics, resulting in better margins and happy shareholders. Given how active management are both in terms new businesses and financial restructuring there is always the increased risk that they make a misstep. The risk reward matrix looks worth it though.