Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

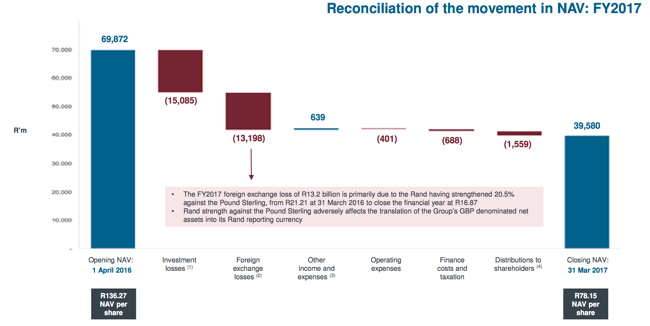

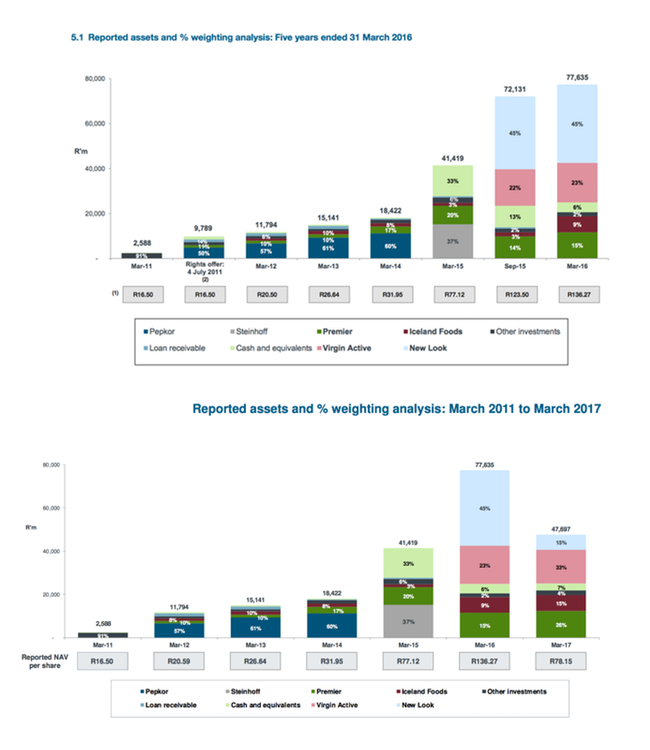

Whoa. Brait has been a disaster as an investment over the last 12 months. Yesterday the company suggested that it was largely to do with their revaluing of their fast retailing asset, New Look in the UK and that Brexit had a marked impact on the currency translation back to Rand. In fact, New Look was once 45 percent of the value of their portfolio, it is now 15 percent. There are two graphs worth noting from the presentation yesterday, firstly a reconciliation of the movement of the net asset value. Their net asset value is reflected in the internal valuations of all their assets, divided by the number of shares in issue (506 million shares in issue).

New Look was once valued (this time last year) at 34.8 billion Rand. By the first half of their financial year, the New Look value was 18.7 billion Rand. Around half. And now? I am afraid ..... 7 billion Rand. How is that possible? Firstly, there has been multiple contraction from 13.3 to 10.3 times, by their own internal metrics. So that is around 30 percent lower for starters. Another 20 percent is the currency, as per the slide. That is a collective 13.2 billion Rand less is their UK asset. The situation (Brexit) has worsened in recent days, a big backfire election on the incumbents has led to a moment of weakness where German Minister of Finance, Wolfgang Schauble (minus the umlaut on the a, bad for our html) has suggested that the door is open. i.e. If you are thinking about reversing that moment, you can. Politics ......

Wow. That is a massive fall off and a major embarrassment for a team that prides themselves on putting quality deals together. It has been nearly two years since they acquired New Look and since then there has been nothing but heartache for investors. These two slides, one taken from the last year annual report and the other taken from the recent results (we can put them on top of each other to save space), tell the story of the value of new look falling into a hole.

So what now? If you hold them, you can see that there is a discount to the NAV. That NAV has plunged. We like the business. We like the fact that Virgin Active should continue to grow (they have increased their footprint by 7 percent). We like their food businesses. Iceland and Premier. New Look do have debt of around 1.2 billion Pound Sterling. Consumer confidence in the UK remains subdued. Whilst several of their businesses have good prospects and remain solid, New Look may be more and more reliant on their expansion in China to start delivering. Those businesses roll outs will take time and be costly, as will their European expansion. We dig in our heels at these levels. Whilst it feels terrible as a holder to see a share price swoon from their levels over a year ago (down 60%), the management team and the biggest shareholder (Christo Wiese) certainly are working hard to deliver the superior returns that shareholder are used to.