"Today is memorial Day in the US, remembrance for those folks who died in armed conflict. What it also does is mark the start of summer, the unofficial start in the Northern Hemisphere."

To market to market to buy a fat pig In contrast to Thursday, where there was a whole lot of everything going on, Friday felt pretty empty by comparison. There was little going on, no OPEC, no rush of retailers telling us how bad it is out there (colloquially the same applies), No G7, a few announcements here and there. New 12 month and in some cases multi decade lows for the likes of Sun International and Adcorp. Adcorp, the staffing and labour business is down 71 percent over a decade. Sun International, the share price, is down nearly 58 percent. Tsogo Sun is down 23 percent. To be blunt, if you haven't owned the big cap multinationals that you can, across our exchange, then you have had very average and mixed returns since the financial crisis. SA inc. shares, the smaller ones, have been battered by economic winds of the poor quality kind.

There were also 12 month lows for some of the out of the majors (and lower) mining stocks, RBPlat and Sibanye (busy with a deep discounted rights issue) reaching 12 month lows. Session end here in Jozi, the all share index had given up around one-twentieth of a percent to slip below 54 thousand points, industrials were up nearly half a percent, financials were down around the same amount. Resources sank as a collective over a percent.

Did you know that the three and ten year return of the broader resources index is about the same, down around 40 percent? Over five years you are "only" down one-third of a percent. Over a year you are basically flat, down over three percent. To put that into perspective, the All Share is about flat over a year, up 8 odd percent in three years and over 60 percent better over half a decade. The last decade return for the All Share is nearly 90 percent. There are some sectors that we tend to avoid, basic materials is definitely one. A bet on commodities is a bet against humanity is what I remember one blogger saying.

It was a mixed bag in both the up and down columns of the majors, Investec slipped Friday after a good run (following good results last week), whilst Shoprite, Vodacom and Aspen were at the top of the leaderboards. Vodacom shareholders still smarting from the recent "good news" regarding the rest of Sub Saharan Africa assets sunk into a single asset here in Johannesburg. Shoprite, according to the Twitter thingie, had seen a positive broker upgrade (I think Goldman), whilst Aspen may be closer to some sort of clarity in their EU investigation on excessive price charges.

Brait released an update of their current valuation, and I can tell you that it certainly looks worse than anticipated:

"With regards to the full financial year, NAV per share of ZAR77.00 to ZAR79.00 is a reduction of between 42.0% and 43.5% from the ZAR136.27 reported at 31 March 2016 (in Euros, between 32.0% and 33.9% from EUR8.12)." Euros? Remembering that Brait decided recently not to pursue a UK based listing, their "bases" are in Europe, even if a large portion of their assets are not, they are in fact in the UK and of course, South Africa. I suspect that the stock will take some pain, perhaps the "worst" is over. The actual restyle will be around the 13th of June, in a couple of weeks time.

Stocks over the seas vast and wide, in New York, New York, traded mixed all day long. Part of the reason is that US markets are closed today, nobody looking for any "action" ahead of the long weekend, the start to "driving season" in the US. Today is memorial Day in the US, remembrance for those folks who died in armed conflict. What it also does is mark the start of summer, the unofficial start in the Northern Hemisphere. For those of you watching the cycling in Italy and the finish yesterday (mostly finished the day before, cycling buffs will know what I mean), summer has long started there. For us sorry souls down here, who are not used to winter of any sort, the winter solstice is in just over three weeks time, the 21st of June. We are ill equipped for the cold here, for good reason really, it is mostly warm around these parts.

Session end the Dow had lost 0.01 percent, the nerds of NASDAQ were marginally higher, up by nearly one-tenth of a percent, whilst the broader market S&P 500 was somewhere in-between the two. Technically, those two closes higher for the broader market and the tech heavy index count as new all time highs. Making up for the lack of volatility on the broader US markets, Oil has been bouncing around as traders try to figure out at what level demand and supply balance out. Thursday the oil price dropped 4% as OPEC was seen to be doing too little and then on Friday it bounced back 2% as the number of US oil rigs only increased by 2, making 19 straight weeks of gains. At the end of the day as a consumer I would rather see lower oil prices than higher oil prices. From a global perspective there are countries and organisations that would rather have a higher oil price but they are in the minority, globally people are better off if they can spend less on transport and use that extra cash to spend it in a different part of the economy, or start businesses of their own.

Linkfest, lap it up

Cullen Roche talking about why betting against progress in a capitalistic society is a bad idea. Progress might not be smooth but the trend is for society to continually create more with less -

Why I am an Optimist. As Buffett says, capitalism is the best way to create wealth, we haven't figured out the best way to distribute that wealth yet though.

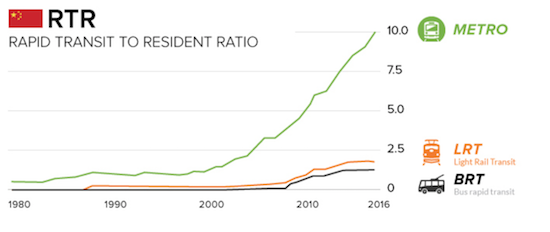

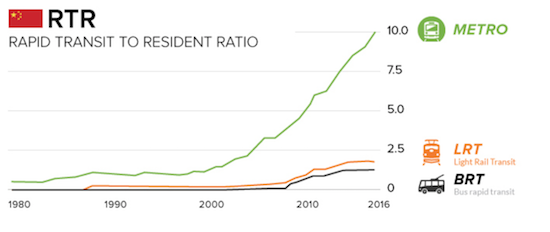

As more and more people move from rural areas to the cities, China has had to upgrade their transport infrastructure -

Animation: China's Rapid Transit Boom (1990 - 2020). It is amazing to see how the numbers suddenly boom.

Facebook told me over the weekend

Facebook told me over the weekend that I signed up 10 years ago. I remember thinking that My Space was a better service and in the not too distant future Facebook would be history. It turns out that My Space lost touch with their audience and Facebook took over, proving that execution is more important than the idea. Here is a timeline of The Zuck -

The fabulous life and career of 33-year-old Facebook CEO Mark Zuckerberg, the fifth richest person on earth

Home again, home again, jiggety-jog. Stocks across Asia are on balance higher than the prior close. This week is jobs week again for the US, the number seems to have become less and less important with the US now sitting at full employment. I suspect that most of the day will be quiet with the US market closed, a Chinese holiday (Dragon Boast festival holiday) and it is also Spring bank holiday today in the UK, direction will be mostly wayward, like a lazy Sunday afternoon drive. There were numbers out of Famous Brands this morning, margins down revenues up. We will have a break down tomorrow.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.