Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tiger Brands reported their half year numbers to March yesterday. I saw the CEO, who is now a year in the job on the box with the CFO, who has done some hard yards at that business. They were talking about how tough it has been to operate, suggesting that much unrest in South Africa has been logistically challenging at times. i.e., if a bakery needs to send their trucks out to deliver and roads are blocked, that means that there is an extra insuring cost to the company and by extension to you the shareholder. And ironically, in trying to recuperate the costs, staples prices would have to go up a little.

The company manufactures South African favourites that are found in most middle income households across the depth and breadth of the country, All Gold, Albany, Tastic, Fatti's and Moni's (did those brothers really exist, like Charles Glass?), Koo, Oros, Black Cat and of course the old favourite, Jungle Oats. The other major and well known household brands are Energade, Maynards and Beacon, Doom, Ingram's, Purity and Enterprise. Whilst these brands may not be in the larder of the serious banter, or in the fridge of said hipster eaters, for most middle class citizens, these represent the staples alongside protein sources and vegetables.

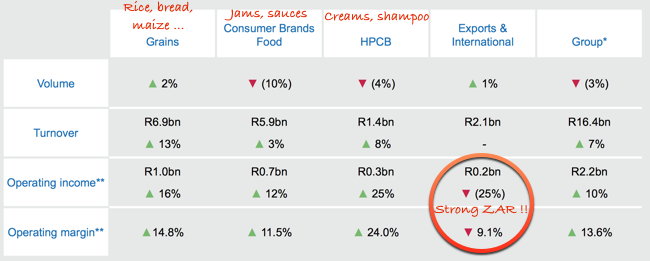

Group turnover for the period for continuing operations (they are in the process of selling various East African assets, one sold, one pending) increased 7 percent to 16.4 billion Rand. Operating income grew 10 percent to 2.2 billion Rand. The dividend was hiked 4 percent, bearing in mind that the new dividend tax is at the higher rate (20 percent as opposed to the older rate 15 percent). The company, through the watchful eye of CFO Noel Doyle, have managed to contain costs to below inflation (at least at a sales/distribution and marketing level). The main reasons that profits were flat for the period was as a result of a higher tax expense and a marginal loss (from a profit situation) from discontinued operations.

Here is a nice slide from the results that shows all the different divisions, I have tried my best to stick in the various divisions. See the impact of the much stronger Rand on the international business, which is the smallest revenue contributor.