Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Mediclinic released their full year numbers during the course of yesterday. We all had a very solid look at these, this is the first year that the integration is all comparable. Remember that the company reversed into the Al Noor listing and then converted your shares of Mediclinic to Mediclinic international. You will recall that as a shareholder from before, you were bought out at a ratio of around 0.625 new Mediclinic for the older ones that you had, at a conversation Rand price of above 200 Rand a share, regardless of what level you had owned them before.

In other words, if you bought, let us say 100 shares, you got 62 and a half (rounded up or down) and a price of 204 Rand for the new ones. Since that moment, 13 February, the price has on balance trended lower. In part, some of that is currency related, the Rand is 37 percent stronger to the Pound since the day Mediclinic "listed" (in the version as we know it) in London. It really is. Some of that is Brexit related and the subsequent recovery of the Rand. The timing has not been that good.

Equally, the results themselves have been tepid. Part UAE stresses on their business as a result of government finances and by extension healthcare benefits under pressure. Taking a bit more time than anticipated. As you can tell, the company has a growth multiple valuation, and if earnings cannot deliver that immediately, the stock will get a re-rating. That of course is very separate to a good business, which we definitely think that this is. Healthcare is a great medium for long term investors, hospitals even more so.

The amount of costs and mistakes that are likely to be reduced in hospitals as a result of improved and improving technology makes me feel that they are going to become more profitable and not less. Added to that will be that an ageing population will be able to have more procedures, and not fewer, as less invasive surgery continues to evolve. My dad (and I hope he doesn't trash me for this) had a small procedure on Friday that required local anaesthetic, yesterday he walked around 15km on a hike in the Cape Mountains. No probs.

The consolidated group reported revenue growth of 30 percent to 2.759 billion Pound Sterling, underlying EBITDA grew 17 percent to 501 million Pounds. Earnings per share were down 19 percent to 29.8 pence. The dividend declared for this period is 4.7 pence (7.9 pence for the whole year), not the biggest payer. In fact, for the full year it is below one percent. So you do not own this business because it pays you a wonderful dividend. You would own this business for their growth prospects. Underlying earnings per share clocked 29.8 pence, which is 19 percent lower than the prior period, which was 36.7 pence. Why? We shall deal with that in a second. Net Debt, as a result of all the recent deals, ramped up 9 percent to 1.669 billion Pounds.

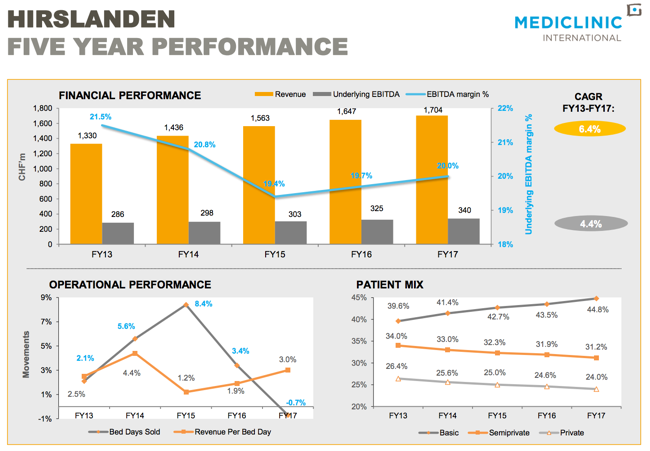

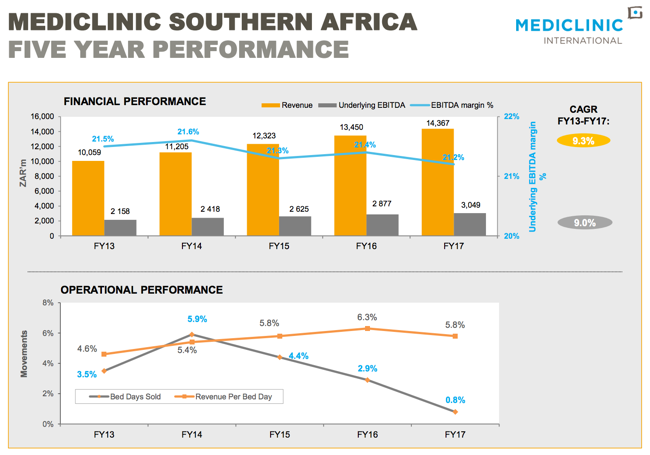

Here are some interesting slides from the presentation that shows the separate business, which are as follows, in revenues: 48 percent Switzerland, 28 percent Southern Africa and 24 percent Middle East (UAE). From an underlying Ebitda perspective, the geographical breakdown is as follows: 53 percent Switzerland, 33 percent Southern Africa and 15 percent Middle East. Firstly, a five year performance of the Swiss business, Hirslanden:

This is a great business that definitely caters for the richest patients, possibly on earth. They (Hirslanden) have a one-third share of the private healthcare market in Switzerland. And then below, the South African business, in the same format from the results presentation.

The CEO says in the commentary: "We expect a gradual improvement in the Middle East platform as we progress through the 2018 financial year and beyond." That is part of the reason why we expect the outlook to brighten. To lend credence to our thesis above, we are in total agreement with CEO Danie Meintjes: "We continue to see growing demand for quality healthcare services which is underpinned by an ageing population, growing disease burden and technological innovation. This is why we place such an emphasis on our Patients First strategy and continue to invest in our facilities and people. With this focus and our leading positions in core markets, Mediclinic is well-positioned to deliver sustainable long-term growth."

When a share price does badly, ordinary investors think that there must be something wrong with the business. In this case, the share price was probably overvalued. I suspect that integration and regulatory issues (healthcare is made an emotive issue for politicians and ordinary citizens) have impacted their performance. I suspect that they will continue to do deals as they see fit. We continue to be patient, and will encourage investors to accumulate on weakness. This time next year the comparable numbers are likely to look more favourable.