Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Steinhoff numbers yesterday morning (and afternoon), this was for the quarter ending December 2016. This is a 300 billion Rand market cap business, sizeable indeed. Of course the business is now listed in the Frankfurt, this is the secondary listing down here. I think that access to cheaper capital and growth in emerging market (as well as looking for opportunities in developed markets) is more important.

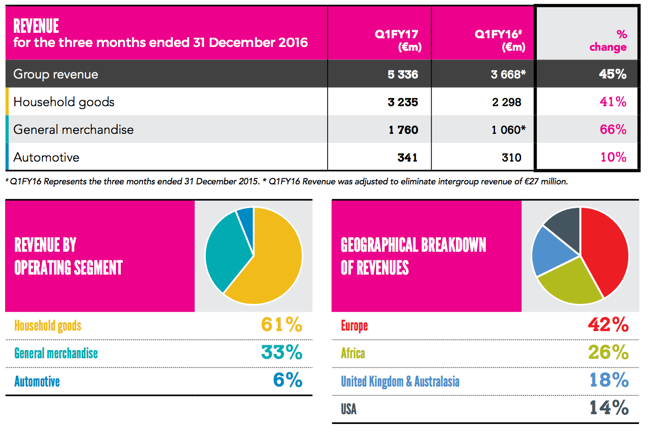

Their listing there, with the backing of big German institutional money makes for favourable reading, from a funding point of view. That is what I think when they made the comment that shares in issue had been stable, I suspect that it will stay that way. There is a *nice* colourful slide for us to use here:

That pretty much sums up the business right there. What Steinhoff have done well over the last half a decade is realise that in the space that they operate in, there were cheap assets that nobody else wanted at the time. They recognised that after the financial crisis there were opportunities that may have only presented themselves once in a decade, or generation for that matter. Through the bumbling of the European sovereign issues, the company found a foothold in Europe and will continue to build on their huge base.

Be patient here, I know that the share price has not rewarded you over the last year (down 20 percent). It looks cheap at these levels and is showing signs of "bedding down" (no pun intended) their recent acquisitions. The risk of course is that they enter "a deal too far" territory. Beds and sofas, kettles and white goods are certainly not the most appealing and dynamic products, that is for sure. We continue to add to the stock of a company that we think has a dynamic and quality management team, searching for perfection.