Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Bidcorp reported results for their first half to end December last week Thursday. Since the results, the stock price is up around 15 percent, in just two trading sessions. In fairness, the stock price was trading near (about four percent above) an all time low before their rally. Before you saw "WHAT?", remember that the company was unbundled from Bidvest less than a year ago, so their unbundling has been less than 12 months. So perhaps it is more fair to say that they were trading at a 12 month low.

The stronger Rand does not help the group, they are no longer just a South African business, as they were in the past. We prefer the foods business over the services business, both are "good", we prefer the expansion plans and geographical reach, as well as the margins. Bidcorp (or BidFood as we like to call them, they are rolling that brand out internationally) has a market cap of 90 billion Rand, relative to the services business Bidvest, which has a market capitalisation of 55 billion.

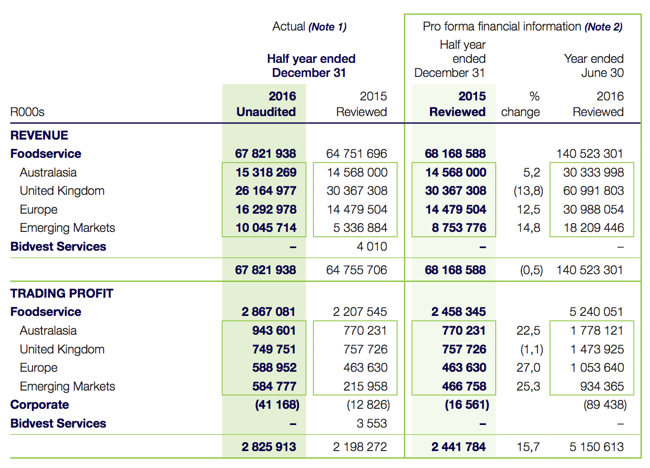

So let us peek at the numbers. Headline earnings per share increased 20 percent to just over 600 cents for the first half of the 2017 financial year, on revenues that were essentially flat (pro forma). The distribution was/is 250 cents per share, the group was really chuffed that they had managed to also pay down net debt by 2.6 billion Rand and slash it to 1.7 billion Rand. Trading margins also improved substantially, from 3.6 to 4.2 percent. As you can tell from their size and scale, they are relatively un-geared.

I suspect that the market likes this too, the fact that they may be in a position to continue to acquire businesses here and there, which has always been the style. As they noted during the six months, whilst there were no material acquisitions, they bought nearly 500 million Rands worth of other businesses in Australia, Brazil, Belgium, Italy and Fresh UK. Fresh UK? Bidvest Fresh UK - Campbell Brothers, Oliver Kay, Hensons. They are always "busy".

Herewith a breakdown of their "global" business, all markets bar for the UK business firing on all cylinders:

Why own this business? I mean, what makes this business so very interesting? For starters as Paul always says when someone points out that cigarettes are addictive, food is more addictive. People are getting busier and richer, which means they are more likely to favour eating out or packaged food. The more handling of fresh food for the consumer and customers out there, the better for Bidcorp. The "prospects column" deliver you a little about the strategy in the coming years, and sums it up *nicely*: