Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Nestle, one of the biggest food businesses in the world, certainly one who holds the gold standard for a large part of their offering, reported full year numbers recently. We recently did a deep dive at their nine month numbers, you will recall the message Nestle 9 month numbers - slow and steady. There we covered the company history in detail, which is important in terms of where to next, most especially in the new CEO era, the first non Nestle insider to run the business. Ulf Mark Schneider has been at the business since the beginning of the year, 45 odd days in, I am sure that he is getting his footing. What often happens with fresh blood is that they "feel" their way around and find a way to inject new energy into this business. Which it desperately needs.

Group sales for the full year grew ever so modestly, only up 0.8 percent in Swiss Francs, experiencing serious currency headwinds of minus 1.6 percent. Still, at 89.5 billion Swiss Francs, this is a beast and a half. Developed markets still account for 52.1 billion Swiss Francs of that, the rest is emerging markets, which have far greater sized populations, many of which are finding their way through the maze of economic tiering. The company reported net profit of 8.5 billion Swiss Francs, reported earnings per share grew 4.8 percent to 2.76 Swiss Francs, whilst the underlying earnings per share grew by 3.4 percent.

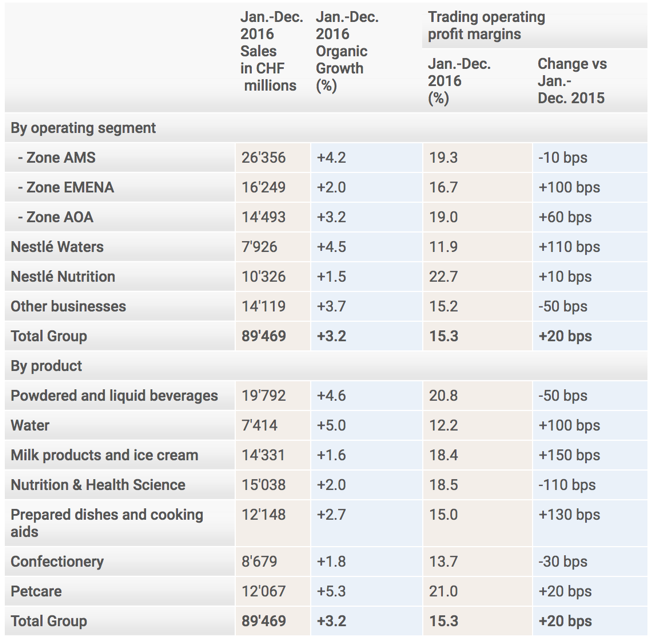

They have a well diversified business as you can see below, from pet-care to water, confectionary to nutrition. Equally, the AMS zone is the Americas, Zone EMENA is Europe (East, West and Central), as well as the Middle East and North Africa. AOA is Sub-Saharan Africa, Asia and Oceana:

A well diversified business with some fantastic brands. It does have pedestrian growth and is unlikely to ever return 5 to 10 percent revenue growth. What may well happen is that the chief, the new fellow, may take the knife to the underperforming business units and look ahead to higher margin and higher growth businesses, the company spoke of selling their stake in L'Oreal, which I think is a win for both businesses. I suspect that we should give the chief a little more time, this is an incredible business that has superb brands. It may well be a case of having to hold for two to three years to see the giant ship change course, you may be well rewarded in the aftermath of slow sales growth between now and then.