Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Woolworths reported 26 week numbers to end 25 December 2016 on Thursday, Ian Moir the CEO put on a brave face. There is no Boxing Day for Woolies in here, before you say, what is that about, the boxing day sale for David Jones in Australia is the single biggest shopping day for the business. Must be a "thing", like Black Friday. Country Road after a few rough years is starting to show "green shoots", the company has a new CEO, no prizes for guessing that it is a Scotsman, Scott Fyfe. What is interesting is that the Scott has a lot of experience in Marks & Spencer.

Let us face it, the consumer both in Australia and South Africa have been impacted by both consumer confidence having ratcheted (global and local politics putting a lid on "things") as well as lower economic growth. Seeing as both economies are reliant to a certain extent on commodities, the levelling off of China, and now subsequent return to growth in demand for commodities. The good news for both Australia and South Africa is that commodity prices have improved markedly from last year. Some prices may look top, who are all of us to know where they will end up. The company talks about consumer confidence in Australia being low, despite record low interest rates, mostly as a result of the change in the mix of the labour market, more part time jobs. In South Africa, consumer confidence continues to be under pressure, for obvious reasons I guess.

Better value for their customers in both food and clothes is what the company said. They invested heavily in their "customer". Woolworths food business is pretty incredible, they really have evolved and continue to grow ahead of the market. They had a "system change" in the middle of last year, chief Ian Moir reckons that this will help dramatically in the coming year. So I guess, as Ian Moir puts his best foot forward, the company is a little better poised than in years gone by. Of course, there needs to be renewed optimism and renewed economic growth in both their territories.

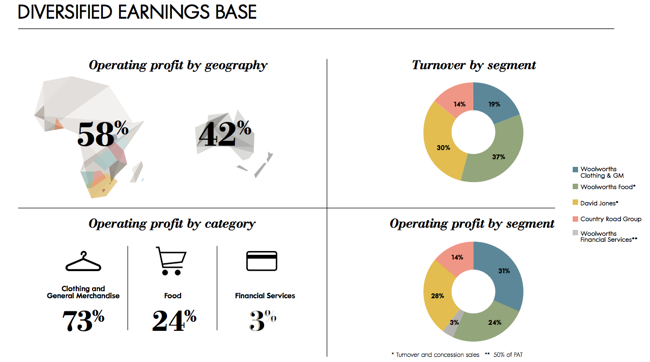

By geography and segment, the company has a *nice* slide at the analyst presentation, which I am going to share here:

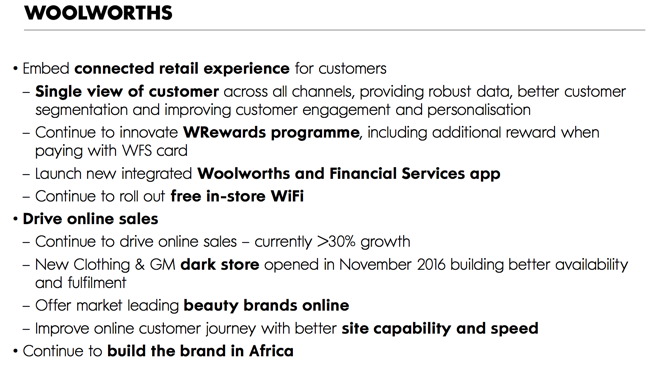

The company is going to continue to invest in their business heavily. They are also looking to take market share in the beauty product space. They are going to stock all of the leading brands, bar for L'Oreal, so there will be Chanel, Bobbi Brown, Clinique and Estee Lauder. I am wondering what this means for their competitors, most notably Edgars and Red Square. The company will also move some of their classic and premium merchandise and rebrand under the David Jones brand. There will also be a launch of a new private label brand. I suspect that the strategy is to improve the retail experience, including in store wifi and to encourage consumers to buy more general merchandise, soft luxury and their newer clothing labels (David Jones). This is a good slide for Woolworths (best known to us South Africans):

I for one am most excited about the David Jones strategy in Australia. Fewer outhouse brands, the roll out of the in-store brands and most importantly (for me), a premium food offering for Australians. There is little competition in that space, I suspect that the new Scottish signing (even though at Country Road) will have some input. Convenience, exclusivity and most importantly, quality, which trumps all. They are basically going to use the model that worked here, to implement that with David Jones. So you are going to have to give them a while. There is a food partnership with a fellow by the name of Neil Perry, I am afraid that I have not heard of him.

That is all very good and well, the truth is that the earnings and sales growth is positively anaemic. The dividend was unchanged at 133 cents for the first half. The stock price has acted accordingly, down since the results. The business trades on a less demanding multiple for obvious reasons. There is little to no growth, top line or bottom line, the stock deserves to trade on a mid to low teens multiple. The dividend underpin, as the business has traditionally always been generous, is likely to put a floor at some level. We continue to accumulate on weakness in what is a wonderful business, and whilst disappointed by the current performance, maintain that quality is important in this segment. The company will continue to innovate and continue to gain market share in all key segments. You have to own this one for the long run.