Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tuesday morning we had an NAV update from Brait for the end of their 3Q. The markets knee jerk reaction was to sell the stock down 6% but then as people read further and adjusted expectations, the stock price recovered to actually finish the day up around 1%!

The reason for the initial sell off was the NAV number coming in 21% lower than it was 3 months ago, now sitting at R82.45. The underlying assumption there though is that the Pound/ Rand exchange rate is 16.95 (currently at 16.13).

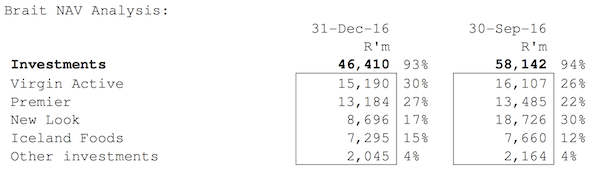

Since the Brexit vote the stock has had a very rough time, roughly losing half of its value. A big factor being the huge devaluation in the Pound. The Pound has lost around 25% of its value when compared to the Rand and given that their biggest assets, New Look & Virgin Active are valued in Pounds, currency translation matters in this case. See the current asset break down below.

The problem asset of the last 6 months has been New Look, where the valuation multiple has been decreased in combination with lower earnings. A double whammy on the carrying value of the asset! New Look has gone from their biggest asset to the number 3 position now. Why the drop? UK sales have been down, like for like sales are down 4.6%. Adding pain to the situation, the weaker Pound means that they are paying more for their stock, so lower margins.

There is a bright side though, their international push. International sales were up 17.9% thanks to their big move into China, store count currently sitting at 106. The international segment is still small for the overall business but as time goes on, will become more significant.

Going forward, I think the New Look valuation multiple will stay the same. It may take a few more quarters for the sales and by extension the profit numbers to stabilise but given the reduced size of New Look their impact should be muted.

I think going forward, the share price will trade in line with our currency (weaker Pound, stronger Rand being bad for the share price). If you have endured the sell off of the last 8 months, I would say that selling now will probably be around the bottom, time will tell though.