Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

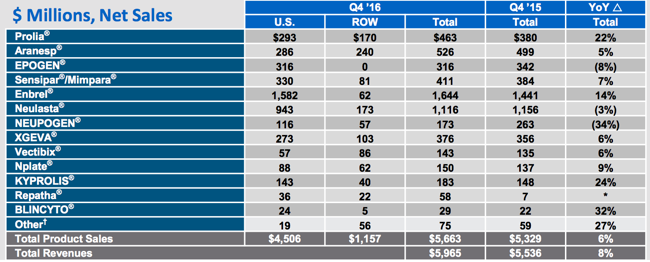

Amgen reported numbers on Thursday evening, after the market closed. I think for the purposes of this 4th quarter update, it is worth publishing a sales table of all of their therapies to explain where the business is right now.

As you can tell, their biggest selling drugs are Neulasta and Enbrel. Their fastest growing therapies are Prolia and Kyprolis. Of course, if you are looking for a breakdown of their therapies (everyone knows what a GoPro is, Neulasta outsells that on their own, not everyone knows what that is), visit the Amgen website - Amgen Products. Neulasta is a prescription drug given to you 24 hours after you have chemotherapy, in order to boost your white blood cell count. This builds greater protection against the chance of infection, i.e. the more white blood cells you have, the greater chance you have of fighting infection risks, should they arise. Enbrel is one of those therapies that treats multiple ailments, from Rheumatoid Arthritis to Psoriasis to Ankylosing Spondylitis (AS - spinal arthritis).

Prolia treats postmenopausal osteoporosis, by strengthening bones most especially in woman who would be prone to heightened risk of fractures. At two shots a year, it is an effective and affordable (in a developed world sense) at 1650 Dollars a year. More or less affordable and a whole lot better than the cost of the ongoing treatment associated with fractures as a result of weaker bone structures. Kyprolis, as per the website "is a prescription medicine for people with relapsed or refractory multiple myeloma who have received at least 1 previous treatment." Amgen bought the therapy when they acquired Onyx Pharma back in 2013.

It is a little complicated as an investor trying to understand all the multiple therapies that they have invested an enormous amount of time and money in, the research and development cost last year was 3.84 billion Dollars, relative to the total annual revenues of 22.991 billion. That is 16.7 percent of total revenues dedicated to the search for the next big blockbuster and ongoing trials and testing of existing therapies. 18.6 percent in R&D relative to product sales for the quarter (they have "other revenues"). Basic earnings per share for the year clocked 10.32 Dollars. The company pays 1.15 Dollars a quarter (pre-tax) in dividends.

The quarterly share buybacks were as much as the dividend check the company paid, very aggressive at these lower prices. That is nearly double (the dividend payment) from this time in 2014. The company has certainly been very generous with their dividends. On a simple historic basis, the stock trades on 16.3x earnings and has a yield of 2.74 percent. This after the results were well received and the stock managed to rally just under five percent Friday, to close at 167.53 Dollars.

One thing that often shocks me, and you have heard us say this before, is the enormous pushback that companies such as these get from the broader community. They are shocked and outraged at the cost of the therapies, yet give little time and effort into trying to understand not only how much money is spent in developing the therapies, but the enormous positive impact that companies like Amgen have on broader society. Getting back your health (admittedly at a cost), is essentially priceless.

The truth is, not everyone can afford these expensive and life saving therapies. I for one would much rather own a company (repeat always) that is dedicated to improving health and contributing positively to longevity, than one that does the opposite. The same said people that have pushback against big pharma, seem to have no problem with booze businesses. You get my drift? Paul sent the WhatsApp group a great Bloomberg story, it ties into the affordability of therapies, an Amgen drug - Repatha Will Test the New Drug Pricing Reality.

The company gave guidance for revenues of between 22.3 to 23.1 billion Dollars, earnings per share in the range of 11.8 to 12.6 Dollars (quite wide), which puts the stock on a 14.2 to 13.3 times earnings multiple forward. We think that there is plenty of room to move for this business, both in terms of existing therapies coupled with a strong pipeline. The company is awaiting further approvals on existing therapies (For Repatha and Kyprolis, as well as Xgeva and Blincyto) and new migraine (Erenumab, remember that name, like Carlos Brathwaite) and cancer drugs. Not expensive, a great history of returning cash to shareholders via dividends and buybacks and the ability to continue to bolt on acquisitions (the market capitalisation is an astonishing 130 billion Dollars) exists. We continue to add and hold this as a core in the healthcare segment of our portfolios.