Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Facebook reported numbers after hours, for the full year and the fourth quarter. Another beat on both metrics, revenues income - Facebook Reports Fourth Quarter and Full Year 2016 Results. Revenues for the full year clocked 27,638 billion Dollars, an increase of 54 percent from last year. Wow. Net income for the full year topped 10 billion Dollars, up 177 percent from the year prior.

Earnings per share grew 171 percent to 3.49 Dollars, from 2015 to 2016. At this sort of growth rate the stock trades on 38 times earnings historic, which you would expect. Bloomberg has the forward multiple as 25.4x, with estimated earnings for the full year at 5.25 Dollars per share. That means that the simple PEG ratio is less than 1, at a very respectable 0.75 times forward. By most metrics, a spectacular failure of an IPO (as it was called at the time) has turned into a roaring success as a business. As the Zuck pointed out on the earnings call, yesterday marked five years exactly from when Facebook announced they were going to IPO.

And also, remember how the company was going to struggle to monetise mobile? Remember how the share price halved after the IPO, inside of the first six months of being listed? Mobile revenue now represents 84 percent of group revenue, up from 80 percent this time last year. And the group is hardly ex growth, I was quite astonished by the increases in users, you have to expect those to plateau at some stage, not everyone in the world will "sign up", even if that is the mission of the Zuck. Daily active users grew to 1.227 billion folks, 1.146 billion on mobile phones. Monthly active users grew to 1.86 billion, on mobile that number is 1.74 billion.

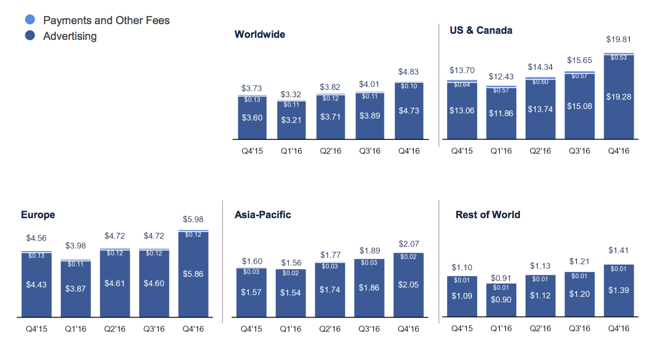

Advertising revenue is being driven (at a geographical level) by North America, Average Revenue Per User (ARPU) in the US and Canada now stands at 19.81 Dollars, for the whole world (all their users), it is 4.83 Dollars. In Europe that stands at 5.98 Dollars. Down in our part of the world (rest of world categorised) it is 1.41 Dollars. As per the annual report, just in case you were thinking that this was an annualised number or monthly number, it is not: "We calculate our revenue by user geography based on our estimate of the geography in which ad impressions are delivered or virtual and digital goods are purchased. We define ARPU as our total revenue in a given geography during a given quarter, divided by the average of the number of MAUs in the geography at the beginning and end of the quarter." Check out the global ARPU spread:

That 19.81 Dollars ARPU is basically 6.60 Dollars per user per month. Or advertisers in Canada and the US are spending 22 cents per user per day. Down here, in our part of the world, it is around one and a half cents per person using the platform per day. Even in Rand cents, that is next to nothing, 21 ZA cents per day on users. Advertisers certainly have plenty of scope to push hard with this advertising platform, I suspect that not everyone has gotten their heads around advertising in this way. Once they do, the fact that the database is so malleable and your target audience can be met so easily, there is big scope to grow.

Before the earnings call, which included guidance from the CFO (that is what everyone is making reference to) that ran a little short, the stock touched all time highs. This was the commentary in the prepared commentary from the CFO "Consistent with my comments on the Q3 call, we continue to expect that our ad revenue growth rate will come down meaningfully in 2017." That has attracted quite a lot of attention, meaningfully cannot really be quantified.

For the time being, the next focus is going to be on video. I am sure that the mobile operators are thrilled that more people are going to be watching videos on their phones! Zuck (second name Elliot) says on the (Conference Call): I've said before that I see video as a megatrend on the same order as mobile. That's why we're going to keep putting video first across our family of apps and making it easier for people to capture and share video in new ways.

The company is in great hands. Sheryl Sandberg, Mark Zuckerberg are about as dynamic as you can get. I suspect that what often happens with businesses like this is that they attract high quality talent, we often make the point that quality attracts quality. The core product is still the core product, the other platforms are growing like gangbusters too, and that presents multiple channels for advertisers. Instagram has 400 million daily active users (count me in there) and 600 million monthly active users. WhatsApp has 1.2 billion active monthly users (I am a daily user), sending 50 billion messages a day. Whoa. At peak SMS, the Zuck notes that there were around 20 billion messages being sent daily.

There is a careful balance on the user experience, I am very sure that they will get that right. i.e. The advertisers would prefer a more direct access, the users would prefer it toned down. This is also useful, the Zuck says in the prepared remarks: "In the past we've taken steps to reduce spam and clickbait, and now we're approaching misinformation and hoaxes the same way."

Lastly, what is the share price worth? Based on the old and trusted PEG ratio, I suspect that there may be as much as 20 percent upside over the next year, depending on user traction remaining the same, and advertisers seeking maximum bang for their buck. The biggest risk to their platforms is competition. It may come, other advertising platforms, I suspect that they will be trend setters for the time being. We maintain our buy recommendation up to the 150-160 Dollars range.