Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

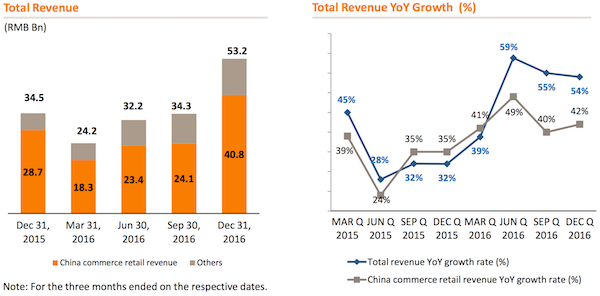

Last week we had 3Q numbers from Alibaba Group, the Chinese e-tail giant. The company is still growing like gang busters, with revenue up 54% YoY!. The huge growth is not coming off a small base either, with revenues for a quarter currently sitting around $7.7 billion.

As the above image shows, the core business, Chinese e-commerce grew revenue by 42%. The number of buyers that visit Alibaba's sites is rather mind numbing. Over the last 12 months they grew their Annual Active Buys base 9% to 443 million people. A large chunk of buyers are accessing the sites via mobile, with Alibaba Group recording that 80% of their Chinese sales come from mobile devices.

As fast as their core retail division is growing, their non-core assets are growing faster. The cloud division grew by 115% YoY but is still only 3% of the entire groups revenue. What is impressive is the number of users of their cloud operation with user numbers growing by 114 000 users in 3 months to 765 000 users. Despite all the growth the division is still loss making.

Their biggest non-core operation is Digital Media & Entertainment Segment, which grew revenue by 273%. The growth in revenue didn't translate into higher profits, the division made bigger losses for the quarter. Like other companies operating in the segment, spending on content is important. Increasing the spend now means losses upfront but the building of a base for the future.

All the top line growth means nothing if it doesn't drop down to the bottom line. Non-GAAP EPS grew by 38%, so still good growth but not in the league of 54% seen in revenue growth. Where were the increased costs? Alibaba group spent more on improving their logistics network, increased spend on content for their Digital Media & Entertainment segment and then good old share based compensation where there are now more shares in issue.

There is no doubt that e-commerce is here to stay and growth rates will continue to be double digits as internet penetration increases and as more people feel comfortable inputting their credit card details. Sales for their international retail division grew 288% but still only accounts for 4% of revenue.. As Chinese sales begin to slow the international division should carry the slack.

The concern with the company though is their complex holding structure, understanding it can be called murky at best. This structure has also resulted in a probe by the SEC which is still ongoing, SEC probes Alibaba accounting methods, shares dive.

Amazon is still our preferred company in this space, they have a better distribution network, better cloud division and better online entertainment division. The big thing that Amazon doesn't have is the big exposure to the Chinese market and for that a non-core Alibaba position in your portfolio might be worth it.