Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

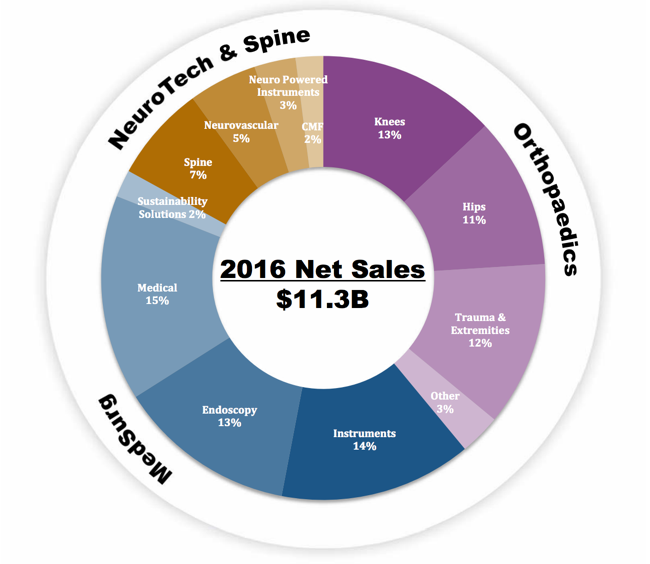

Stryker reported numbers post the market close. In a recent JP Morgan healthcare conference, a couple of weeks back, the company gave a great breakdown of all of their business divisions. As "they" say in the classics, a picture is worth 1000 words, download it here: 35th Annual J.P. Morgan Healthcare Conference Presentation.

It is a business that is well diversified across different segments, hip and knee replacements are becoming increasingly minor procedures (if there is such a thing). Let us take a dive in - Stryker reports 2016 results and 2017 outlook. Net sales for the year were up nearly 14 percent, reported net earnings were 14.5 percent up on the year to 1.6 billion Dollars. Decent enough margins, they are selling everything from bone cement to hospital beds to complicated surgical equipment. Spinal implants, that looks next level!

The bionic man of yesteryear is to a certain extent a reality today, although these are the products that you are grateful for, you are less likely to rush out and use (get) them willingly. Whilst a hip and knee implant will change your life for the better, and lift the quality of your life, you do not want to get to the point in which you need them, if you get my drift.

Guidance for the year ahead was decent enough, the company expects earnings per share for the full year to be between 6.35 to 6.45 Dollars for the full year (1.40 to 1.45 Dollars in the first quarter). That compares to the 5.80 Dollars on the same metric, that being just reported for the full year to end 2016. At the closing price of 121.5 Dollars last evening, the stock trades just shy of 21 times earnings historic and on the company guidance in the midpoint of the range given, just less than 19 times.

Hardly a bargain, on a PEG ratio basis (Price to Earnings over Growth rate), it is closer to 1.8. Which again, is not "cheap", nor is it wildly expensive. Which is why I guess the market hardly budged after-hours on these numbers, if the company is likely to produce 10-15 percent earnings growth, the market is happy to rate the stock on a 19 multiple forward. With a dividend yield of only around 1.4 percent, you are certainly not buying this one for the income.

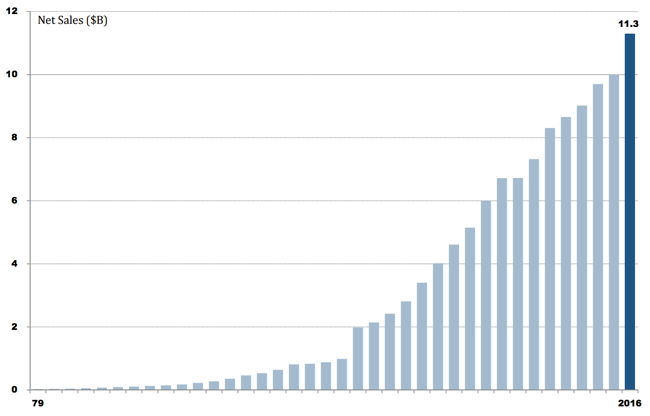

What is clear to me, and to many, is that this continues to be a growth industry. Many more people can enjoy something that was only available to richer people of yesteryear, from that same conference presentation that we spoke of above, the growth in Stryker revenues has been a sight to behold, this is from 1979 to last year:

The company continues to make acquisitions, they have now integrated the MAKO business into theirs wonderfully well (acquisition done back in 2013), having sold their incredible robotic arms that deliver bespoke knees and hips to their "customers". Check them out - Robotic-Arm Assisted Technology. There are 381 of these worldwide, so far, with 333 of them in the US. With their bigger business and bite sized acquisitions, they are able to roll out these products at a faster rate. We expect the company to continue to look at these, as and when they arise. The company spent roughly 15 percent of their market cap on acquisitions over the last three years.

This is a growth business that you are buying on a fairly "cheap" forward multiple. The growth thesis is also contained inside that their international presence is fairly limited, they are predominately a US based business, so there is plenty of scope to tap rich developed and richer middle income people in developing markets. We remain buyers of what is a great business with superb leaders, I like Kevin Lobo. Defensive in nature, growth in future.