Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

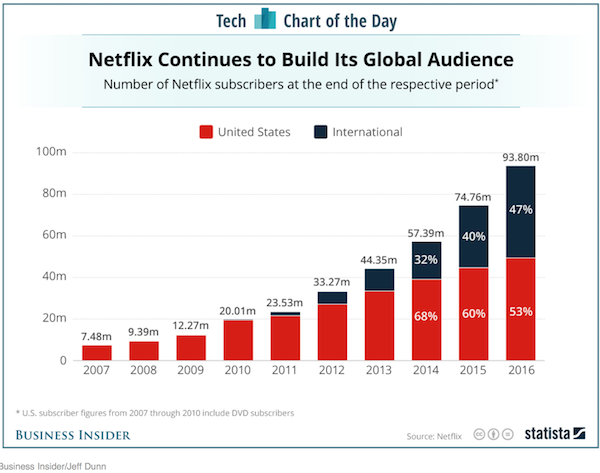

Whoa, Netflix continues to crush expectations. On Wednesday after the market close they released their 4Q results & shareholder letter. The stock shot up 8% in after hour trading. At the close of trading yesterday it only ended up 4% after all was said and done. Compared to the same time last year, streaming revenue is up 41% to $2.35 billion for the quarter. The numbers people were more interested in was what the subscriber growth looked like and the growth didn't disappoint (see below).

Note on the above image, that it says that subscribers up until 2010 includes, DVD subscribers. As most of you will know, Netflix started out as a DVD hire company, where they post you the DVD, you watch it and then post it back to them. What most of you won't know is that Netflix still has 4.1 million subscribers using their DVD service!. When was the last time you watched a DVD or even saw a DVD shop? Now add into the equation using the Post Office, talk about old school tech. This part of the business is profitable though, generating a profit of $68 million for the quarter and more than off setting the loss of $67 million from the international streaming devision.

As Sasha points out, Netflix has made 3 rather big transformations in a relatively short period of time. They started as a DVD company, then changed to a streaming company and now they have changed into a content producing company. House of Cards was their first big hit but since then they have spent billions on content, forecast to spend a whopping $6 billion on content creation in 2017.

Content creation is the moat around the company at the moment, it is what differentiates Netflix from other streaming providers. The Crown, a series that depicts Queen Elizabeth's life, won Best TV Drama & Best Actress of TV Drama at the Golden Globes, so their push into new content is working.

All this growth comes at a cost, from a valuation point of view the stock is trading on a trailing P/E of 374 and a forward P/E of 69. On a business level the company is spending huge amounts of money up front to grow their content base but also grow their international market with the result being that they are going to have negative cash flow of $2 billion for 2017! All in all this is not a stock for the faint hearted. The key question that you need to answer yourself is, will they continue to create block buster content? If the answer is yes then I would say this stock is a buy for your 'outliers portfolio'.