Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont produced a 3rd quarter trading update for the period to end 31 December yesterday, just before the market opened. Jewellery sales across their platforms were stronger. Asia Pacific showing good growth, thanks mostly to South Korea and Mainland China, Macau and Hong Kong still a little in the dumpsters, the release suggests continued declines. I suspect a slight change in shopping patterns, mainland customers will become bigger consumers, even with the higher duties. In China it is called "consumption tax", see Import-Export Taxes and Duties in China. As far as my "research" on Hong Kong, the rate is zero for imported jewellery, it is by extension far cheaper to buy luxury items in Hong Kong than on the mainland.

Total sales for the three months, when compared to the prior reported period was 6 percent stronger at actual exchange rates. At constant rates, it was 5 percent better. The market obviously had pretty low expectations, the stock soared 8.6 percent in their primary market, Zurich. Locally, the Rand being stronger against a basket globally meant that we "only" gained 6 percent. It has been really tough for stock holders, the stock price was here in August of 2013. For most retail clients, understandably, the stock prices "not going anywhere" is too much to bear over a period such as that. I think when owning this business, you have to be mindful that fine jewellery and luxury goods are enduring. Brand replication at this quality is very hard and takes decades.

I remember writing this, back in 2014, and like the quality of their brands, it remains true today: "There is not only the price of the pieces that are beyond reach of most, but they are difficult to reach. Exclusivity is however in the luxury goods business part of the allure. A rich and discerning customer wants to know that they are part of an exclusive and select group. And that is at the heart of it all, much like natural beauty (Table Mountain to the Kruger Park), you cannot replicate quality Maisons with hundreds of years of history. In fact, the bulk of the Richemont brands are over a century old. From the Richemont website, here are the years of founding of the respective businesses: Purdey (1814), Baume & Mercier (1830), Jaeger-LeCoultre (1833), Lange & Sohne (1845), Cartier (1847), Officine Panerai (1860), IWC (1868), Piaget (1874), Lancel (1876), Alfred Dunhill (1893), Van Cleef & Arpels (1906) and Montblanc (1906)."

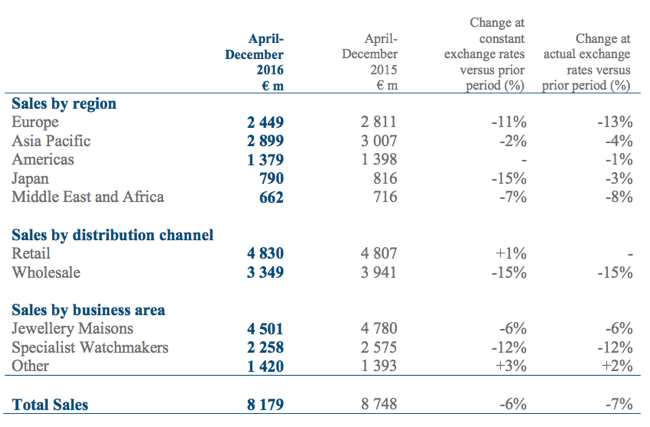

The nine month numbers look a whole lot less exciting than the three months past. In fact, you would wonder if we are talking about the same thing. Here is a regional sales table:

The only noticeable positive is that some of their businesses that they were not too in amid with, the likes of Chloe and Lancel (if memory serves, some of the leather businesses were being earmarked for sale) are "ok", and that being all relative. I get the sense that "softer" luxury has had a better time of it late, which is why leather sales have been better globally. Much better than watches, there is definitely a move afoot where wearables are going to capture a larger part of the market, at the expense of all the watch makers. I get the sense that perhaps the mid tier producers will be the ones in peril, not necessarily the high end.

Have they turned the corner? I would caution against wild two am cork popping, these are "good signs" however. I suspect that sales have bottomed and at some level this tells you something about the global customer patterns, they are in another early stage of improved sentiment. The business is hardly cheap and possibly trades at the correct level, right now. We remain holders of this company, that owns some of the most iconic brands on the planet. Brands that have been selling for centuries. Brands that are likely to continue to sell to richer consumers across the globe for decades to come. We stay the course here and accumulate on weakness.