Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The Hoff is back in town, sans red budgie smuggler and lifesaving plastic device thingie. No automated car either that speaks into a wearable device (come to think of it, Knight Rider was way ahead of it's time). Talking watches (Siri and her users) and self driving cars, those exist today. Turbo boost = ludicrous mode. I told you, that Hoff is a legend. Actually, Glen A. Larson, who also created Buck Rogers and Magnum P.I. is the legend.

Moving swiftly along to my favourite Hoff - you guessed it, Steinhoff. The company reported numbers with a changed year end to June yesterday. The dividend, the interim dividend actually filtered through at the beginning of the week, it is unusual for that to happen, it just coincides with the change in reporting periods.

OK, so what are the highlights here? I listened into the conference call for a while, the internet wobbled and bobbled and buffering ensued. I managed to get the first bit, the most important bits which had an associated Powerpoint presentation for the results to 12 months. Revenues of 13 billion Euros represent growth of 33 percent, operating profit clocked 1.474 billion Euros, up 32 percent when compared to the same period last year. Operating margins were a little softer, down to 11.3 percent.

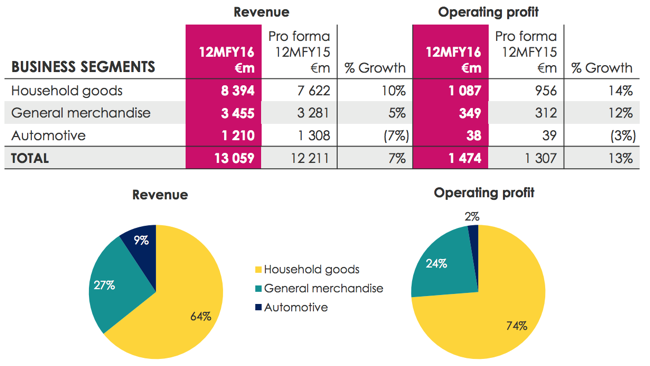

A couple of useful slides, first the segmental revenues and profits. General merchandise is clothing and footwear, as well as household goods and personal accessories. It is also cellular products and financial services. The much bigger household goods segment is furniture, appliances, consumer electronics, DIY and building materials, as well as some household goods and home accessories. Lastly, automotive is so small, it is really a rounding error when it comes to the overall group profits. Vehicles, parts and rentals.

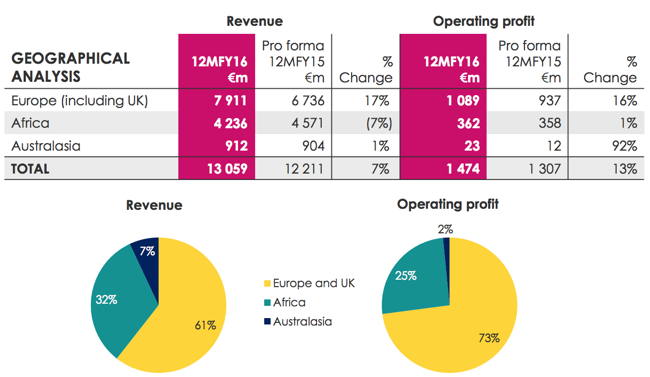

And then of course, the main reason why the company sought a European listing, the geographical breakdown of revenues and profits.

Of course, recently there are loads of moving parts and recent transactions include that of Mattress Firm - Steinhoff moving into the USA and Poundland in the UK. Tekkie Town here in South Africa and Fantastic Furniture in Australia - Steinhoff buying Fantastic Furniture in Australia. And the company plans to extend their store presence in Eastern Europe in a big way, planning to open another 1000 odd stores, doubling the base over the next half a decade. That would take them from a standing start at the turn of the century to 2 thousand stores in Eastern Europe in 2 decades, no mean feat.

Eastern Europe is the focus, the chief Markus Jooste suggested that they would not be looking at South America. I should hope so, with that type of growth, you would need to be on point to execute that type of strategy. I back them. I back them as a result of South Africa's finest retail specialist, Christo Wiese who has thrown his lot in with Markus Jooste. Just recently - Billionaire Wiese Invests $1.8 Billion More in Steinhoff.

We continue to recommend what is a very hard charging management team, implementing a global titan of tomorrow. At these levels we continue to accumulate the stock for those who are underweight and continue to recommend the company as a buy.