"Here we are in our market down at the Southern tip of Africa, and we believe that we have deep and liquid capital markets. We did a quick scan through of all of the stocks that have a local listing and have a market capitalisation of more than 10 billion Dollars (over 140 billion Rand). There is a grand total of 6. That is it sports lovers. Makes you think."

To market to market to buy a fat pig Yesterday was a funny old day with a whole lot going on. Analysis here on the political front, there was analysis of the SARS and Treasury release. I still am amazed that notwithstanding the economic quagmire, total taxes collected have increased by high single digits. If the economy was to turn and fire on all cylinders, a smaller and more efficient government were in place and we were getting bang for our buck, we would definitely not attract the negative attention of those ratings agencies. Pesky things, advising people on whether or not the ability to repay debt is "all good". Some may view them negatively and reactionary, I am sure that their internal structures were forced to have a deep and dark look in the mirror post the financial crisis.

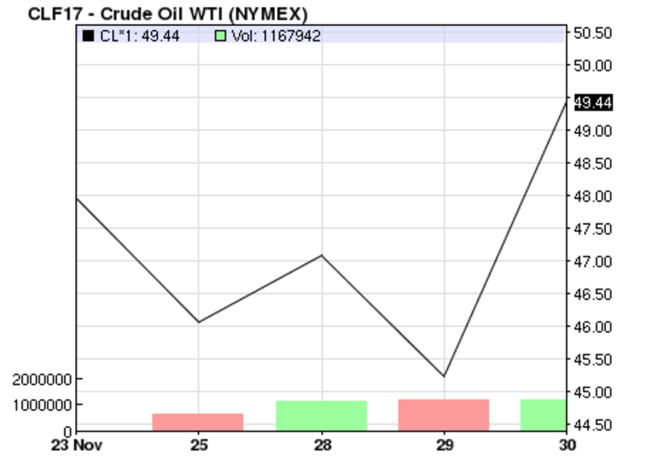

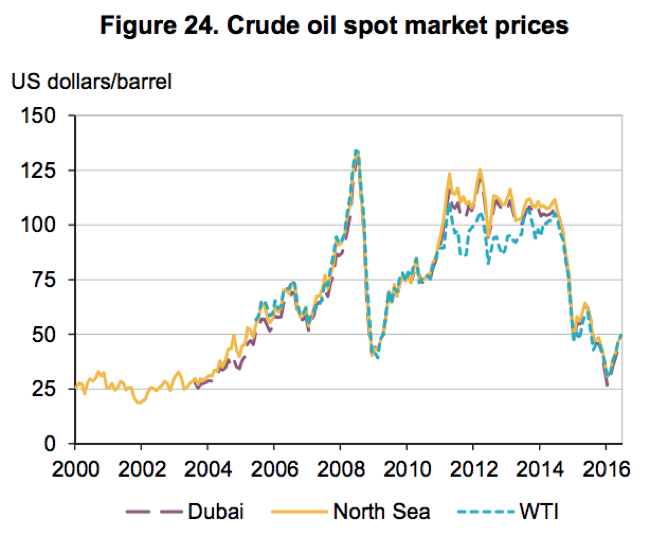

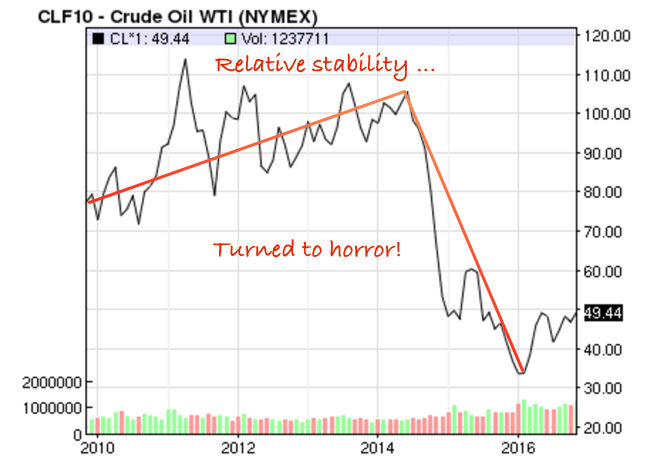

Yet that was not the main story of the day, by a long, long shot. It was all about the oil cartel folks meeting in Vienna (Austria is not an OPEC member) to discuss output cuts. And the moves then in oil prices were something to behold, perhaps the shorts were being squeezed out of sight, who knows, right? The story broke when the Iranian oil minister was jostling his way through tens of journalists at a hotel or convention centre and suggested a deal was close. In the ensuing scrum, oil traders scrambled for direction, and it was one way traffic! Herewith an average looking (hey, it is free!) graph of all the action on the day, relative to the last 7 days, from the NYMEX website -

WTI (NYMEX) Price

Here is the official announcement that came a little later in the day, sending the oil price up ten percent at some stage

Here is the official announcement that came a little later in the day, sending the oil price up ten percent at some stage, the presser note is simply titled -

Agreement. It sets out all the targeted cuts for the members, all but Iran, who can increase production marginally. It is an agreement to cut production by 1.2 million barrels (the release actually says "by around") for a period of six months. It could be extended by another six months, if needs be. What is also important here is that the Russians are working with OPEC -

"This agreement has been reached following extensive consultations and understanding reached with key non-OPEC countries, including the Russian Federation that they contribute by a reduction of 600 tb/d production."

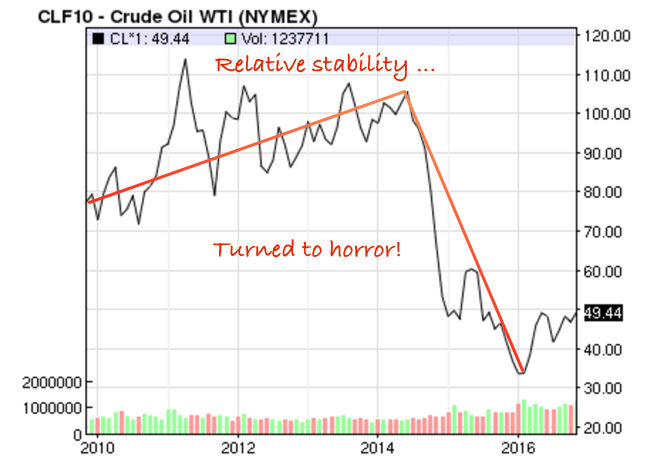

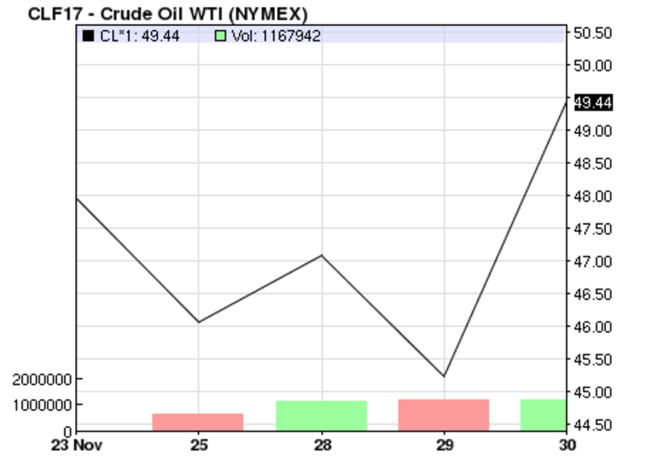

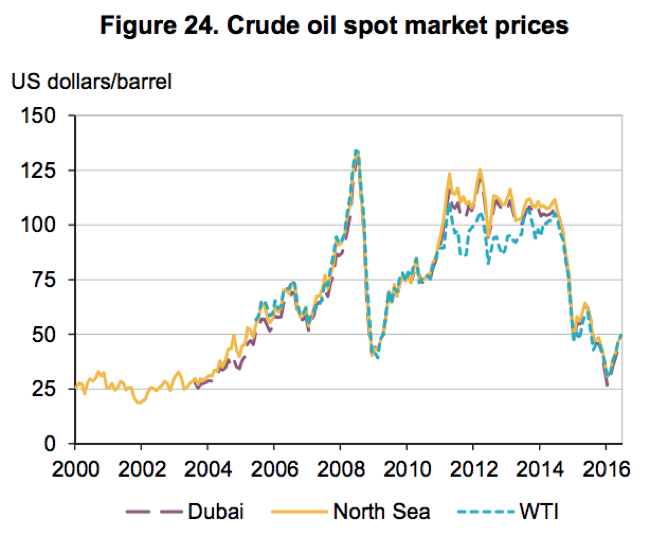

So why is all of this being done? Why is OPEC deciding that they must cut production? It is best summed up in a single graphic, a seven year oil price graph -

When these countries of OPEC, hugely reliant on oil exports to balance budgets and provide essential services to their people suddenly watched a horror show unfold, they were essentially powerless. Private enterprise, the frackers and the Russians had ramped up production significantly. Equally, some of the OPEC members themselves would not stick to production levels.

And therein lies the answers to whether this works or not, budget constraints.

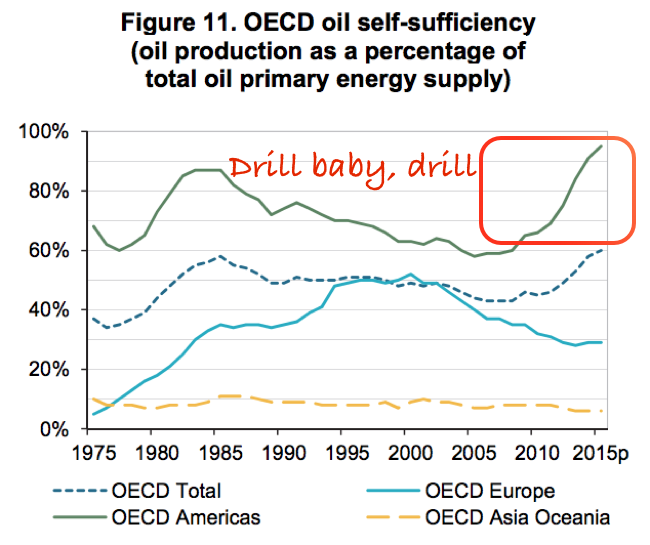

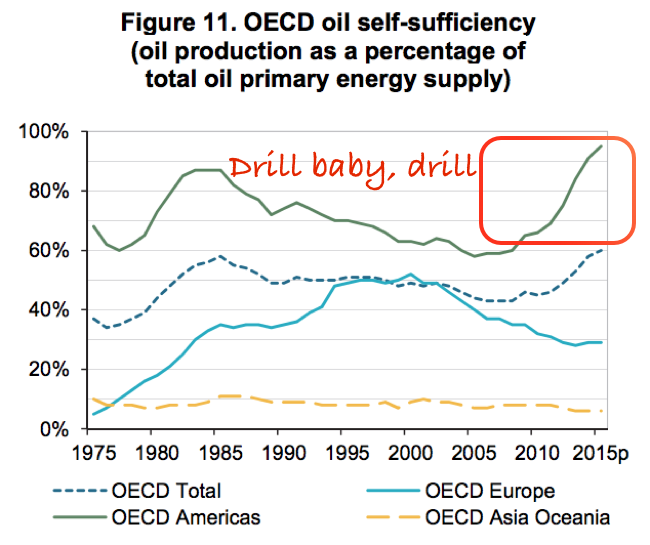

A bit of background, from the International Energy Agency -

Key Oil Trends. Excerpt from: Oil information. So first, this is the OECD countries by region that are self sufficient, as you can see, North America as a result of alternative extraction methods (fracking) are becoming increasingly able to fill any void:

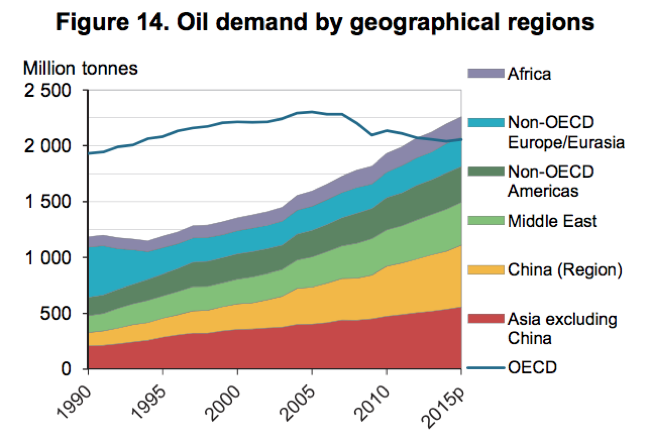

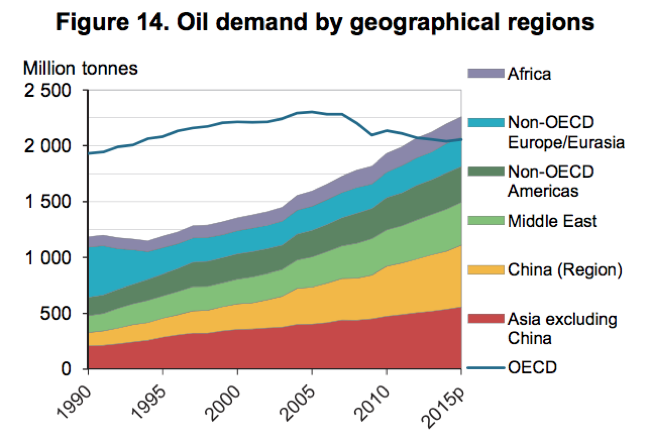

Lastly, this may not matter too much, the US is a huge user of oil, the biggest users have emerged as China and the rest of Asia over the last 25 years. The other regions have become less relevant to the overall mix.

Whilst this is a HUGE story yesterday, perhaps all of this is best put into context with a longer dated oil price graph. This is from way back when oil prices were half of what they are now, and just represents how hard it has been for these countries, that are extremely reliant on elevated prices to deliver meaningful change to their people. Diversification is key, and more people like Harold Hamm will be big benefactors as these countries cut production.

By the way, Harold Hamm on paper added 3 billion Dollars yesterday. This Bloomberg story confirms what we have been suggesting -

Texas Shale Is Big Winner as OPEC Deal Brightens Oil Outlook.

Stocks in New York, New York, armed with this big news (and the selection of new Trump administration finance people) saw stocks as a collective down one quarter of a percent (the broader market S&P 500), with the Dow Jones Industrial Average up 0.01 percent. Tech stocks sank, the nerds of NASDAQ lost over a percent on the day. Facebook, Alphabet and Microsoft as well as Amazon all fell pretty sharply, all the oil businesses ramped up sharply. Petrobras was up over ten percent, Royal Dutch Shell ramped up over four and a half percent. Banks also "did well", Bank of America was up four and a half percent too. Wells Fargo added just over two percent. Energy as a collective added nearly five percent, with some huge moves in some minors, businesses with huge losses. Seems like a big knee jerk trade last evening.

Locally we had another mixed bag. There is an interesting pattern (humans are great at picking that up) in that we start well and then the EM trade comes later in the day here, we sell off. Yesterday stocks locally ended one-tenth of a percent higher. Understandably Sasol was at the top of the pile in the majors, up nearly 5 percent. Here is an amazing statistic. Here we are in our market down at the Southern tip of Africa, and we believe that we have deep and liquid capital markets. We did a quick scan through of all of the stocks that have a local listing and have a market capitalisation of more than 10 billion Dollars (over 140 billion Rand). There is a grand total of 6. That is it sports lovers. Makes you think.

Linkfest, lap it up

It seems that politics is moving towards the extreme edges, where to solve problems one camp is arguing that governments are the solution and the other camp is arguing that free markets are the way (but only behind trade barriers, walls and labour flow restrictions?) -

Capital and Capitalism. The reality is that governments are inefficient, so less is normally better. Having said that, we don't live in a perfect world, we don't have perfect information and perfect flow of capital and labour. The result is that governments are needed to help fill the gaps and help level the playing field of opportunities. I think like most things in life, a balance normally works best.

The one item that is synonyms with Mc Donald's is their big mac, which almost never made it out of one franchises kitchen -

Jim Delligatti, Big Mac Inventor at McDonald's Chain, Dies at 98

Here is a cool map -

Map Shows Every Country's Tourism Slogan

Home again, home again, jiggety-jog. Stocks across Asia are better, stocks here have started better, how many times have we said that over the last couple of weeks? We certainly haven't been the benefactor of the new president elect in the US, emerging markets have been under loved.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.