Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tiger brands reported their full numbers to end September, both the CEO Lawrence Macdougall, (relatively new at the business) and the CFO, Noel Doyle, (an old timer at the business) were on the telly yesterday on CNBC - Tiger Brands FY profit up after Nigeria sale. It is tough out there, solid numbers, not altogether any volume growth, steady enough though. It is interesting how the CFO Noel Doyle reckons there is still likely to be heightened cost inflation with regards to their inputs (grains), not all of that can be passed onto the customer.

Straight to the Group Results Presentation. We were scratching around for all the brands known well to all South Africans, most especially after this slide from Tiger. This is where these respective brands sit in their categories in a survey done by Nielsen over a rolling 12 month period:

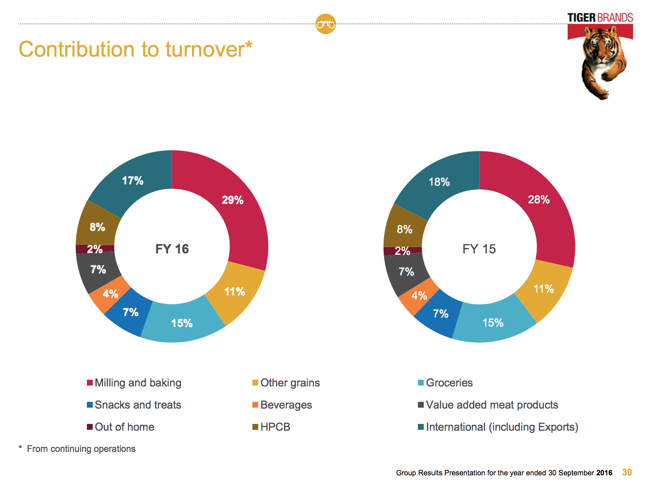

All the major brands that you would expect to be there, of course what is missing here is maize meal, that was the first noticeable thing. Or course in that department for Tiger is Ace, both the traditional offering as well as porridge, and then of course King Korn and Morvite. Breakfasts and of course side starches. Grains contribute 12.845 billion Rand (out of a group total of 31.698 billion Rand), groceries (Koo, Crosse & Blackwell, Black Cat) contributed 4.7 billion Rand. Snacks, Treats and Beverages (Oros, Energade and Maynards) sales for the full year contributed 2.271 billion and 1.326 billion Rand respectively. Home, personal and baby care (Doom, Purity) sales were 2.437 billion Rand. International, which is their African businesses, had sales of 5.386 billion Rand.

Here are two very nice graphs below of the separate businesses by revenues first, this compares 2015 to 2016.

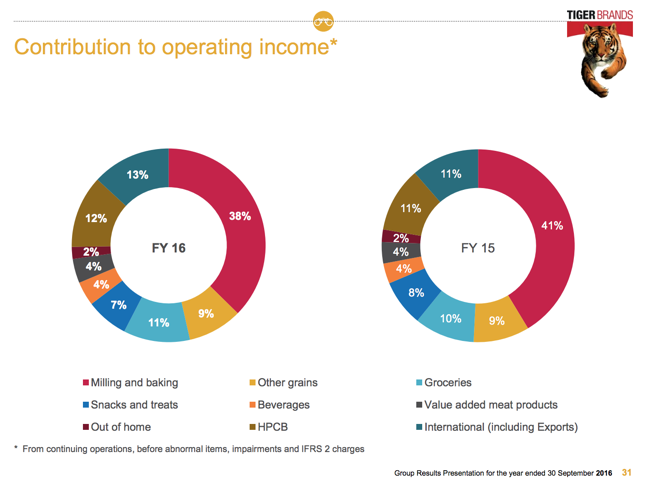

And then after that, their operating income when compared to the year prior, 2015.

Grains (staples) is their most important business, in that part they have struggled to deal with rising input costs. As they point out, raw material costs rose 22 percent. Wow. That is a tough old struggle, to keep your costs low and to make sure that the customer certainly does not bear the full brunt of all of that. The company has managed to cut costs by 380 million Rand in the last financial year, mainly on procurement savings. Improving costs at the fringes in all departments. And of course nearly 100 million Rand saved on manufacturing efficiencies.

Consumers have been grappling with rates going up, slow economic growth and joblessness has ticked up. Consumers will "shop down" to more affordable brands, which is why Tiger and their lengthy brand association with South Africa must continually stay relevant.

Earnings! What do those look like? Total headline earnings per share increased 19 percent to 2127 ZA cents, dividends for the second half was 702 cents per share, bringing the full year dividend to 1065 cents per share. At the closing price last evening the stock traded up nearly 2 percent to 392.24 Rand, the multiple historical is now 18.4 times, with a dividend yield of 2.72 percent. It is hardly the cheapest of all the stocks around, we have seen some of the retailers beaten up lately. The analyst community have the stock trading forward on around 16 and a half times. As the company pays out around 50 percent of all earnings in dividends, the dividend yield forward is over three percent.

This is a keeper. This kind of business continues to make progress year in and year out. The company will not be the overly volatile one in your portfolio. Volatility in earnings and by extension share prices is enjoyable when share prices go up, not so much when share prices go down. Tiger has certainly had their fair share of problems over the last half a decade, Nigeria is now a bad memory and out of the equation. We will accumulate this business on weakness, it is almost as timeless as some of their brands. Hey, Black Cat Peanut Butter turns 90 this year, remember these two classics - Black Cat - Packed with Protein Power and Black Cat Peanut Butter - The Boy with Nine lives. Classics, ha ha!