Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont stock soared 8 percent on Friday, the last three years however has seen the stock slip nearly 9 percent, notwithstanding the excellent day Friday. There were six month results and at face value they hardly looked like anything to get excited about. Perhaps they were less bad, perhaps we can put it down to the announcment that there are likely to be significant changes to the management structure of the business. Even at a global level there are no real peers in the luxury goods industry to compare Richemont to. LVMH has booze and handbags aplenty, Kering owns Puma and Volcom, so it is hardly comparable. Prada. Nope. Tiffany & Co., maybe it is close enough. The quality of the brands of Richemont are at a "higher" level. Some of their Maisons (houses) are timeless themselves. See a recent deep dive - Richemont review - balance sheet and brands for the future.

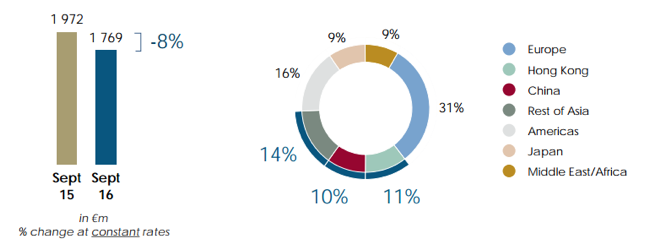

The results themselves, let us have a quick look at the six month numbers. First half sales in Euros were 17 percent lower than the corresponding sales last year. Understandably, watches are starting to take some heat, clearly from wearables in part, a crackdown in gifting too. Mainland China continues to grow at the expense of the other territories. China represents 21 percent of the total sales of the group, with Hong Kong being 11 percent and then mainland China the rest. Europe is 31 percent of sales. Here is a *nice* graph from the presentation to break it down:

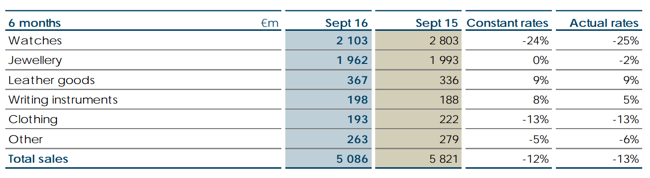

There is about an even spread between watches and jewellery, in terms of sales, what is noticeable is that leather goods have made quite a big comeback. Lancel was a business that Richemont were looking to sell, it seems that there is growth there. And LVMH showed that too. Herewith the breakdown.

What is also apparent in these results is that the buybacks impacted the profits significantly. i.e. instead of discounting their goods, as normal retailers, the company never dilutes the brand, they buy the products back from the wholesalers. That is key to the longevity and appeal of the products. If you cannot afford them at the list price, then you cannot afford the product. The group would rather suffer a slump in sales until the global consumer is on an even keel. When owning this stock you must know that you are in the same mindset as the business. You are going to be owning it through global growth cycles. And as I often say, as each and every year passes and the workmanship improves on the products, they become more valuable as investments.

And then on the management changes, all of which you can read here - Changes to board of directors and senior management, Johann Rupert says the following: