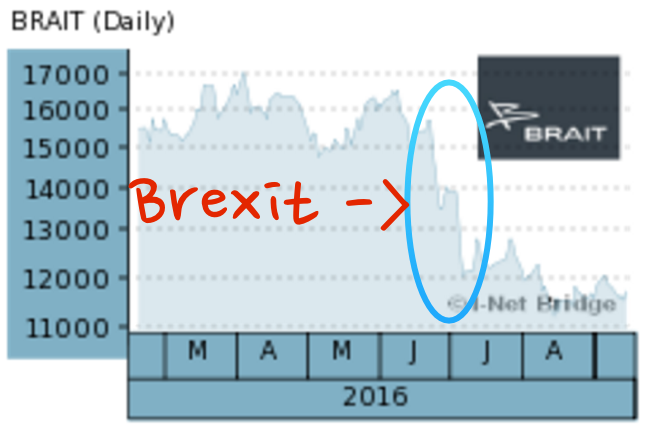

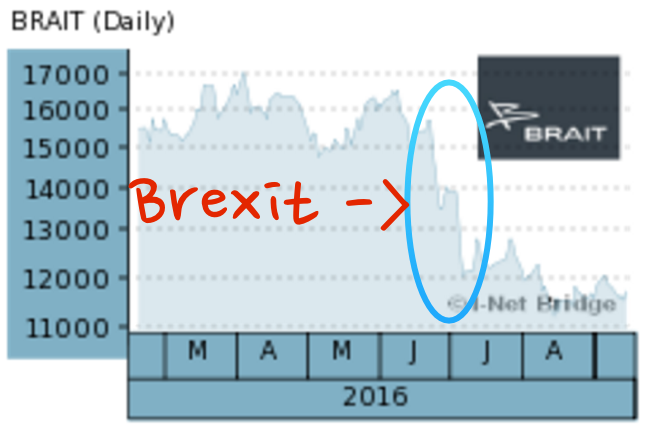

Brait has been a stock that has sucked serious wind lately. And by lately, I mean in the last three months. Up until Brexit. And then basically everything changed from there, check out the share price taking a couple of legs down post the Brexit vote and the subsequent rerating of their UK assets. Of course those Pounds are worth less Rands, a reverse Rand hedge if you will, as the hedge is NOT working in your favour:

In part the recent results have led the market to rerate the NAV again, which would probably fall further. And as such the price of Brait has given back some hard fought gains. Game over? Most certainly not, CEO John Gnodde has moved to London. With good reason, two days back the company announced their intention to list in London. First, they are going to shift business HQ to London. They give some background to the history of the business, in five years they have gone from a private equity business to a holding company:

"The Company raised ZAR8.6 billion through a ZAR6.4 billion rights issue and private placement on 4 July 2011, as well as a ZAR2.2 billion increase in its debt facilities. Since then, it has acquired significant stakes in a number of well-known South African and UK brands including Premier (in which it holds a 91.4 per cent. shareholding), Iceland Foods (57.1 per cent.), New Look (88.7 per cent.), Virgin Active (78.2 per cent.) and increased its shareholding in DGB (81.3 per cent.)."

DGB is Douglas Green Bellingham. The others you are familiar with, not so? If not, use the best library known to mankind, the inter-webs. Yet ..... Trivial Pursuit is still fun.

Why a London listing? The UK is their biggest market in terms of assets, that makes sense. It gives them flexibility (open market) to do deals quicker and of bigger size. It allows them to attract a multitude of new investors with more money, and that includes any further capital raising exercises. Inclusion into various high profile indices gives them the ability to raise money to execute deals at cheaper rates. Lower risk profile is synonymous with cheaper cost of capital. The way that the company views it from a tax point of view (as a result of where the assets are) is that it is tax neutral.

They are also teeing up shareholders for another capital raise, another rights issue, although it may not happen, this is all market dependant. There is no commitment, just be aware I think is what the company is saying. Timing? End of March next year. The common thread with Steinhoff and Mediclinic recently is that they externalise their business by acquiring assets offshore and then it makes more and more sense for them to list their businesses where it becomes cheaper to raise money.

It is better for Mediclinic/Steinhoff and now Brait to have access to capital in markets closer to their biggest assets. I have no idea why people in general feel like they are rushing away, we should rather celebrate these captains of industry. Well done. The shares are held here too, by South African pension funds and by extension large swathes of investors who have retirement savings. All three of these businesses have delivered market beating and superior returns to their stockholders and regardless of the currency, should continue with superior management skills and deal execution to be able to continue that trend. We endorse.