Aspen results! Those were released mid afternoon here in Jozi, the stock reacted positively, notwithstanding being smashed last week when the trading statement revealed the BS they have to put up with in Venezuela. Stephen Saad said that when the Venezuelan Deputy President was here in Msanzi not so long ago, spewing garbage about their awesomeness (how can you tell I am not a fan?), there were assurances of being paid, and guess what? They didn't materialise! What a twist, socialists lying!!! In theory sharing is actually caring, when big purple dinosaurs tell you to do so with biscuits or crisps or plastic play things, when we grow up instinct kicks in. I am afraid whilst we can organise ourselves into some sort of working patterns in cities and in the workplace (and so on), the early instincts of oneupmanship still remain, it is hard coded to perform better than your peers. You can try and take that away, sorry, it doesn't work.

OK, enough about nut job Venezuelans, as usual the people suffer with dumb economic policies. And Aspen shareholders, amongst many other businesses globally. So let us deal with why headline earnings per share decreased 23 percent to 889 cents, ZA of course. It is almost all due to the company taking a decision to devalue their entire business in that country. Just above we were talking about unicorn exchange rates, in the context of Nigeria and MTN. Venezuela takes it to another whole level. Let us copy and paste the commentary from the company:

"The economic situation in Venezuela deteriorated over the year to 30 June 2016 and the Venezuelan authorities have increasingly limited authorisations to pay for pharmaceutical imports using the official DIPRO rate during this period of between Venezuelan Bolivar ("VEF") 6,30 and 10,00 per US Dollar ("USD"). As a consequence of the limited payment approvals and the uncertain economic and political situation in Venezuela, before reporting the interim results for the six months ended 31 December 2015, the Group has concluded that it would be more appropriate to apply the DICOM exchange rate (VEF628,34 per USD at 30 June 2016) to report the Venezuelan business' financial position, results of its operations and cash flows for the year ended 30 June 2016. This has resulted in a one-off currency devaluation loss on foreign denominated liabilities of R870 million."

On the parallel market (in the real world where people really transact) the Venezuelan Bolivar traded at 1022 to the US Dollar (source here -

Parallel dollar weakens slightly, modification of exchange rate system is still widely expected). So in real life, the Venezuelan government were wanting Aspen to sell their drugs at one percent of the real rate. Of course you cannot operate in a market like that, in the very short term Aspen have made the right decision. It hurts, and it is what it is.

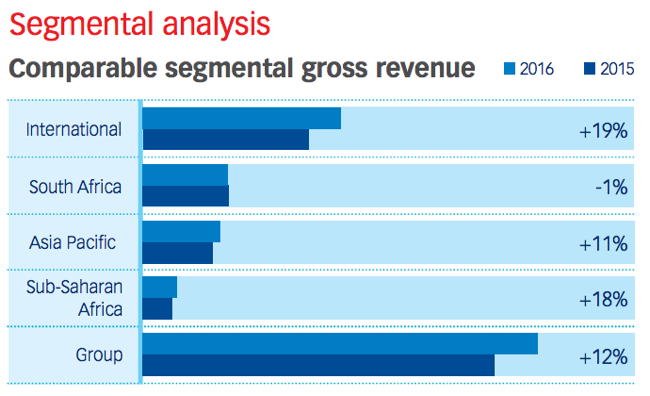

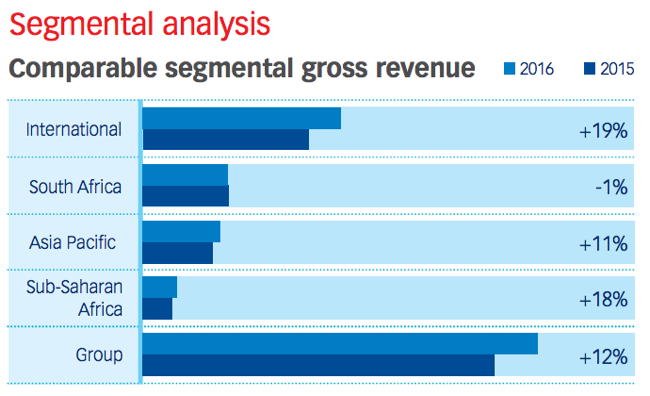

Normalised headline earnings grew ten percent to 1263.7 cents per share. The stock trades on 25x earnings. It is not cheap and the market is expecting BIG things. The South African business was the biggest issue outside of this. Herewith a segmental analysis of their territories:

Stephen Saad said in an interview on CNBC Africa that he was pleased in a sense that there were problems with their business in South Africa, he can fix them here. On the investor presentation, on the page about South Africa, there is an angry face.

What is up with these recent transactions? I suspect that Aspen have identified that there are likely to be more and more surgeries and hospital visits in the coming years, across all of their territories. People are living longer, they are likely to have many more surgeries than their parents. Their Thrombolytic portfolio now is second only to Sanofi (who are miles ahead), and ahead of Pfizer. When you competing against those businesses, you know that you have more than arrived. They have an effective 18 percent share in the anticoagulants (blood thinning) therapy.

Cast an eye to their anaesthetics portfolio (recently added), they are likely to have just over twenty percent, ex the USA. Of course Aspen are not going to be in that market (the USA) with the recently acquired therapies from AstraZeneca and GSK excluding that territory. Remember, we wrote about this a couple of days back -

Aspen update on GSK deal. Aspen have 350 representatives selling the anaesthetics products in China, the management team here no doubt will expect big things, 50 percent of sales currently come from Asia Pacific.

Prospects? They look pretty good. The company and the drivers have done an incredible job in transforming this business from a second tier South African business to something that is now bordering on a second tier global operator. I am pretty sure, that by a country mile, Saad and Attridge are not finished. They want to still change the world, they still have the energy, they still make mistakes and then fix it. I back the team, I back the space that they operate in. The stock is priced for earnings growth of mid teens or more, I am pretty sure that they can deliver, we continue to accumulate the stock at what are likely to be favourable levels in the coming years.